Chapter19: Lease And Intermediate-term Financing

Section: Chapter Questions

Problem 19P

Related questions

Question

Part c

Without using exel

Transcribed Image Text:PROBLEM 1:

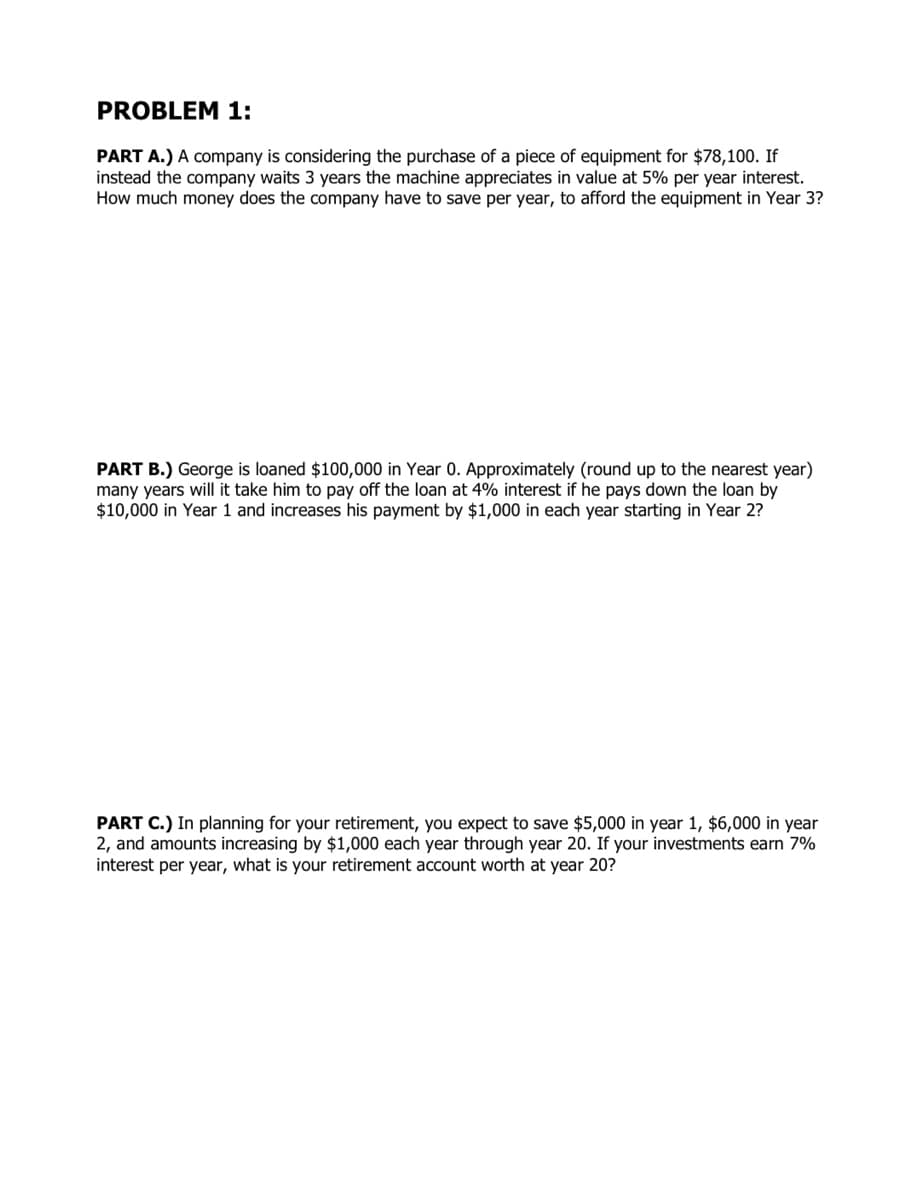

PART A.) A company is considering the purchase of a piece of equipment for $78,100. If

instead the company waits 3 years the machine appreciates in value at 5% per year interest.

How much money does the company have to save per year, to afford the equipment in Year 3?

PART B.) George is loaned $100,000 in Year 0. Approximately (round up to the nearest year)

many years will it take him to pay off the loan at 4% interest if he pays down the loan by

$10,000 in Year 1 and increases his payment by $1,000 in each year starting in Year 2?

PART C.) In planning for your retirement, you expect to save $5,000 in year 1, $6,000 in year

2, and amounts increasing by $1,000 each year through year 20. If your investments earn 7%

interest per year, what is your retirement account worth at year 20?

Expert Solution

Introduction

The future value of a series of cash flows can be defined as the terminal value of the account at some future date, taking into consideration, all payments made and the compound interest on those payments. Calculating the future value is also called compounding, whereas calculating the present value is called discounting. The value of money changes with time due to a variety of factors like inflation, interest rate, market conditions, etc. This change in the value of money with time is called the time value of money.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College