With reference to the information given above, Discuss the relationship between risk and return of the individual securities. Demonstrate the meaning and advantages of diversification by constructing a portfolio consisting of equal investments in the High-Tech Co. and the Counter- Cyclical Co. Explain your idea and show your work clearly. Perform calculations or quantitative analyses to support your answers where necessary.

With reference to the information given above, Discuss the relationship between risk and return of the individual securities. Demonstrate the meaning and advantages of diversification by constructing a portfolio consisting of equal investments in the High-Tech Co. and the Counter- Cyclical Co. Explain your idea and show your work clearly. Perform calculations or quantitative analyses to support your answers where necessary.

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter15: Capital Investment Analysis

Section: Chapter Questions

Problem 15.1.1MBA

Related questions

Question

With reference to the information given above,

Discuss the relationship between risk and return of the individual securities.

Demonstrate the meaning and advantages of diversification by constructing a portfolio consisting of equal investments in the High-Tech Co. and the Counter- Cyclical Co. Explain your idea and show your work clearly.

Perform calculations or quantitative analyses to support your answers where necessary.

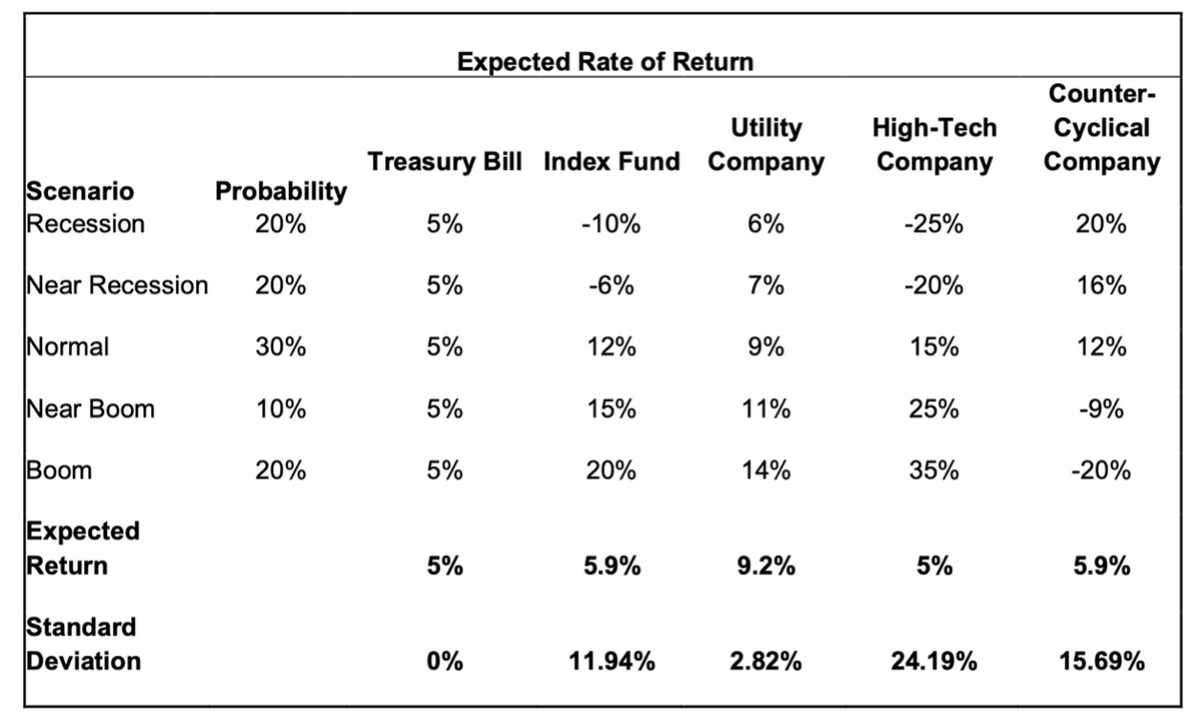

Transcribed Image Text:Expected Rate of Return

Counter-

Utility

Treasury Bill Index Fund Company

High-Tech

Company

Cyclical

Company

Scenario

Recession

Probability

20%

5%

-10%

6%

-25%

20%

Near Recession

20%

5%

-6%

7%

-20%

16%

Normal

30%

5%

12%

9%

15%

12%

Near Boom

10%

5%

15%

11%

25%

-9%

Вoom

20%

5%

20%

14%

35%

-20%

Expected

Return

5%

5.9%

9.2%

5%

5.9%

Standard

Deviation

0%

11.94%

2.82%

24.19%

15.69%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning