Q: You want to buy a $200000 home. You plan to pay $20000 as a down payment, and take out a 20 year…

A: Here, Value of Home is $200,000 Down payment is $20,000 Time Period of Loan is 20 years Interest…

Q: Consider a mortgage loan where the periodic payment is 1 and the per period mortgage interest is 5%.…

A: Perpetuity can be defined as a cash flow of equal amount at equal intervals of time with out an end.…

Q: You want to buy a $170000 home. You plan to pay $34000 as a down payment, and take out a 20 year…

A: Price of Home =$ 170000 Down Payment =$ 34000 Amount Financed = $ 170000-$ 34000 = 136000 Years = 20…

Q: Which of the following is the cheapest for a borrower? 6.7% annual money market basis 6.7%…

A: Interest rate are compounded than effective interest rate is more and effective interest rate is…

Q: What are the actual total savings for a borrower if the note rate is 6.625%, 30 year, 2/1 buy-down,…

A: Here, Sales Price is $140,000 Down Payment us $20,000 Interest Rate is 6.625% Time Period is 30…

Q: T/F and why?

A: Real interest rate is the rate of interest that received by the investor after adjusting the…

Q: Please show all equations and work as needed. Make the correct answer clear. If possible, please…

A: The computation of net amount is as follows:Hence, the net amount of funds from the loan is $511560.…

Q: You are given the following information: 3-m Libor 3.2% 3x6 Forward rate 3.3-3.4% 6x9 Forward rate…

A: Borrowing costs are the interest and other expenses incurred by a company when it borrows money. IAS…

Q: I would like to understand the process of this equation and how it end up to be 5%: "If $22,050 is…

A: Interest rate is the rate of interest earned/paid on an investment/loan. The interest will be paid…

Q: 3. Mathematically, what is the difference between a fixed payment equation and a coupon bond…

A: Fixed Payment equation : PMT = P × i(1+i)n(1+i)n-1 PMT = Fixed Principal and Interest payment per…

Q: If you are LOANING money to another party, would you prefer to offer a 12% interest rate compounded…

A: The formula for compounding quarterly is : FV = PV*[1+(i/4)]4*t Whereas, PV = Present value, i =…

Q: Example 6 A person requires a loan of R10 000. The bank offers a simple interest rate of 15% p.a..…

A: Lets understand the basics. For calculating loan period we will need to use below formula. Interest…

Q: Do you want to By A home for $330,000. You plan to pay 33,000 as a down payment and take out a 15…

A: Loan amount is the amount that is borrowed from a financial institution after paying a certain…

Q: 2. If you receive $249 each quarter for 4 quarters and the discount rate is 0.08, what is the…

A: In this Question we require to calculate the Present Value of Cash flows received every quarter for…

Q: What is the PV of an annuity due with 5 payments of $2,500 at an interest rate of 5.5%? Hint: when…

A: Annuity due is a series of payments where cash flow is done at the beginning of each period. In…

Q: Would you rather invest in an account that pays 7% with annual compounding or7% with monthly…

A: An investor should invest the account that pays the interest compounded monthly because of greater…

Q: Suppose you take out a loan for 160 days in the amount of $14,000 at 7% ordinary interest. After 30…

A: Interest is charged on the outstanding balance of loan for the number of days left till the…

Q: Consider a loan repayment plan described by the following initial value problem, where the amount…

A:

Q: The most expensive method of calculating the dollar cost of the interest on this installment loan…

A: Informantion provided: Borrowing amount = $1000 Interest rate = 10% Definitions: Simple interest…

Q: (b) Suppose that you took out PTPTN loans totalling RM24000 with interest of 1% per year. You have…

A: Interest is the cost of borrowing the money. It can be either simple or compounding.

Q: Would you rather have a 10% loan that compounds quarterly or monthly? Explain your reasoning.

A: The real interest that an investor earns on the investment and a borrower pays on loan after…

Q: How much is the effective cost if you need to borrow $250,000 for one year with 12% single payment…

A: As per our guidelines, we are supposed to answer only 1 question ( if there are multiple questions…

Q: You plan to borrow P10,000 from your bank, which offers to lend you the money at a 7.5% nominal rate…

A: Nominal rate (D)= 7.5% Borrowed amount = P10,000

Q: A lender requires PMI that is 0.8% of the loan amount of $470,000. How much (in dollars) will this…

A: Working note:

Q: Your firm is considering a one-year loan for $522,000. The fees are 2% of the loan amount and the…

A: The lender deducts the fees upfront while disbursing the money, so effectivly the borrower get the…

Q: In order to borrow $100,000 for a 5% loan on a discount loan basis with a 5% compensating balance;…

A: Whenever an individual is in need of extra funds to finance his or her purchase in case of less cash…

Q: onsider a loan at 4.125% APR on 6 years for a $23,000 car a. Estimate the monthly payment (using…

A: Equated Monthly Installments are one part of the equally divided monthly outgoes to clear off an…

Q: You want to buy a $280000 home. You plan to pay $56000 as a down payment, and take out a 15 year…

A: Dear student we need to use excel to solve this problem. The formulas that you need to understand to…

Q: How much would be the loan discount if you need to borrow $300,000 for one year with a discount loan…

A: Required loan = $ 300,000 Discount rate = 8%

Q: Assume you take out a car loan of $8,600 that calls for 48 monthly payments of $300 each. a.…

A: Annual Percentage Rate(APR) is the specified rate of interest charged by any of the authorizing…

Q: You plan to borrow P10,000 from your bank, which offers to lend you the money at a 7.5% nominal rate…

A: Borrowed amount is P10,000 Nominal interest rate is 7.5% To Find: Effective interest rate on a…

Q: What practical TVM application would you expect to encounter in your future? Explain.

A: The time value of money is an important and most commonly used concept for evaluating the worth of…

Q: the following Information Which financing metnod has lowest Ihterest cost? How much interest savings…

A: Given: Loan amount = R2,500,000 Term = 180 days Rate = 8%+2.5% = 10.5%…

Q: Using the average interest rate for a federal loan of 2.75% AND the average interest rate for a…

A: The number of months taken to repay a loan: The number of months it takes to repay a loan depends on…

Q: 4. If you know the simple interest due on a P10 000 loan, explain how you can use that figure to…

A: We’ll answer the first question since the exact one wasn’t specified. Please submit a new question…

Q: Q.Considering the following information, what is the net benefit if the borrower refinances the loan…

A: Loan refinance means, take the another loan for the payment of old loan. Before the refinancing, net…

Q: Payday loans are very short-term loans that charge very high interest rates. You can borrow $500…

A: * We are authorized to give one answer at a time, since you have not mentioned which part you are…

Q: 1) What is the loanable funds market? 2) Calculate the following: You save $100 and want to see…

A: “Since you have posted a question with multiple sub-parts, we will solve the first three subparts…

Q: A lender requires PMI that is 0.7% of the loan amount of $490,000. How much (in dollars) will this…

A: Working note:

Q: what does variable 5-5-5 cap 2 loan mean? Suppose a variable 5-5-5 cap 2 loan. Total maturity is 20…

A: An essential component is the 28/36 ratio, which defines a consumer's financial situation. It helps…

Q: You want to buy a $190000 home. You plan to pay $19000 as a down payment, and take out a 15 year…

A: Two points of loan is that 2% discount on loan.

Q: Optimizing economic agents use the roal interest rate when thinking about the economic costs and…

A: We Know That, (1+Nominal rate) = (1+real Rate)*(1+inflation rate) => Nominal Rate = (1+real…

Q: How much would be the principal amount of loan if you need to borrow $300,000 for one year with a…

A: A discount loan does not charge any interest but provides a lesser financing with a higher stated…

Q: You want to buy a $280000 home. You plan to pay $56000 as a down payment, and take out a 15 year…

A: A mortgage is the type of loan that a person is required to buy a house. It is the loan in which a…

Q: Suppose you want a 35-year, fixed-rate mortgage loan in the amount of $144,400. If the lowest fixed…

A: Loan Amount = 144,400 Since Monthly payments, Time Period = 35 years * 12 = 420 months Interest % =…

