y stamp taxes ntage taxes cal business taxes paid in 2019 due for 2020

Chapter15: Choice Of Business Entity—other Considerations

Section: Chapter Questions

Problem 72P

Related questions

Question

100%

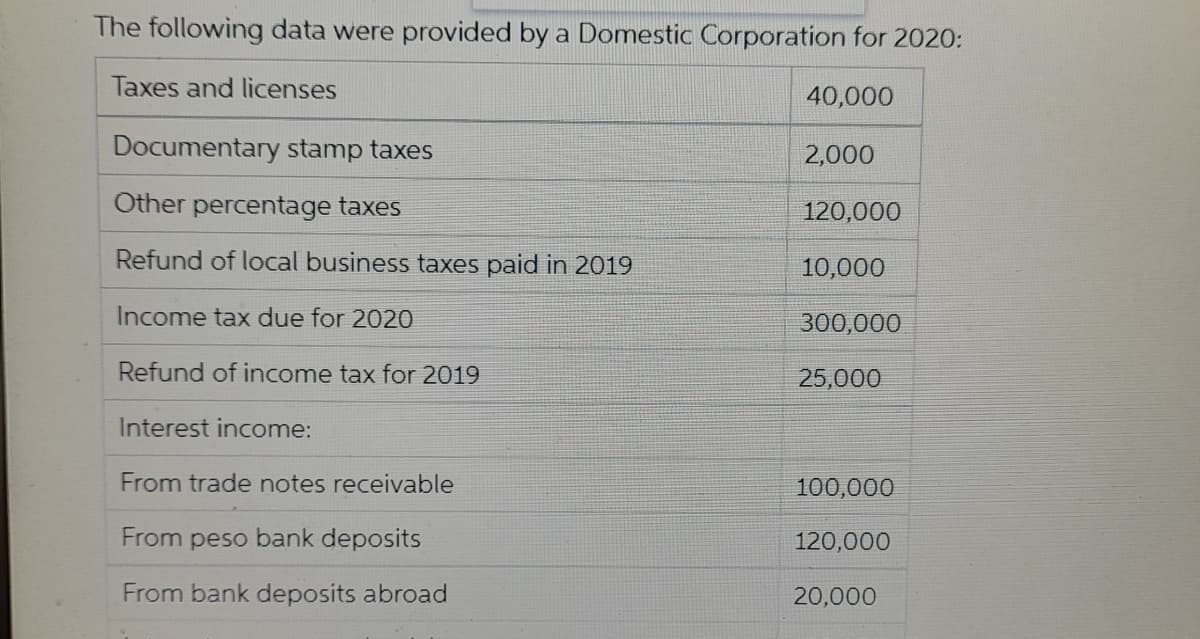

Transcribed Image Text:The following data were provided by a Domestic Corporation for 2020:

Taxes and licenses

40,000

Documentary stamp taxes

2,000

Other percentage taxes

120,000

Refund of local business taxes paid in 2019

10,000

Income tax due for 202O

300,000

Refund of income tax for 2019

25,000

Interest income:

From trade notes receivable

100,000

From peso bank deposits

120,000

From bank deposits abroad

20,000

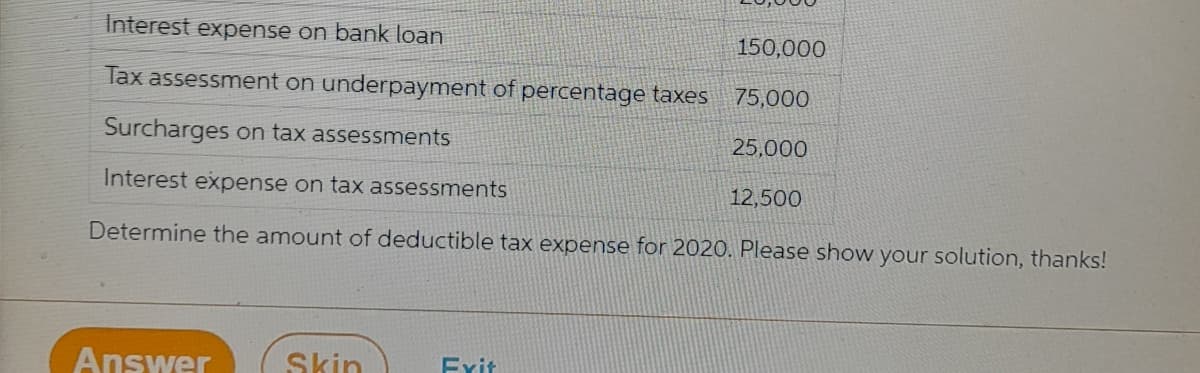

Transcribed Image Text:Interest expense on bank loan

150,000

Tax assessment on underpayment of percentage taxes

75,000

Surcharges on tax assessments

25,000

Interest expense on tax assessments

12,500

Determine the amount of deductible tax expense for 2020. Please show your solution, thanks!

Answer

Skin

Exit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT