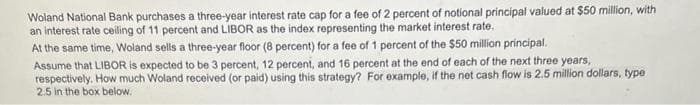

Woland National Bank purchases a three-year interest rate cap for a fee of 2 percent of notional principal valued at $50 million, with an interest rate ceiling of 11 percent and LIBOR as the index representing the market interest rate. At the same time, Woland sells a three-year floor (8 percent) for a fee of 1 percent of the $50 million principal. Assume that LIBOR is expected to be 3 percent, 12 percent, and 16 percent at the end of each of the next three years, respectively. How much Woland received (or paid) using this strategy? For example, if the net cash flow is 2.5 million dollars, type 2.5 in the box below.

Q: The following data pertains to Xena Corp. Xena Corp. Total Assets $23,610 Interest-Bearing Debt…

A: Cost of debt capital = Average borrowing rate for debt ×[1- Tax rate]

Q: c) An investor purchases a six-month (182-day) T-bill with a $10,000 face value for $9,745.…

A: T-bills also known as treasury bills, these are type of bonds of government or as a debt security…

Q: On May 6, May Payment makes a purchase of $258.50 on her credit card. The purchase appears on her…

A: A credit card is a pay later facility where banks pay on behalf of customers at the time of purchase…

Q: A company had 20 000 shares of ordinary shares outstanding on January 1; on May 1, 4 000 shares were…

A: Earnings per share = Net income available to common stock holders/weighted average number of common…

Q: IRQ has common stock outstanding, which is trading at $25 per share. IRQ paid a dividend yesterday…

A: Last Dividend = $2.22 Growth rate = 0.03 Current stock price = $25 Cost of common equity = ?

Q: I. Find the value (using Binomial Tree) of a European style call option on an underlying stock which…

A: Options are derivatives. The value of option is derived from the value of an underlying asset.…

Q: A company had 20 000 shares of ordinary shares outstanding on January 1; on May 1, 4 000 shares were…

A: Earnings per share = Net income available to common stockholders/Weighted average number of shares…

Q: Cross Town Cookies is an all-equity firm with a total market value of $790,000. The firm has 46,000…

A: Earnings per share: Earnings per share is the earnings available for the equity shareholders of the…

Q: D4) What is the interest income in dollars on a $10 million art financing loan priced at 8%…

A: A loan under which the borrower pledges his/her asset to get the loan is known as a collateral loan.…

Q: At the end of each quarter, a life insurance client deposits Ph 6,366 for 5 years. If money is worth…

A: Solution:- When an equal amount is deposited each period at end of period, it is called ordinary…

Q: 6. How much is the present value of a perpetuity of P1,000 payable semi-annually if money is worth…

A: Given, Here, we have to calculate the perpetuity value. Amount = P1,000 Interest Rate = 5% Interest…

Q: How much is the present value of a perpetuity of P1,000 payable semi-annually if money is worth 5%…

A: Present value of perpetuity is calculated for those securities from which keeps generating cash…

Q: Which of the following is true about the WACC? It’s the appropriate discount rate for all new…

A: Solution:- Weighted Average Cost of Capital (WACC) means the minimum rate of return required by the…

Q: Yesterday, John bought a ten-year, $50,000 coupon bond with an annual rate of 5% compounded…

A: Bonds are debt instruments that companies issue in order to raise funds in the form of debt.…

Q: Consider the case of Scorecard Corporation: Scorecard Corporation is considering the purchase of…

A: Given: Purchase price $11,250 Years 4 Loan $11,250 Interest rate 3.60% Annual maintenance…

Q: Name two reasons that requiring more disclosure in the securities market is helpful.

A: Disclosure means making the information or facts about the company known to the public, customers…

Q: A firm earns $895 million in profits and pays $626 million in dividends for the year. The firm has…

A: Dividend: The dividends are the returns provided to the shareholders by the company. The dividends…

Q: expansion purposes. You decided to issue semi- annual R1 000 bonds which pay a coupon of 10% for a…

A: Price of bond is present value of coupon payment and present value of par value of the bond at…

Q: Morty is looking into buying an apartment. He checked out a few places recently, and it looks like…

A: The answer is Yes. Morty is ready to buy that apartment.

