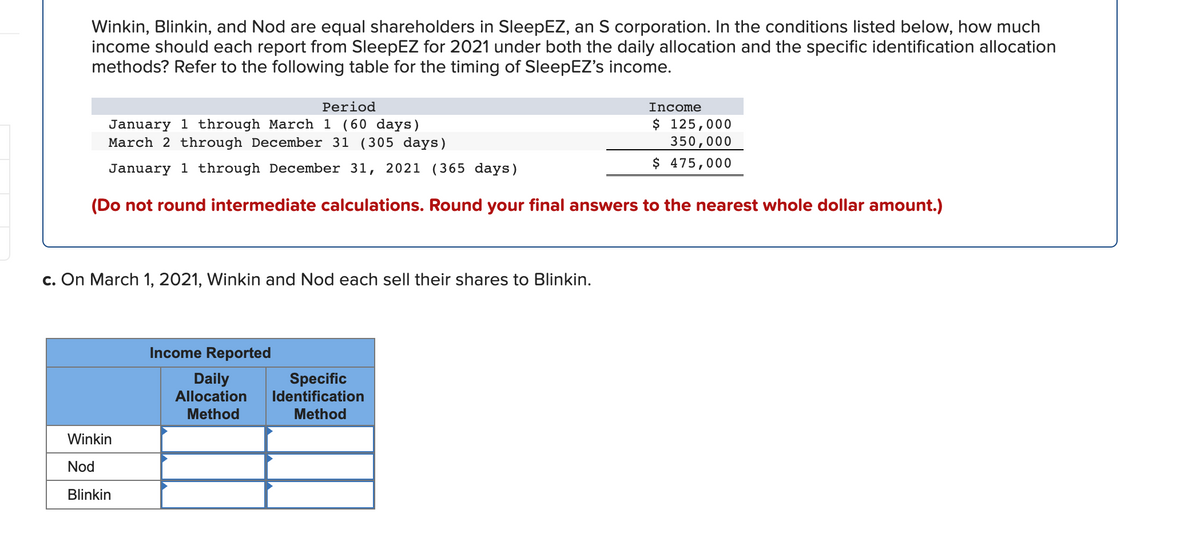

Winkin, Blinkin, and Nod are equal shareholders in SleepEZ, an S corporation. In the conditions listed below, how much income should each report from SleepEZ for 2021 under both the daily allocation and the specific identification allocation methods? Refer to the following table for the timing of SleepEZ's income. Income $ 125,000 350,000 $ 475,000 Period January 1 through March 1 (60 days) March 2 through December 31 (305 days) January 1 through December 31, 2021 (365 days) (Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount.) c. On March 1, 2021, Winkin and Nod each sell their shares to Blinkin. Income Reported Daily Allocation Specific Identification Method Method Winkin Nod Blinkin

Winkin, Blinkin, and Nod are equal shareholders in SleepEZ, an S corporation. In the conditions listed below, how much income should each report from SleepEZ for 2021 under both the daily allocation and the specific identification allocation methods? Refer to the following table for the timing of SleepEZ's income. Income $ 125,000 350,000 $ 475,000 Period January 1 through March 1 (60 days) March 2 through December 31 (305 days) January 1 through December 31, 2021 (365 days) (Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount.) c. On March 1, 2021, Winkin and Nod each sell their shares to Blinkin. Income Reported Daily Allocation Specific Identification Method Method Winkin Nod Blinkin

Chapter22: S Corporations

Section: Chapter Questions

Problem 36P

Related questions

Question

100%

Transcribed Image Text:Winkin, Blinkin, and Nod are equal shareholders in SleepEZ, an S corporation. In the conditions listed below, how much

income should each report from SleepEZ for 2021 under both the daily allocation and the specific identification allocation

methods? Refer to the following table for the timing of SleepEZ's income.

Period

Income

January 1 through March 1 (60 days)

March 2 through December 31 (305 days)

$ 125,000

350,000

$ 475,000

January 1 through December 31, 2021 (365 days)

(Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount.)

c. On March 1, 2021, Winkin and Nod each sell their shares to Blinkin.

Income Reported

Daily

Allocation

Specific

Identification

Method

Method

Winkin

Nod

Blinkin

Expert Solution

Introduction :

Given :

Total Income = $ 475000

January 1 to March 1 is $ 125000

March 2 to December 31 is $ 350000

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you