Yager Corporation purchased residential real estate several years ago for $225,000, of which $50,000 was allocated to the land and $175,000 was allocated to the building. Yager took straight-ine MACRS deductions of $40,000 during the years it held the property. In the current year, Yager sells the property for $275,000, of which $55,000 is allocated to the land and $220.000 is allocated to the building Requirement What are the amount and character of Yager's recognized gain or loss on the sale? Begin by computing the gain or loss on sale. Select the formula and then enter the amounts and compute the gain or loss on the sale for the land, building and for the total Land Building Total Recognized gain Next, determine the character of the gain or loss on sale of the land and building (Complete all input fields. Land Building Total Recognized gain or loss 0 balance, make sure to enter a 0 in the appropriate cel)

Yager Corporation purchased residential real estate several years ago for $225,000, of which $50,000 was allocated to the land and $175,000 was allocated to the building. Yager took straight-ine MACRS deductions of $40,000 during the years it held the property. In the current year, Yager sells the property for $275,000, of which $55,000 is allocated to the land and $220.000 is allocated to the building Requirement What are the amount and character of Yager's recognized gain or loss on the sale? Begin by computing the gain or loss on sale. Select the formula and then enter the amounts and compute the gain or loss on the sale for the land, building and for the total Land Building Total Recognized gain Next, determine the character of the gain or loss on sale of the land and building (Complete all input fields. Land Building Total Recognized gain or loss 0 balance, make sure to enter a 0 in the appropriate cel)

Chapter9: Acquisitions Of Property

Section: Chapter Questions

Problem 42P

Related questions

Question

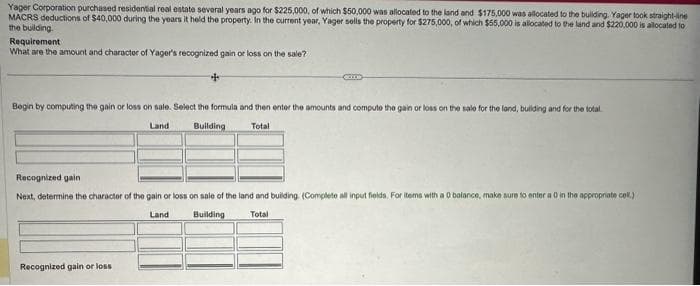

Transcribed Image Text:Yager Corporation purchased residential real estate several years ago for $225,000, of which $50,000 was allocated to the land and $175,000 was allocated to the building. Yager took straight-line

MACRS deductions of $40,000 during the years it held the property. In the current year, Yager sells the property for $275,000, of which $55,000 is allocated to the land and $220,000 is allocated to

the building.

Requirement

What are the amount and character of Yager's recognized gain or loss on the sale?

Begin by computing the gain or loss on sale. Select the formula and then enter the amounts and compute the gain or loss on the sale for the land, building and for the total

Land

Building

Total

Recognized gain

Next, determine the character of the gain or loss on sale of the land and building. (Complete all input fields. For items with a 0 balance, make sure to enter a 0 in the appropriate cell.)

Building Total

Land

Recognized gain or loss

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you