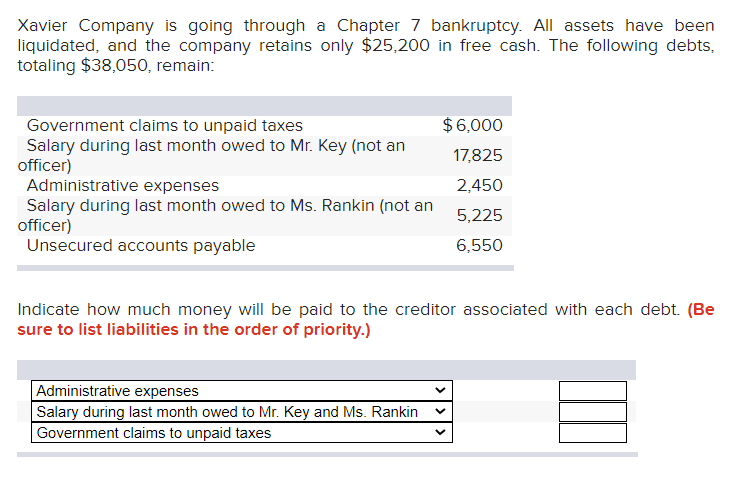

Xavier Company is going through a Chapter 7 bankruptcy. All assets have been liquidated, and the company retains only $25,200 in free cash. The following debts, totaling $38,050, remain: Government claims to unpaid taxes Salary during last month owed to Mr. Key (not an officer) Administrative expenses Salary during last month owed to Ms. Rankin (not an officer) Unsecured accounts payable $6,000 17,825 2,450 5,225 6,550 Indicate how much money will be paid to the creditor associated with each debt. (Be

Xavier Company is going through a Chapter 7 bankruptcy. All assets have been liquidated, and the company retains only $25,200 in free cash. The following debts, totaling $38,050, remain: Government claims to unpaid taxes Salary during last month owed to Mr. Key (not an officer) Administrative expenses Salary during last month owed to Ms. Rankin (not an officer) Unsecured accounts payable $6,000 17,825 2,450 5,225 6,550 Indicate how much money will be paid to the creditor associated with each debt. (Be

Chapter23: Corporate Restructuring

Section: Chapter Questions

Problem 6P

Related questions

Question

Transcribed Image Text:Xavier Company is going through a Chapter 7 bankruptcy. All assets have been

liquidated, and the company retains only $25,200 in free cash. The following debts,

totaling $38,050, remain:

Government claims to unpaid taxes

Salary during last month owed to Mr. Key (not an

officer)

Administrative expenses

Salary during last month owed to Ms. Rankin (not an

officer)

Unsecured accounts payable

$6,000

17,825

2,450

5,225

6,550

Indicate how much money will be paid to the creditor associated with each debt. (Be

sure to list liabilities in the order of priority.)

Administrative expenses

Salary during last month owed to Mr. Key and Ms. Rankin

Government claims to unpaid taxes

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Business Its Legal Ethical & Global Environment

Accounting

ISBN:

9781305224414

Author:

JENNINGS

Publisher:

Cengage

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Business Its Legal Ethical & Global Environment

Accounting

ISBN:

9781305224414

Author:

JENNINGS

Publisher:

Cengage