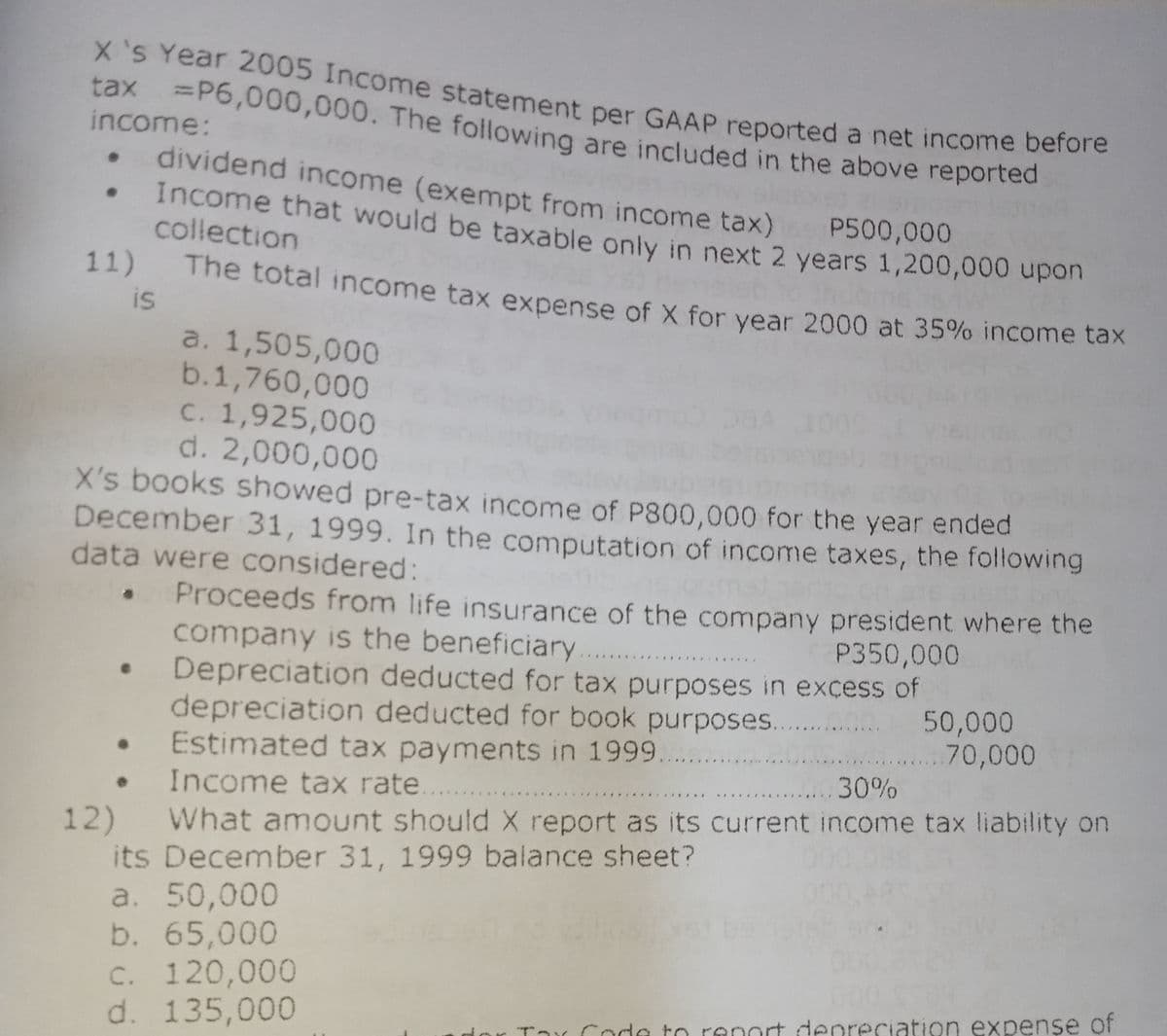

X's Year 2005 Income statement per GAAP reported a net income before tax =P6,000,000. The following are included in the above reported income: dividend income (exempt from income tax) Income that would be taxable only in next 2 years 1,200,000 upon collection P500,000 11) The total income tax expense of X for vear 2000 at 35% income tax is a. 1,505,000 b.1,760,000 C. 1,925,000 d. 2,000,000

X's Year 2005 Income statement per GAAP reported a net income before tax =P6,000,000. The following are included in the above reported income: dividend income (exempt from income tax) Income that would be taxable only in next 2 years 1,200,000 upon collection P500,000 11) The total income tax expense of X for vear 2000 at 35% income tax is a. 1,505,000 b.1,760,000 C. 1,925,000 d. 2,000,000

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter3: Taxes On The Financial Statements

Section: Chapter Questions

Problem 4BCRQ

Related questions

Question

Transcribed Image Text:X's Year 2005 Income statement per GAAP reported a net income before

tax =P6,000,000. The following are included in the above reported

%3D

income:

dividend income (exempt from income tax)

Income that would be taxable only in next 2 years 1,200,000 upN

collection

P500,000

11)

The total income tax expense of X for year 2000 at 35% income tax

is

a. 1,505,000

b.1,760,000

C. 1,925,000

d. 2,000,000

X's books showed pre-tax income of P800,000 for the year ended

December 31, 1999. In the computation of income taxes, the following

data were considered:

Proceeds from life insurance of the company president where the

company is the beneficiary

Depreciation deducted for tax purposes in excess of

depreciation deducted for book purposes.

• Estimated tax payments in 1999.

P350,000

50,000

70,000

...30%

Income tax rate.

What amount should X report as its current income tax liability on

12)

its December 31, 1999 balance sheet?

a. 50,000

b. 65,000

C. 120,000

d. 135,000

Tar Code to renort denreciation expense of

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT