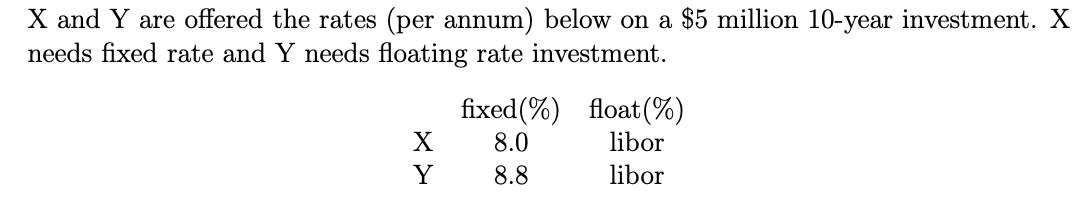

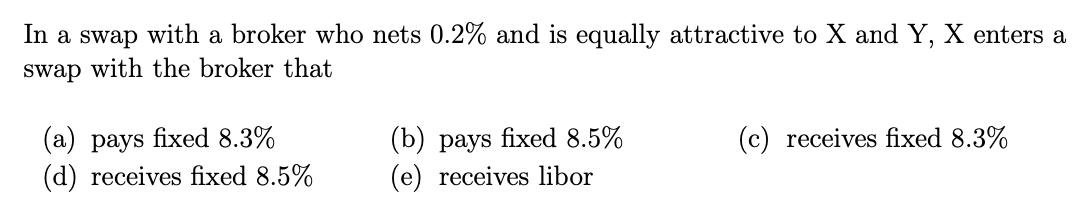

X and Y are offered the rates (per annum) below on a $5 million 10-year investment. X needs fixed rate and Y needs floating rate investment. fixed (%) float (%) X 8.0 libor Y 8.8 libor

Q: 3) Consider two individuals, Susan and Rachel, who are deciding how much education to receive. The…

A: MRR is the rate at which additional money can be borrowed and that is based on the risk involved.

Q: As an Investment Analyst who researches and analyses markets, companies, and stocks to be invested…

A: Detailed analysis belowExplanation:Detailed explanation: Apple Inc. (AAPL):Apple Inc. is a leading…

Q: A health insurance policy pays 80 percent of physical therapy costs after a deductible of $260. In…

A: The health insurance policy will pay 80% of the cost after a deductible of $260.It means out of…

Q: Consider two mutually exclusive projects A and B: Cash Flows (dollars) Project Co A -39,500 B…

A: Internal Rate of Return (IRR) means the discount rate at which the present value of cash flows and…

Q: Pari Inc., an all-equity firm, has earnings before interest and taxes of $950,000 and an un-levered…

A: The objective of the question is to calculate various financial metrics for Pari Inc., an all-equity…

Q: Required information [The following information applies to the questions displayed below.] A pension…

A: T-bill market rate = 5.5%Expected return on stock fund (S) = 16%Expected return on bond fund (B) =…

Q: The Cambro Foundation, a nonprofit organization, is planning to invest $125,303 in a project that…

A: Discounted cash flow: Discounted cash flow (DCF) valuation is a formula that is used to discounts…

Q: Imagine you are starting the firm with your Team and you are all college seniors with limited work…

A: A Passionate and Agile Team for [Company Name] Building for Success While our team may be young, we…

Q: Bhupatbhai

A: The objective of the question is to determine the value of the leased equipment that will be…

Q: The Atlantic Medical Clinic can purchase a new computer system that will save $7,000 annually in…

A: Annual savings = $7,000Period =9 yearsNote : Here we have to use the present value of the annuity…

Q: A student loan is offered under the following conditions: credit of 30, 000 euros at 3% over a…

A: The objective of the question is to calculate the constant annuities of a student loan and to draw…

Q: will be making end of month deposits of $800 into the account for 12.5 years. How much will you need…

A: The future value is an estimate of how much money you will have in the future from investments or…

Q: A7X Corporation just paid a dividend of $1.60 per share. The dividends are expected to grow at 40…

A:

Q: Which situation is generally a consequence of overly lenient loan repayment terms A. The borrower…

