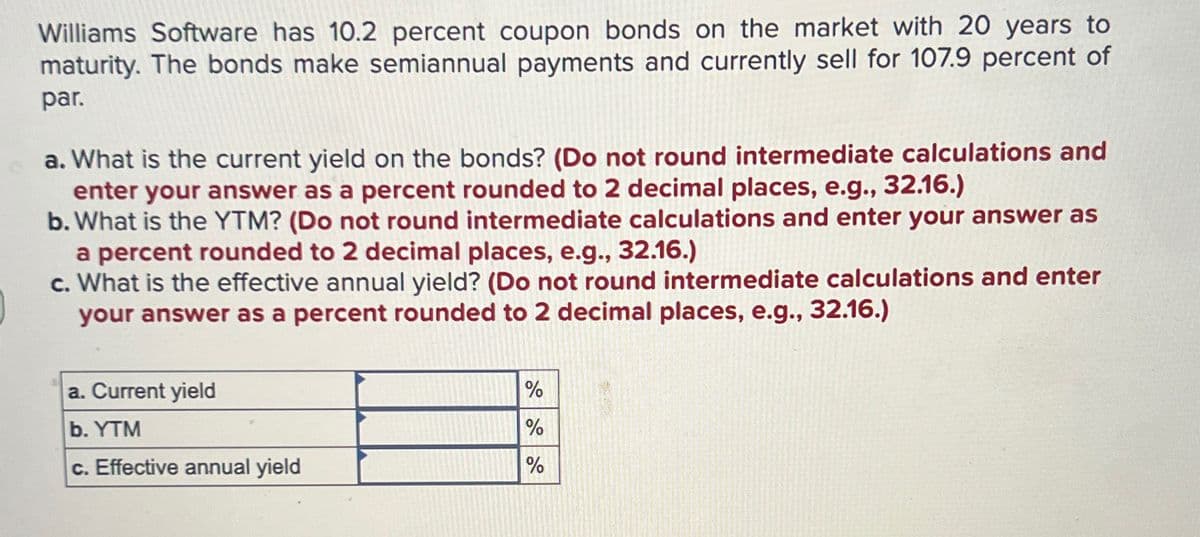

Williams Software has 10.2 percent coupon bonds on the market with 20 years to maturity. The bonds make semiannual payments and currently sell for 107.9 percent of par. a. What is the current yield on the bonds? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. What is the YTM? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) c. What is the effective annual yield? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) a. Current yield b. YTM % % c. Effective annual yield %

Williams Software has 10.2 percent coupon bonds on the market with 20 years to maturity. The bonds make semiannual payments and currently sell for 107.9 percent of par. a. What is the current yield on the bonds? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. What is the YTM? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) c. What is the effective annual yield? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) a. Current yield b. YTM % % c. Effective annual yield %

Chapter14: Investing In Stocks And Bonds

Section: Chapter Questions

Problem 6DTM

Related questions

Question

Please Give Step by Step Answer

Otherwise i give DISLIKES !!

Transcribed Image Text:Williams Software has 10.2 percent coupon bonds on the market with 20 years to

maturity. The bonds make semiannual payments and currently sell for 107.9 percent of

par.

a. What is the current yield on the bonds? (Do not round intermediate calculations and

enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)

b. What is the YTM? (Do not round intermediate calculations and enter your answer as

a percent rounded to 2 decimal places, e.g., 32.16.)

c. What is the effective annual yield? (Do not round intermediate calculations and enter

your answer as a percent rounded to 2 decimal places, e.g., 32.16.)

a. Current yield

b. YTM

%

%

c. Effective annual yield

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,