Q: binomial model account of volatility

A: Volatility is simply referred to as the uncertainty or risk in the change in the value of a…

Q: The Shell Corporation has a 34% tax rate and owns a piece of petroleum-drilling equipment that costs…

A: Explanation : NPV is help in decision making if I have Calculate the NPV & it comes to positive…

Q: Case A B C D E Amount of Annuity $2,500 500 30,000 11,500 6,000 Interest Rate 8% 12 20 9 14 Deposit…

A: Ordinary annuity is the annuity in which regular payment has been made at the end of each period…

Q: You would like to purchase a car that costs $47000 at 7% APR for 3 years. What is your monthly…

A: Cost (PV) = $47000 Interest rate = 7% Monthly interest rate (r) = 7%/12 = 0.583333333333333% Period…

Q: what is the expected return of the portfolio? (Format: 1.11%)

A: Expected Return on Portfolio: It is estimated by the sum of individual security returns which is…

Q: 21. Aluminum maker Alcoa has a beta of about 1.9, whereas Hormel Foods has a beta of 0.37. If the…

A: First, we will calculate the Cost of Equity by applying the required formula for both companies and…

Q: discuss Volkswagen deciding to go for a Foreign Direct Investement with Ghana

A: Volkswagen is the flagship brand of the Volkswagen Group, is a German motor vehicle manufacturer…

Q: 12. A company has agreed to pay $4.2 million in 6 years to settle a lawsuit. How much must it invest…

A: Future value required = $4,200,000 Interest rate = 6% Number of compounding per year = 12 Period= 6…

Q: Weston Industries has a debt–equity ratio of 1.5. Its WACC is 11 percent, and its cost of debt is 7…

A: Weighted average cost of capital (WACC) When a firm has both equity and debt as its sources of…

Q: Find the cash price of an Android-based phone plan if a customer pays PhP 999 monthly for 2 years at…

A: Monthly payment is PhP 999 Time period is 2 years Interest rate is 4.4% Compounded monthly To Find:…

Q: A public school teacher receiving a monthly salary of P26,494 with mandatory annual deductions of…

A: An individual's gross income (sometimes known as gross pay on a paycheck) is their total earnings…

Q: How does title insurance work? Why is it not absolute (fool-proof

A: Title insurance is that insurance product that is related to the world of real estate. It is an…

Q: _______ When a company reports financial numbers that are lower than expected, generallya. the…

A: Company Results: These are results reported by the company to the investors and general public…

Q: The company has a 25% tax rate, and its WACC is 10%. Write out your answers completely. For example,…

A: Operating Cash Flow: It is the amount of cash generated from normal business operations. Cash from…

Q: ako sa sunour busa buong p ly Determine your monthly mortgage payment (in dollars). (Round your…

A: Loan Payments: These payments are made by the borrower to the lender to amortize the loan amount.…

Q: The managerial accountant at managerial funding resources reported in 2014 its earnings per share…

A: The Price Earnings Ratio: The price-earnings ratio or the P/E ratio as it is more commonly known, as…

Q: Clifford, Inc., has a target debt-equity ratio of .80. Its WACC is 9.1 percent, and the tax rate is…

A: WACC is a weighted average cost of all the sources of capital. It is equal to the sum of products of…

Q: Mackenzie Company has a price of $33 and will issue a dividend of $2.00 next year. It has a beta of…

A: Given, (Part a)The cost of capital,=Risk-free rate+Beta×Market (risk) premium…

Q: 15% n=7 Initial Cost (A)100 (B)60 (C)80 Uniform Annual Benefit (A)26 (B)15 (C)17 a)…

A: Budget is the process by which a firm assesses truly massive projects or investments.A new plant's…

Q: a wants to give her daughter Mara a financial gift on the latter's college graduation two years now.…

A: Solved using Financial Calculator PV = -2,000 FV = 5,000 N = 2 years * 4 quarters = 8 CPT I/Y =…

Q: 5) Determine the present value at time 0 of payments of $1,000 at the start of each month for 5…

A: Present Value: The present value is the value of cash flow stream or the fixed lump sum amount at…

Q: Suppose you had just gone long (purchased) on lot of Syarikat XYZ stock at a price of RM 15.00 each,…

A: Long position: Long position means we will buy stock now and sell them in future expecting the price…

Q: Find the compound interest earned if PhP 30,860 is deposited in a bank at 2.8% compounded monthly…

A: Future Value refers to the value of the current asset or investment or of cash flows at a specified…

Q: It costs P500,000 at the end of each year to maintain a section of Kennon Road in Baguio City. If…

A: The question is based on the concept of the present value of money. The present value is calculated…

Q: Che-Che bought his brother a laptop 5 years ago which has a cost of around 25,000PhP. The laptop’s…