A: The general consequence of overly lenient loan repayment terms will be:Answer: Option C, The…

Q: Suppose that a firm's recent earnings per share and dividend per share are $3.15 and $2.60,…

A: Earnings per share = $3.15Dividends per share = $2.60Growth rate = 6%Expected PE ratio fall within…

Q: Timothy Mother Ms. Parker find out her Monthly Rent is $496.00 every month but she owes $13,842.00…

A: The objective of the question is to find out how much more money Ms. Parker needs to take out from…

Q: S Doug Bernard specializes in cross-rate arbitrage. He notices the following quotes: Swiss…

A: a. Yes, Doug Bernard has an arbitrage opportunity based on these quotes. b. Arbitrage profit:…

Q: The Berndt Corporation expects to have sales of $12 million. Costs other than depreciation are…

A: "Since you have posted a question with multiple sub-parts we will solve the first three sub-parts…

Q: Cheng Inc. is considering a capital budgeting project that has an expected return of 43% and a…

A: Given:Expected return (E[R]) = 43%Standard deviation (σ) = 30%

Q: Consider the following table, which gives a security analyst's expected return on two stocks in two…

A: Beta can be calculated as

Q: Brandtly Industries Invests a large sum of money in R&D; as a result, it retains and reinvests all…

A: In the valuation of a firm the discounted cash flow (DCF) approach is based on the present value of…

Q: You plan to spend $400 to buy a new IPAD at the beginning of year3 and $1,000 to buy a new phone at…

A: The objective of this question is to calculate the amount of money that needs to be saved each year…

Q: You find the following corporate bond quotes. To calculate the number of years until maturity,…

A: A bond refers to a fixed-income investment instrument issued by governments, municipalities, or…

Q: If you are trying to build credit by using a credit card, each time you make a purchase with the…

A: Credit cardA sort of credit facility offered by banks is a credit card, which enables users to…

Q: (Appendix 13A and 13B) A company anticipates a tax-deductible cash expense of $40,000 in year 2 of a…

A: The present value of a cash outflow is the current worth of a future sum of money that is to be paid…

Q: When Maria Acosta bought a car 2 years ago, she borrowed $13,000 for 48 months at 6.6% compounded…

A: The mortgages are the mechanism where the investment can use the amount that is borrowed for a…

Q: You believe that PEP price will only vary slightly in the coming days and therefore you decide to…

A: BUTTERFLY SPREADIt refers to an options strategy that combines bull and bear spreads and involves…

Q: A pension fund manager is considering three mutual funds. The first is a stock fund, the second is a…

A: Optimal risky portfolio is one which gives the highest risk to reward ratio and lies on the tangent…

Q: The yield to maturity of a $ 1 000 bond with a 7.2 % coupon rate, semi-annual coupons, and two…

A: The objective of the question is to calculate the price of a bond given its yield to maturity,…

Q: 3. Lohn Corporation is expected to pay the following dividends over the next four years: $9, $7,…

A: calculating Lohn Corporation's current share price using the Dividend Discount Model (DDM), a key…

Q: Courtney Limited has capital project opportunities each of which would require an initial investment…

A: Net Present Value (NPV) is a financial measure used to analyze the profitability of an investment by…

Q: BUG's stock price S is $50 today. It pays a dividend of $0.25 after two months and $0.30 after five…

A: A forward contract is a special agreement between two parties to purchase or sell an item at a…

Q: Citco Company is considering investing up to $512,000 in a sustainability-enhancing project. Its…

A: Pay back period, NPV , Profitability index And IRR can be explained by following formulasPay back…

Q: Consider this project with an internal rate of return of 15.5%. The following are the Year Cash Flow…

A: Discount rate = 13%IRR = 15.50%Year 1 cash flow = $105Year 2 cash flow = -$65Year 3 cash flow =…

Q: Company Sunland sells $2400 of merchandise on account to Company Wildhorse with credit terms of…

A: Discount Scheme 1/10 means if the customer pays the amount within 10 days he shall get a discount of…

Q: Complete the following using the present value formula or financial calculator. Note: Do not round…

A: Amount desired at the end of the period = $7,300Number of years = 5 yearsInterest rate = 4%

Q: Rate Maturity Month/Year Bid Asked Change Ask Yield ?? May 32 103.4742 103.5470 +.3145 6.199 5.724…

A: Yield to maturity:Yield to maturity (YTM) is a crucial concept in finance, particularly in bond…

Q: Do not use chatgpt.

