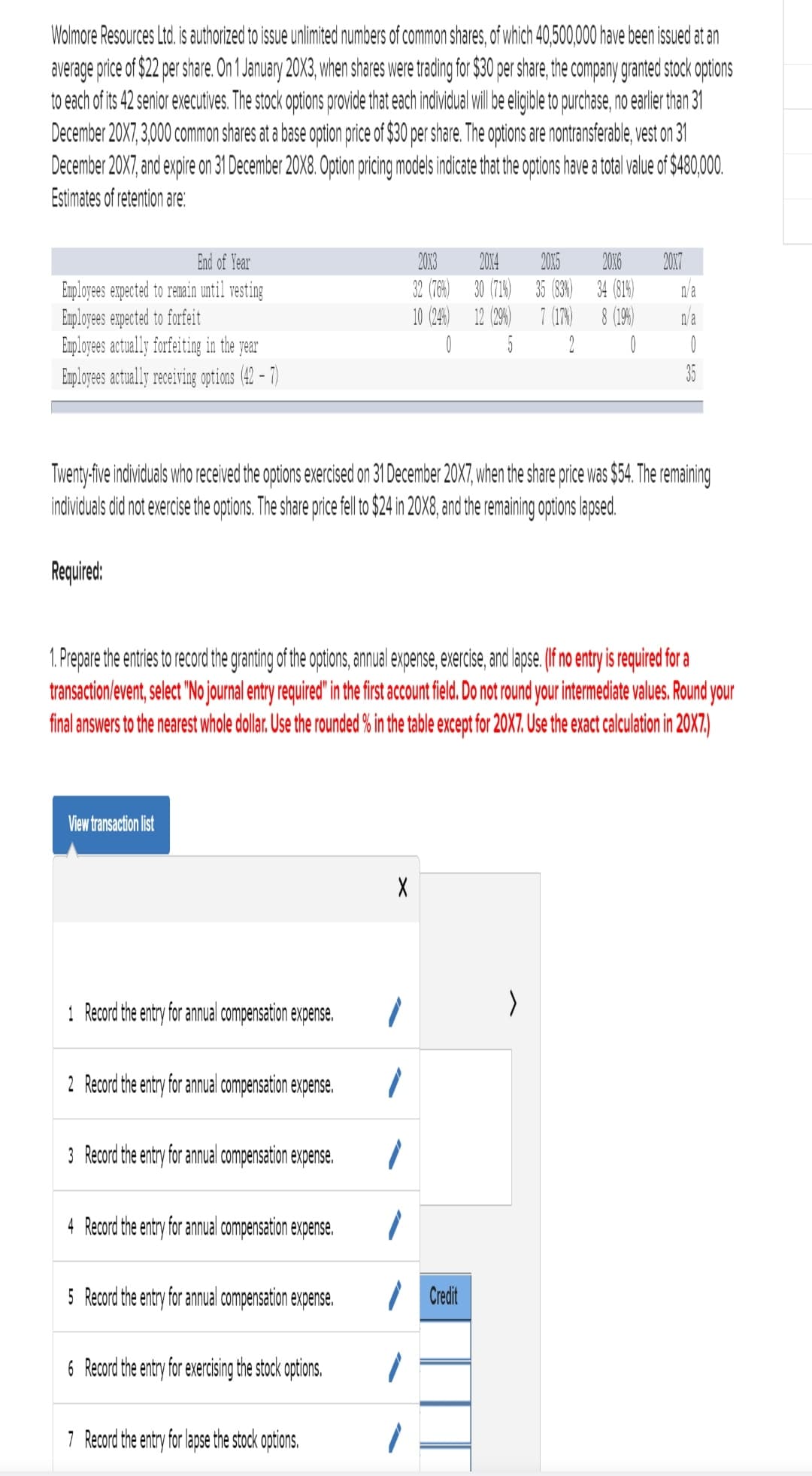

Wolmore Resources Ltd. is authorized to issue unlimited numbers of common shares, of which 40,500,000 have been issued at an average price of $22 per share. On 1 January 20X3, when shares were trading for $30 per share, the company granted stock options to each of ts 42 senior executives. The stock options provide that each individual il be elileto purchase, no earlie than 31 December 20X7, 3,000 common shares at a base option price of $30 per share. The options are nontransferable, vest on 31 December 20X7, and expire on 31 December 20X8. Option pricing models indicate that the options have a total value of $480,000. Estimates of retention are: 2017 2014 32 (764) 30 (714) 10 (24) 12 (294) End of Year 2013 2015 2016 35 (34) 34 (S14) 7 (17%) 8 (194) Employees expected to remain until vesting Employees empected to forfeit Employees actually forfeiting in the year Employees actually receiving opions (42 – 7) n/a n/a 5 2 0 35 Twenty-five individuals who received the options exercised on 31 December 20X7, when the share price vas $54. The remaining individuals did not exercise the options. The share price fel to $24 in 20X8, and the remaining optons lapsed. Required: 1. Prepare the entries to record the granting of the options, annual expense, exercie, and lapse. (f no ntry is required for a transaction/event, select 'Nojounal entryrequird'in the fist acount fed. Do not ound your intermediate values. Round your final answers to the nearest whole olla.Ue the rounded % in the table except for 20X7. Use the exact calculation in 20X7) View transactin list

Wolmore Resources Ltd. is authorized to issue unlimited numbers of common shares, of which 40,500,000 have been issued at an average price of $22 per share. On 1 January 20X3, when shares were trading for $30 per share, the company granted stock options to each of ts 42 senior executives. The stock options provide that each individual il be elileto purchase, no earlie than 31 December 20X7, 3,000 common shares at a base option price of $30 per share. The options are nontransferable, vest on 31 December 20X7, and expire on 31 December 20X8. Option pricing models indicate that the options have a total value of $480,000. Estimates of retention are: 2017 2014 32 (764) 30 (714) 10 (24) 12 (294) End of Year 2013 2015 2016 35 (34) 34 (S14) 7 (17%) 8 (194) Employees expected to remain until vesting Employees empected to forfeit Employees actually forfeiting in the year Employees actually receiving opions (42 – 7) n/a n/a 5 2 0 35 Twenty-five individuals who received the options exercised on 31 December 20X7, when the share price vas $54. The remaining individuals did not exercise the