A: Given: Particulars Amount Cost of laptop 25000 Php Years 5 Extended life 10…

Q: Ms. Jones deposited $400 at the end of each month for 20 years into a savings account earning 6%…

A: Solution: The total amount in the saving account after twentieth year is the sum of future value of…

Q: Logan Company is considering two projects, A and B. The following information has been gathered on…

A: Solution:- Profitability Index measures the ratio of Present value of future cash flows to the…

Q: A project requires an initial outlay at t = 0 of $4,000, and its cash flows are the same in Years 1…

A: Weighted Average cost of capital (WACC): The WACC is the overall cost of capital from all the…

Q: Nominal annual interest rates are 7.3%. If a businessperson has an opportunity to invest $40,000…

A: Option 1: If 40,000 invested at 7.3% for 5 years: Future Value = Present Value * ( 1 + Interest…

Q: Yesterday, John bought a ten-year, $50,000 coupon bond with an annual rate of 5% compounded…

A: Solution:- Coupon rate of bond shows that how much coupon does the bond is paying to the bondholder,…

Q: Alphabet Inc., formerly Google Inc. recently had a market cap of $531.40 billion, total equity of…

A: Market Cap of Alphabet Inc. is $531.40 billion Total equiy is of $127.88 billion Total number of…

Trending now

This is a popular solution!

Step by step

Solved in 6 steps

- The investment manager for Draxler Co. pays $988,472 to purchase a $1,000,000 face-value bond maturing in five years and paying interest semiannually at an annual rate of 2.75 percent. The annual market rate for comparable bonds at the time of issuance is 3.00 percent. With two years remaining, the manager determines that the bond will pay the full $1,000,000 at maturity but will pay $3,000 less in interest than planned every six months for the remainder of the bond’s life. The relevant present value factors for $1 and a $1 ordinary annuity are 0.9422 and 3.8544, respectively. If the bond’s current fair value with two years remaining is $994,800 and the amortized cost of the bond is $995,182, the current expected credit loss, assuming that the bond is classified as held-to-maturity, is closest to: A. $4,835 B. $6,710 C. $11,165 D. $11,545An investor borrows a principal of £1,000,000 and agrees to an interest-only repayment at a rate of 5% p.a., in equal quarterly installments, paid in arrears for 10 years. After 10 years the principal is paid back with a lump payment. The investor uses part of the principal to buy £200,000 nominal of 10-year government bonds, paying semi-annual coupons at a rate of 4% p.a. and producing a yield of 3.5% p.a. effective. Bonds are redeemed at par after 10 years. The remaining portion of the principal (denoted by P) is used to purchase properties that produce annual rental income at a rate of 4% of their initial value P for the first 5 years and, subsequently, at a rate of 5% of their initial value P. Rent is payable monthly in advance. a) Let iL = 4% p.a. be the annual effective rate applied to liabilities. Evaluate the present value at time zero of the total liability. b)Compute the present value at time zero of the portion of principal invested in bonds and deduce the investment in…Mack Company, HappyDay’s branch, plans to invest $50,000 in land that will produce annual rent revenue equal to 15 percent of the investment, starting on January 1, Year 3. The revenue will be collected in cash at the end of each year, starting December 31, Year 3. Mack can obtain the cash necessary to purchase the land from two sources. Funds can be obtained by issuing $50,000 of 10 percent, five-year bonds at their face amount. Interest due on the bonds is payable on December 31 of each year with the first payment due on December 31, 2021. Alternatively, the $50,000 needed to invest in land can be obtained from equity financing. In this case, the stockholders (holders of the equity) will be paid a $5,000 annual cash dividend. Mack Company is in a 30 percent income tax bracket. Prepare an income statement and statement of cash flows for Mack Company for Year 3 under the two alternative financing proposals (debt financing and equity financing). Write a short memorandum explaining why…

- Mack Company, HappyDay’s branch, plans to invest $50,000 in land that will produce annual rent revenue equal to 15 percent of the investment, starting on January 1, Year 3. The revenue will be collected in cash at the end of each year, starting December 31, Year 3. Mack can obtain the cash necessary to purchase the land from two sources. Funds can be obtained by issuing $50,000 of 10 percent, five-year bonds at their face amount. Interest due on the bonds is payable on December 31 of each year with the first payment due on December 31, 2021. Alternatively, the $50,000 needed to invest in land can be obtained from equity financing. In this case, the stockholders (holders of the equity) will be paid a $5,000 annual cash dividend. Mack Company is in a 30 percent income tax bracket. 1. Prepare an income statement and statement of cash flows for Mack Company for Year 3 under the two alternative financing proposals (debt financing and equity financing)A company receives a 5-year $100 million loan commitment from Wells Fargo at a fixed rate of 4.5%. The up-front commitment fee is 40 basis points and the unused portion of the loan is charged 15 basis points. The bank borrows a total of $45 million at the beginning of the year and none thereafter. The following is true, except: A The interest paid on the drawdown amount for the full year is $2,025,000. B The interest rate paid on the drawdown amount for the full year is 4.90% C The fee for the loan commitment for the full year is $400,000. D The fee for the unused portion of the loan commitment for the full year is $82,500On January 2, 2020, Parton Company issues a 5-year, $10,000,000 note at LIBOR, with interest paid annually. The variable rate is reset at the end of each year. The LIBOR rate for the first year is 5.8%. Parton Company decides it prefers fixed-rate financing and wants to lock in a rate of 6%. As a result, Parton enters into an interest rate swap to pay 6% fixed and receive LIBOR based on $10 million. The variable rate is reset to 6.6% on January 2, 2021. Instructions a. Compute the net interest expense to be reported for this note and related swap transactions as of December 31, 2020. b. Compute the net interest expense to be reported for this note and related swap transactions as of December 31, 2021.

- Hemingway Company purchases equipment by issuing a 7-year, $350,000 non-interest-bearing note, when the market rate for this type of note is 10%. Hemingway will pay off the note with equal payments to be made at the end of each year. Required: Prepare the journal entry to record Hemingway’s acquisition of the equipmAbbott, Inc., plans to issue $500,000 of ten percent bonds that will pay interest semiannually and mature in five years. Assume that the effective interest rate is 12 percent per year compounded semiannually. How would I Calculate the selling price of the bonds.On January 1, 2002, Cougar Company received a two-year $500,000 loan. The loan calls for payments to made at the end of each year based on the prevailing market rate at January 1 of each year. The interest rate at January 1, 2002, was 10 percent. Aggie company also has a twoyear $500,000 loan, but Aggie's loan carries a fixed interest rate of 10 percent. Cougar Company does not want to bear the risk that interest rates may increase in year two of the loan. Aggie Company believes that rates may decrease and they would prefer to have variable debt. So the two companies enter into an interest rate swap agreement whereby Aggie agrees to make Cougar's interest payment in 2003 and Cougar likewise agrees to make Aggie's interest payment in 2003. The two companies agree to make settlement payments, for the difference only, on December 31, 2003. If the interest rate on January 1, 2003, is 12 percent, what will be Cougar's settlement payment to/from Aggie? $5,000 payment $10,000 payment…

- nsurance company, IHI, is part of a swap agreement with investment bank Lachlin Bank on a notional principal of $100 million. IHI has agreed to pay Lachlin Bank the six month BBSW rate and receives 7% pa, convertible half-yearly. If the swap has a residual life of 18 months, and the next interest payment is due in six months, calculate the value of the swap for Lachlin, given BBSW rates (compounding continuously) for the corresponding 6, 12 and 18 month maturities are 6.91% pa, 7.3% pa, 7.35% pa and the half year BBSW rate on the next payment is known to be 7% pa compounding half-yearly. Give your answer in millions of dollars to 2 decimal places. Value = $ ___________ million ANSWER IN TYPING OTHER WISE DOWNVOTE YOUMarshall Corporation purchased equipment and in exchange signed a three-year promissorynote. The note requires Marshall to make equal annual payments of $20,000 at the end of each ofthe next three years. Marshall has other promissory notes that charge interest at the annual rateof 6 percent.Required:1. Compute the present value of the note, rounded to the nearest dollar, using Marshall’s typicalinterest rate of 6 percent.2. Show the journal entry to record the equipment purchase (round to the nearest dollar).3. Show the journal entry at the end of the first year to record the first payment of $20,000.4. Show the journal entry at the end of the second year to record the second payment of $20,000.5. Show the journal entry at the end of the third year to record the third payment of $20,000.The CFO of Kendrick Enterprises, is evaluating a 10-year, 7.6 percent loan with gross proceeds of $6,400,000. The interest payments on the loan will be made annually. Flotation costs are estimated to be 2.7 percent of gross proceeds and will be amortized using a straight-line schedule over the 10-year life of the loan. The company has a tax rate of 23 percent and the loan will not increase the risk of financial distress for the company. a. Calculate the net present value of the loan excluding flotation costs. (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. Calculate the net present value of the loan including flotation costs.