A: Profitability Index = Present Value of Cash Flows / Initial Investment project 1:Calculate the…

Q: Paul Adams owns a health club in downtown Los Angeles. He charges his customers an annual fee of…

A: The time value of money is used in finance when the value of a certain amount of money is to be…

Q: A student loan is offered under the following conditions: credit of 30, 000 euros at 3% over a…

A: The objective of the question is to calculate the constant annuities of a student loan and to draw…

Q: A Treasury bond with 11 years to maturity is currently quoted at 113:9. The bond has a coupon rate…

A: A Bond is a debt investment which is issued by a borrower to the investor, it is usually used by…

Q: Suppose you purchase a $1,000 TIPS on January 1, 2024. The bond carries a fixed coupon of 1 percent.…

A: Coupon payment refers to an amount that is paid by the bondholder to the issuer of the bond at every…

Q: ($ thousands) Net cash flow Present value at 19% Net present value 0 1 3 -13,700 -13,700 3,541 (sum…

A: Net present value refers to the method of capital budgeting used for evaluating the viability of the…

Q: Find the intrinsic value of the stock stabili

A: The projected or computed value of a business, stock, money, or product that is ascertained via…

Q: Jordan purchased a franchise agreement to distribute electronic gadgets for 8 years. The agreement…

A: The objective of this question is to calculate the Internal Rate of Return (IRR) for Jordan's…

Q: An investor purchased a 182-day, $10,000.00 T - bill on its issue date for $ 9910.29. After holding…

A: The objective of the question is to calculate the original yield of the T-bill, the selling price of…

Q: Problem 9-13 Portfolio Return (LG9-7) Year-to-date, Oracle had earned a -1.39 percent return. During…

A: StockWeightReturnsOracle15%-1.39%Valero Energy20%7.65%McDonald's65%0.42%

Q: On January 1, 2024, Avalanche Corporation borrowed $104,000 from First Bank by Issuing a two-year,…

A: The net effect on earnings refers to the overall impact or result of various factors on a company's…

Q: Scholastic Co. is evaluating a machine with an initial cost of $450,000 and a five-year life that…

A: Calculating the NPV (Net Present Value) of the project involves determining the cash flows…

Q: 21. NPV and Payback Period Kaleb Konstruction, Inc., has the following mutually exclusive projects…

A: Here, YearCash FlowsProject AProject B0 $ (195,000.00) $ (298,000.00)1 $…

Step by step

Solved in 3 steps with 3 images

- Suppose you have a 2.5-year remaining on an interest rate swap with a notionalprincipal of $10, 000, 000 between Company A and Company B. Company A pays fixed rateand Company B pays the float rate. Fixed and float payments are exchanged every year andthe last payment was exchanged 6 months ago. The fixed rate is 3.5% per annum, and thefloating rate is tied to the annual LIBOR. The previous 1-year LIBOR rate, set 6 months ago,is 2.75%, 6 month LIBOR is 3.25%. the 1.5-year LIBOR is 3.25%, and the 2.5-year LIBOR is3.50%.Calculate the present value of the fixed and floating legs of the swap, and determine the swap’snet present value from Company A’s perspective. Assume annual compounding for discounting.Given CHF 3,500,000 as your capital, calculate the possible profit from covered interest arbitrage. Explain specific steps that you must take to make a coveredinterest arbitrage. CHF Fr = SwissFranc BND = Brunei Darul Salam Spot rate CHF0.7359/BND 270-day forward rate CHF 0.7359/BND 9-month Brunei interest rate 5% 9-month swiss interest rate 4% Step 1 1) Different i for Base rate -Quote rate = 2) Different between Spot and Forward = (1) + (2) = invest in _ borrow in _ Step 2 explain using tableSuppose that the 9-month and 12-month LIBOR rates are 4% and 4.2%, respectively. What is the value of an FRA where 5% is received and LIBOR is paid on £1 million for the quarterly period? All rates are quarterly compounded and expressed as per annum. Assume that LIBOR is used as the risk-free discount rate. Select one: a. £478.115 b. £422.870 c. £479.062 d. £426.132

