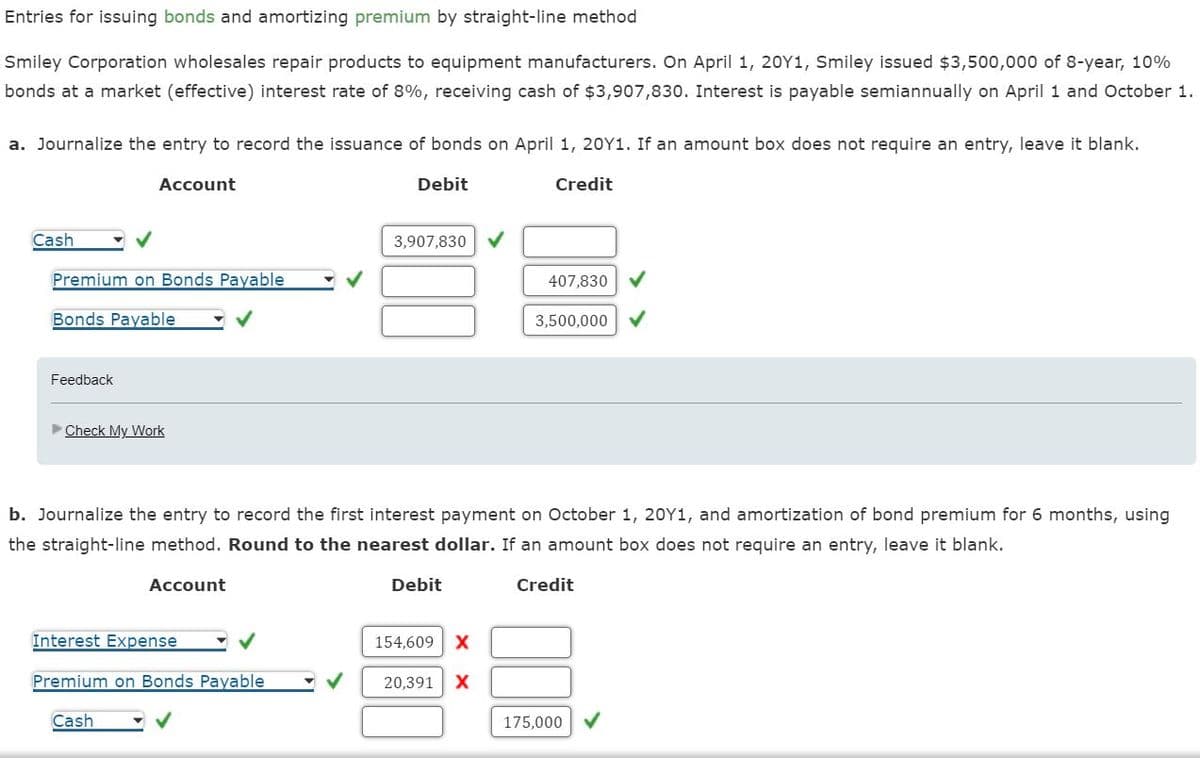

Entries for issuing bonds and amortizing premium by straight-line method Smiley Corporation wholesales repair products to equipment manufacturers. On April 1, 20Y1, Smiley issued $3,500,000 of 8-year, 10% bonds at a market (effective) interest rate of 8%, receiving cash of $3,907,830. Interest is payable semiannually on April 1 and October 1. a. Journalize the entry to record the issuance of bonds on April 1, 20Y1. If an amount box does not require an entry, leave it blank. Account Credit Cash ✓ Premium on Bonds Payable Bonds Payable Feedback ►Check My Work Account Debit Interest Expense Premium on Bonds Payable Cash 3,907,830 b. Journalize the entry to record the first interest payment on October 1, 20Y1, and amortization of bond premium for 6 months, using the straight-line method. Round to the nearest dollar. If an amount box does not require an entry, leave it blank. Credit Debit 154,609 X 407,830 20,391 X 3,500,000 175,000

Entries for issuing bonds and amortizing premium by straight-line method Smiley Corporation wholesales repair products to equipment manufacturers. On April 1, 20Y1, Smiley issued $3,500,000 of 8-year, 10% bonds at a market (effective) interest rate of 8%, receiving cash of $3,907,830. Interest is payable semiannually on April 1 and October 1. a. Journalize the entry to record the issuance of bonds on April 1, 20Y1. If an amount box does not require an entry, leave it blank. Account Credit Cash ✓ Premium on Bonds Payable Bonds Payable Feedback ►Check My Work Account Debit Interest Expense Premium on Bonds Payable Cash 3,907,830 b. Journalize the entry to record the first interest payment on October 1, 20Y1, and amortization of bond premium for 6 months, using the straight-line method. Round to the nearest dollar. If an amount box does not require an entry, leave it blank. Credit Debit 154,609 X 407,830 20,391 X 3,500,000 175,000

Chapter13: Long-term Liabilities

Section: Chapter Questions

Problem 5PA: Volunteer Inc. issued bonds with a $500,000 face value, 10% interest rate, and a 4-year term on July...

Related questions

Question

100%

Transcribed Image Text:for issuing bonds and amortizing premium by straight-line method

Entries

Smiley Corporation wholesales repair products to equipment manufacturers. On April 1, 20Y1, Smiley issued $3,500,000 of 8-year, 10%

bonds at a market (effective) interest rate of 8%, receiving cash of $3,907,830. Interest is payable semiannually on April 1 and October 1.

a. Journalize the entry to record the issuance of bonds on April 1, 20Y1. If an amount box does not require an entry, leave it blank.

Debit

Cash

Account

Premium on Bonds Payable

Bonds Payable

Feedback

►Check My Work

3,907,830

Interest Expense

Premium on Bonds Payable

Cash

Debit

b. Journalize the entry to record the first interest payment on October 1, 20Y1, and amortization of bond premium for 6 months, using

the straight-line method. Round to the nearest dollar. If an amount box does not require an entry, leave it blank.

Account

Credit

154,609 X

Credit

20,391 X

407,830

3,500,000

175,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 1 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Would you please help me understand how you got 16 for semiannual periods (number of period)?

Bond premium amortised = Total bond premium ÷ Number of period

= $407,830 ÷16 semiannual periods = $25,489 (Rounded to the nearest dollars).

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,