Exolains it correctly

Not use excel

Step by step

Solved in 2 steps

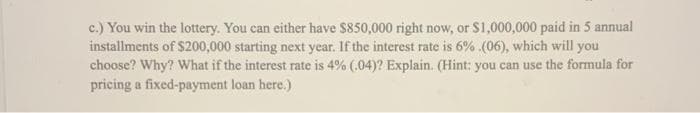

- Use the tables in Appendix B to answer the following questions. A. If you would like to accumulate $2,500 over the next 4 years when the interest rate is 15%, how much do you need to deposit in the account? B. If you place $6,200 in a savings account, how much will you have at the end of 7 years with a 12% interest rate? C. You invest $8,000 per year for 10 years at 12% interest, how much will you have at the end of 10 years? D. You win the lottery and can either receive $750,000 as a lump sum or $50,000 per year for 20 years. Assuming you can earn 8% interest, which do you recommend and why?You put $600 in the bank for 3 years at 15%. A. If Interest Is added at the end of the year, how much will you have in the bank after one year? Calculate the amount you will have in the bank at the end of year two and continue to calculate all the way to the end of the third year. B. Use the future value of $1 table In Appendix B and verify that your answer is correct.Use the tables in Appendix B to answer the following questions. A. If you would like to accumulate $4,200 over the next 6 years when the interest rate is 8%, how much do you need to deposit in the account? B. If you place $8,700 in a savings account, how much will you have at the end of 12 years with an interest rate of 8%? C. You invest $2,000 per year, at the end of the year, for 20 years at 10% interest. How much will you have at the end of 20 years? D. You win the lottery and can either receive $500,000 as a lump sum or $60,000 per year for 20 years. Assuming you can earn 3% interest, which do you recommend and why?

- You just won the TVM Lottery. You will receive $1 million today plus another 10 annual payments that increase by $450,000 per year. Thus, in one year, you can receive $1.45 million. In two years, you get $1.9 million, and so on. If the appropriate interest rate is 6.2 percent, what is the value of your winnings today? (Please also provide financial calculator calculations if possible)An executive is looking to buy a Bugatti for $1.9 million. The car dealer can offer financing at a 4.9% rate over 5 years. If $900,000 is put down towards the purchase and the financing terms accepted, what will the monthly payment for the loan be? and what formula would i use to calculate this in excel?You want to buy a $130,000 home. You plan to pay 5% as a down payment, and take out a 30 year loan at 6.25% interest for the rest. The bank will charge 3 points on the amount financed.a) What is the amount of the down payment?b) How much is the loan amount going to be?c) What will be the amount charged for 3 points?d) Find the amount of the monthly payment.

- You want to buy a $280000 home. You plan to pay $56000 as a down payment, and take out a 15 year loan at 3.5% interest for the rest. a) What is the amount of the payment? b) If the bank charges 3 points on the loan, what is the amount charged for points? c) If the bank charges 3 points on the loan, what is the true interest rate?you have just won the lottery and will receive $460,000 in one year. you will receive payments for 21 years, and the payments will increase 4 percent per year. if the appropriate discount rate is 11 percent, what is the present value of your winnings? Please explain how to solve using the financial calculator to show and explain steps thanksSuppose you want to buy a car. You have surveyed the dealers' newspaper advertisements, and the one shown has caught your attention. You can afford to make a down payment of $2,678.95, so the net amount to be financed is $20,000.(a) What would the monthly payment be?(b) After the 25th payment, you want to pay off the remaining loan in a lumpsum amount. What is this lump sum?

- If you borrow $25,000 from a local finance company and you are required to pay $4,424.50 per year for 10 years, what is the annual interest rate on the loan? a) 12% d) 13.6% b) 18.9% e) 14.4% c) 15.9% How to solve using financial calculator?You want to buy a car, and a local bank will lend you $30,000. The loan would be fully amortized over 4 years (48 months), and the nominal interest rate would be 9%, with interest paid monthly. What is the monthly loan payment? Do not round intermediate calculations. Round your answer to the nearest cent. $ What is the loan's EFF%? Do not round intermediate calculations. Round your answer to two decimal places. %You are taking a car loan of 100000, for 5 years and monthly payment of 1648, the interest rate is 10.48%, and a final payment of 35000 at the end of the loan. -Calculate all the necessary to help you determine if it is a good loan or not