- Assume that Caterpillar’s return on investments is 2.50% per annum for the next four years. Next, suppose that Caterpillar and UBS (a financial institution) enter the following four year interest rate swap: Catepillar pays X% per annum fixed to UBS and receives LIBOR from UBS. All payments are made annually. Catepillar’s net return after it enters the swap is (LIBOR + 0.75%) per annum. In this case, Catepillar transforms ___________ into __________ and X equals to ________.a. Floating Rate Investment; Fixed Rate Investment; 1.75%b. Fixed Rate Investment; Floating Rate Investment; 3.25% c. Floating Rate Liability; Fixed Rate Liability; 3.25%d. Fixed Rate Investment; Floating Rate Investment; 3.50%e. Fixed Rate Investment; Floating Rate Investment; 1.75%What is the approximate return on a 5-year market-linked guaranteed investment certificate (GIC) that has a 25% cap rate where the relevant index had an initial index level of 9,473 and an ending index level of 15,498? 36.40% 25.00% 33.00% 63.60% Plz do fast asapGiven CHF 3,500,000 as your capital, calculate the possible profit from coveredinterest arbitrage. Explain specific steps that you must take to make a coveredinterest arbitrage.Spot rate CHF 0.7359/BND270-day forward rate CHF 0.7955/BND9-month Brunei interest rate 5%9-month Swiss interest rate 4%CHF Fr.= Swiss Franc.BND = Brunei Darul Salam.

- Suppose an investment has an initial capital cost of $1100, an ongoing cost of $6.50 per year and an annual benefit of $80. If the project lasts for 20 years and the discount rate is 7%, the internal rate of return is: Provide your answer in percentage form (e.g. an IRR of 17.66% should be entered as 17.66) to 2 decimal places. Do not include any $ or % 's in your response.A firm, whose cost of capital is 8 percent, may acquire equipment for $146,825 and rent it to someone for a period of five years. Note: Although payment of rent is typically considered to be an annuity due, treat it as an ordinary annuity when completing this problem in a spreadsheet or when using present value factors. If the firm charges $38,730 annually to rent the equipment, what are the net present value and the internal rate of return on the investment? Use Appendix D to answer the questions. Use a minus sign to enter negative values, if any. Round your answers for the net present value to the nearest dollar and for the internal rate of return to the nearest whole number. NPV: $ IRR: % Should the firm acquire the equipment? The firm acquire the equipment as the net present value is , and the internal rate of return the firm's cost of capital. If the equipment has no estimated residual value, what must be the minimum annual rental charge for the firm to earn the required 8…Assume $100,000 is available for investment and MARR =10% per year. If alternative A would earn 25% per year on inveatment of 60,000 and B would be earn 20% per year on investment of 75000 the weighted average(ROR) of A

- You are given the following long-run annual rates of return for alternative investment instruments: U.S. Government T-bills 3.50% [0.0048] Large-cap common stock 11.75 [ ] Long-term corporate bonds 5.50 [ ] Long-term government bonds 4.90 [ ] Small-capitalization common stock 13.10 [ ] The annual rate of inflation during this period was 3 percent. Compute the real rate of return on these investment alternatives.What is the present value of a 15 year investment amounting to Ᵽ 45,670 if the prevailing interest is 2.5%? Based on Item No. 1 compute for the present value of Ᵽ 45,670 in 20, 22 and 25 years if the interest rates are 5.5%, 6.8% and 9.80% respectively.The 1-year spot rate is 8%p.a. effective. The term structure of 1-year effective forwardratesisasfollows: attimet=1therateis7%,attimet=2therate is 6%, at time t = 3 the rate is 5%. (a) Determine the term structure of spot rates. (b) A fixed income security pays £10 annual coupons and it is redeemed after 4 years for £100. Compute its price at time t = 0.