(worth $35,000), inventory (worth $83,750), and copyrights $12,250). Instructions: 1. Prepare the July 1 entry for Aeroplus Corporation to record the purchase. 2. Prepare the December 31 entry for Aeroplus Corporation to record amortization of intangibles. The copyrights have an estimated useful life of 5 years with a residual value of $2,250.

(worth $35,000), inventory (worth $83,750), and copyrights $12,250). Instructions: 1. Prepare the July 1 entry for Aeroplus Corporation to record the purchase. 2. Prepare the December 31 entry for Aeroplus Corporation to record amortization of intangibles. The copyrights have an estimated useful life of 5 years with a residual value of $2,250.

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter8: Property Transactions: Capital Gains And Losses, Section 1231 And Recapture Provisions

Section: Chapter Questions

Problem 38P

Related questions

Question

Transcribed Image Text:(worth $35,000), inventory (worth $83,750), and copyrights (worth

$12,250).

Instructions:

1. Prepare the July 1 entry for Aeroplus Corporation to record the

purchase.

2. Prepare the December 31 entry for Aeroplus Corporation to

record amortization of intangibles. The copyrights have an

estimated useful life of 5 years with a residual value of $2,250.

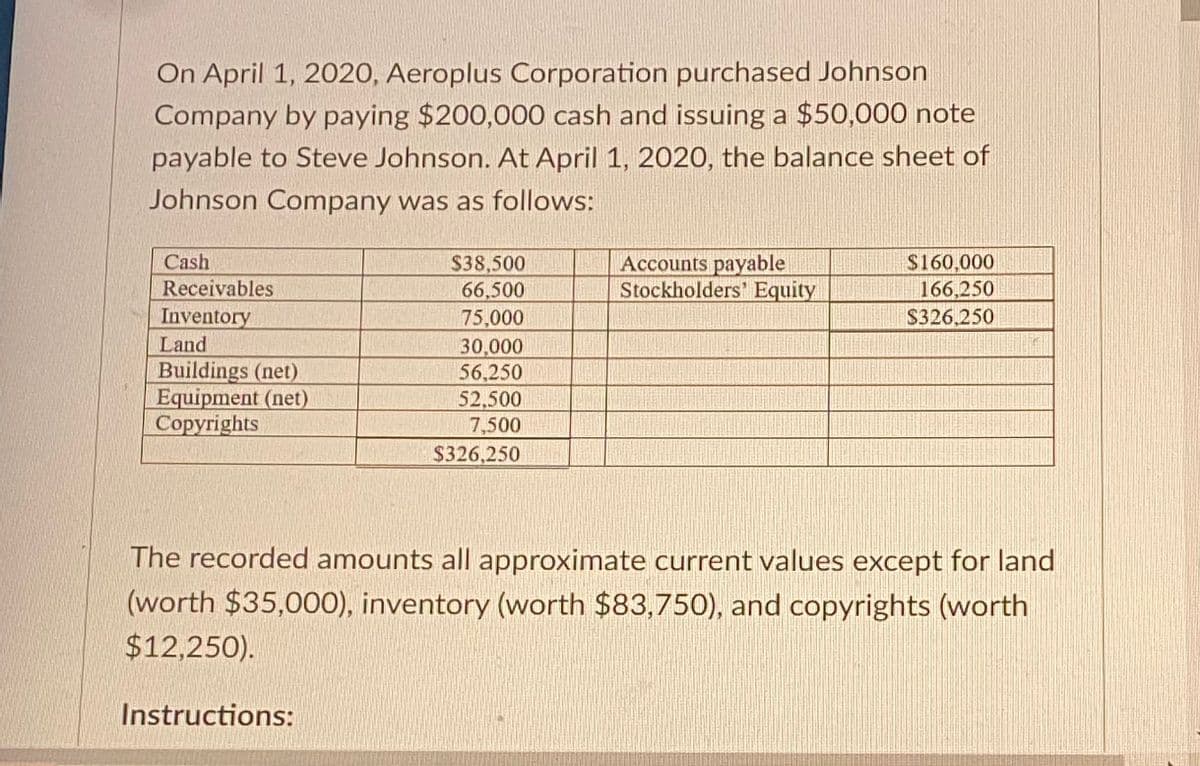

Transcribed Image Text:On April 1, 2020, Aeroplus Corporation purchased Johnson

Company by paying $200,000 cash and issuing a $50,000 note

payable to Steve Johnson. At April 1, 2020, the balance sheet of

Johnson Company was as follows:

Cash

Receivables

Inventory

Land

Buildings (net)

Equipment (net)

Copyrights

$38,500

66,500

75,000

30,000

56,250

Instructions:

52,500

7,500

$326,250

Accounts payable

Stockholders' Equity

$160,000

166,250

$326,250

The recorded amounts all approximate current values except for land

(worth $35,000), inventory (worth $83,750), and copyrights (worth

$12,250).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning