Wildhorse Quest Games Co. adjusts its accounts annually. The following information is available for the year ended December 31, 2020. 1. Purchased a 1-year insurance policy on June 1 for $2,220 cash. 2. Paid $6,100 on August 31 for 5 months’ rent in advance. 3. On September 4, received $3,870 cash in advance from a company to sponsor a game each month for a total of 9 months for the most improved students at a local school. 4. Signed a contract for cleaning services starting December 1 for $1,100 per month. Paid for the first 2 months on November 30. (Hint: Use the account Prepaid Cleaning to record prepayments.) 5. On December 5, received $1,600 in advance from a gaming club. Determined that on December 31, $460 of these games had not yet been played. List of Accounts Accounts Payable Accounts Receivable Accumulated Depreciation-Buildings Accumulated Depreciation-Equipment Advertising Expense Buildings Cash Depreciation Expense Equipment Insurance Expense Interest Expense Interest Payable Land Maintenance and Repairs Expense Mortgage Payable No Entry Notes Payable Owner's Capital Owner's Drawings Prepaid Advertising Prepaid Cleaning Prepaid Insurance Prepaid Rent Rent Expense Rent Revenue Salaries and Wages Expense Salaries and Wages Payable Sales Revenue Service Revenue Subscription Revenue Supplies Supplies Expense Ticket Revenue Unearned Rent Revenue Unearned Service Revenue Unearned Subscription Revenue Unearned Ticket Revenue Utilities Expense Utilities Payable

Wildhorse Quest Games Co. adjusts its accounts annually. The following information is available for the year ended December 31, 2020. 1. Purchased a 1-year insurance policy on June 1 for $2,220 cash. 2. Paid $6,100 on August 31 for 5 months’ rent in advance. 3. On September 4, received $3,870 cash in advance from a company to sponsor a game each month for a total of 9 months for the most improved students at a local school. 4. Signed a contract for cleaning services starting December 1 for $1,100 per month. Paid for the first 2 months on November 30. (Hint: Use the account Prepaid Cleaning to record prepayments.) 5. On December 5, received $1,600 in advance from a gaming club. Determined that on December 31, $460 of these games had not yet been played. List of Accounts Accounts Payable Accounts Receivable Accumulated Depreciation-Buildings Accumulated Depreciation-Equipment Advertising Expense Buildings Cash Depreciation Expense Equipment Insurance Expense Interest Expense Interest Payable Land Maintenance and Repairs Expense Mortgage Payable No Entry Notes Payable Owner's Capital Owner's Drawings Prepaid Advertising Prepaid Cleaning Prepaid Insurance Prepaid Rent Rent Expense Rent Revenue Salaries and Wages Expense Salaries and Wages Payable Sales Revenue Service Revenue Subscription Revenue Supplies Supplies Expense Ticket Revenue Unearned Rent Revenue Unearned Service Revenue Unearned Subscription Revenue Unearned Ticket Revenue Utilities Expense Utilities Payable

Chapter10: The Basics Of Capital Budgeting: Evaluating Cash Flows

Section10.4: Internal Rate Of Return (irr)

Problem 6ST

Related questions

Question

Wildhorse Quest Games Co. adjusts its accounts annually. The following information is available for the year ended December 31, 2020.

| 1. | Purchased a 1-year insurance policy on June 1 for $2,220 cash. | |

| 2. | Paid $6,100 on August 31 for 5 months’ rent in advance. | |

| 3. | On September 4, received $3,870 cash in advance from a company to sponsor a game each month for a total of 9 months for the most improved students at a local school. | |

| 4. | Signed a contract for cleaning services starting December 1 for $1,100 per month. Paid for the first 2 months on November 30. (Hint: Use the account Prepaid Cleaning to record prepayments.) | |

| 5. | On December 5, received $1,600 in advance from a gaming club. Determined that on December 31, $460 of these games had not yet been played. |

List of Accounts

- Accounts Payable

Accounts Receivable - Accumulated

Depreciation -Buildings - Accumulated Depreciation-Equipment

- Advertising Expense

- Buildings

- Cash

- Depreciation Expense

- Equipment

- Insurance Expense

- Interest Expense

- Interest Payable

- Land

- Maintenance and Repairs Expense

- Mortgage Payable

- No Entry

- Notes Payable

- Owner's Capital

- Owner's Drawings

- Prepaid Advertising

- Prepaid Cleaning

- Prepaid Insurance

- Prepaid Rent

- Rent Expense

- Rent Revenue

- Salaries and Wages Expense

- Salaries and Wages Payable

- Sales Revenue

- Service Revenue

- Subscription Revenue

- Supplies

- Supplies Expense

- Ticket Revenue

- Unearned Rent Revenue

- Unearned Service Revenue

- Unearned Subscription Revenue

- Unearned Ticket Revenue

- Utilities Expense

- Utilities Payable

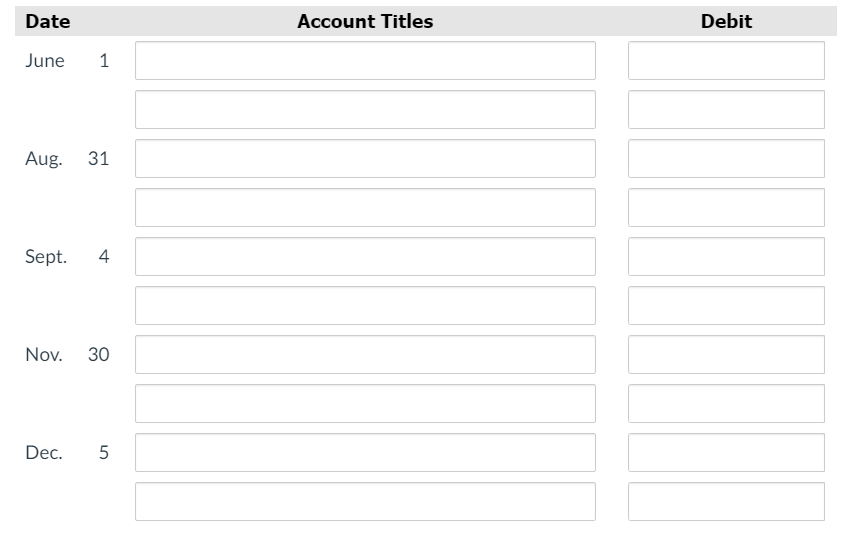

Transcribed Image Text:Date

Account Titles

Debit

June

1

Aug.

31

Sept.

4

Nov.

30

Dec.

5

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you