options. The share price fel to $24 in 20X8, and the remaining optons lapsed. Required: 1. Prepare the entries to record the granting of the options, annual expense, exercie, and lapse. (f no ntry is required for a transaction/event, select 'Nojounal entryrequird'in the fist acount fed. Do not ound your intermediate values. Round your final answers to the nearest whole olla.Ue the rounded % in the table except for 20X7. Use the exact calculation in 20X7) View transactin list

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter15: Contributed Capital

Section: Chapter Questions

Problem 5MC

Related questions

Concept explainers

Question

Transcribed Image Text:Wolmore Resources Ltd. is authorized to issue unlimited numbers of common shares, of which 40,500,000 have been issued at an

average price of $22 per share. On 1 anuary 20X3, when shares were tradig for $30 per share, the company granted stock options

to each of its 42 senior executives. The stock options provide that each individual will e eligible t purchase, no earler than 31

December 20X7, 3,000 common shares at a base option price of $30 per share. The options are nontransferable, vest on 31

December 20X7, and expire on 31 December 20X8. Option pricing models indicate that the options have a total value of $480,000.

Estimates of retention are:

End of Year

203

2014

2015

2016

2017

32 (76) 30 (714) 35 (636) 34 (814)

8 (194)

7 (17%)

Employees empected to remain until vesting

Employees expected to forfeit

Employees actually forfeiting in the year

Enployees actually receiving options (42 - 7)

n/a

10 (24) 12 (294)

n/a

Twenty-five individuals who received the options exercised on 31 December 20X7, when the share price vas $54. The remaining

individuals did not exercise the options. The share price fel to $24 in 20X8, and the remaining options lapsed.

Required:

sto record the granting of the options, annual expense, exercise, and lapse. (f no entry is required for a

1. Prepare the e

transaction/event, select "No journal entry required" in the first acount field. Do not round your intermediate values. Round your

final answers to the nearest whole dollar. Use the rounded % in the table except for 20X7. Use the exact calculation in 20X7.)

View transaction list

1 Record the entry for annual compensetion expense.

2 Record the entry for annual compensation expense.

3 Record the entry for annual compensation expense.

4 Record the entry for annual compensation expense.

5 Record the entry for annual compensation expense.

Credit

6 Record the entry for exercising the stock options.

7 Record the entry for lapse the stock options.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,