working capital management

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter12: Fainancial Statement Analysis

Section: Chapter Questions

Problem 87PSB

Related questions

Question

Evaluate the

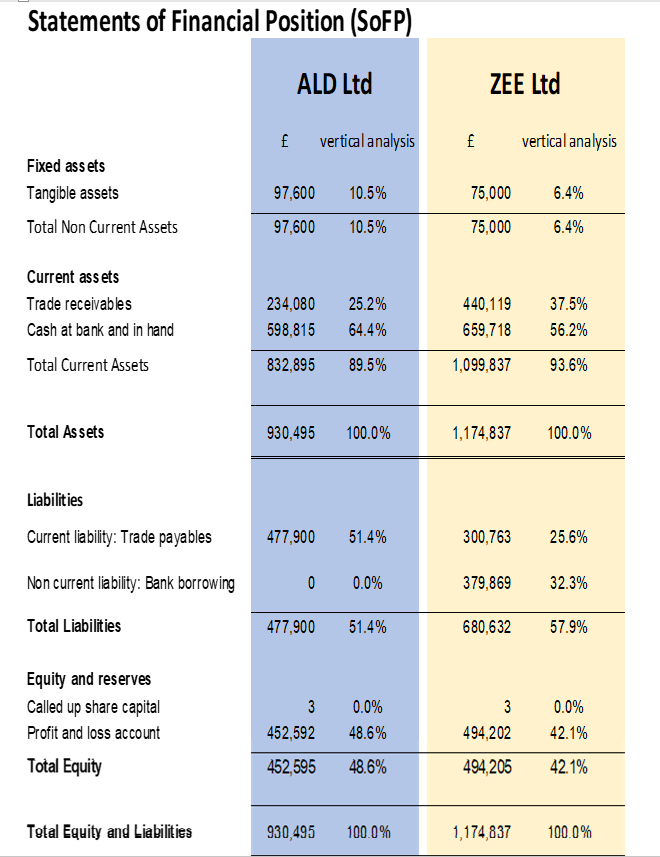

Transcribed Image Text:Statements of Financial Position (SOFP)

ALD Ltd

Fixed assets

Tangible assets

Total Non Current Assets

Current ass ets

Trade receivables

Cash at bank and in hand

Total Current Assets

Total Assets

Liabilities

Current liability: Trade payables

Non current liability: Bank borrowing

Total Liabilities

Equity and reserves

Called up share capital

Profit and loss account

Total Equity

Total Equity and Liabilities

£

97,600

10.5%

97,600 10.5%

234,080 25.2%

598,815 64.4%

832,895 89.5%

930,495 100.0%

vertical analysis

477,900 51.4%

0

477,900

3

452,592

452,595

930,495

0.0%

51.4%

0.0%

48.6%

48.6%

100.0%

4

ZEE Ltd

75,000

75,000

1,174,837

440,119

37.5%

659,718 56.2%

1,099,837

93.6%

vertical analysis

680,632

6.4%

6.4%

300,763 25.6%

3

494,202

494,205

379,869 32.3%

1,174,837

100.0%

57.9%

0.0%

42.1%

42.1%

100.0%

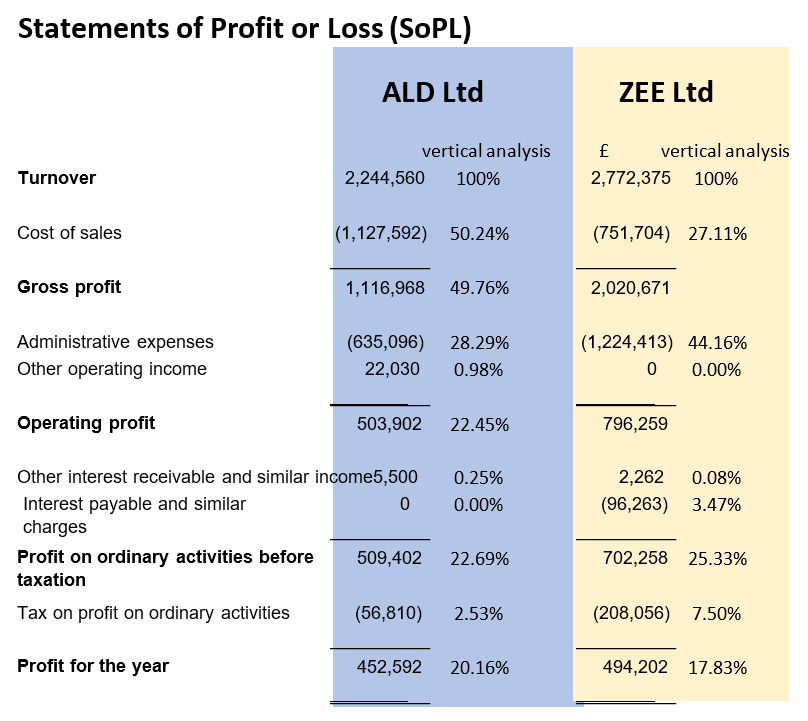

Transcribed Image Text:Statements of Profit or Loss (SOPL)

ALD Ltd

Turnover

Cost of sales

Gross profit

Administrative expenses

Other operating income

Operating profit

2,244,560 100%

Profit for the year

vertical analysis

(1,127,592) 50.24%

1,116,968 49.76%

(635,096) 28.29%

22,030 0.98%

Other interest receivable and similar income5,500

Interest payable and similar

charges

503,902

0

Profit on ordinary activities before 509,402

taxation

Tax on profit on ordinary activities

(56,810)

452,592

22.45%

0.25%

0.00%

22.69%

2.53%

20.16%

ZEE Ltd

vertical analysis

£

2,772,375 100%

(751,704) 27.11%

2,020,671

(1,224,413) 44.16%

0

0.00%

796,259

2,262

0.08%

(96,263) 3.47%

702,258 25.33%

(208,056) 7.50%

494,202 17.83%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning