Year 0 -20,000 Project 1 Project 2 Project 3 Project 4 Project 5 -20,000 -20,000 -20,000 -20,000 Year 1 4000 5000 2000 2000 5000 Year 2 3000 4000 3000 5000 5000 Year 3 2000 12,000 4000 9000 5000

Q: you've observed the following returns on Pine Computer's stock over the past five years: -29.7 cent,…

A: Relation between real and nominal rateReal and nominal rate are related with each other through the…

Q: Cullumber Corp. is considering purchasing one of two new diagnostic machines. Either machine would…

A: NPV ( Net Present Value) is a method that is used to assess an investment's profitability by…

Q: A price level adjusted mortgage (PLAM) is made with the following terms: Amount = $96,000 Initial…

A: A price level adjusted mortgage (PLAM) is a particular kind of mortgage in which variations in the…

Q: The four people below have the following investments. Invested Amount Interest Rate Compounding…

A: Future value- A dollar invested today in a financial instrument grows throughout investment as per…

Q: Builtrite needs to raise $2,000,000 for a plant improvement. It plans to sell $1000 par value bonds…

A: The value of a bond can be obtained by adding the present value of the bond's cash flows such as…

Q: eBook 目 Problem Walk-Through nd X is noncallable and has 20 years to maturity, a 10% annual coupon,…

A: Par value$1,000Coupon rate10%Total maturity period20YTM on a 15-year bond8.5%Investor plans to hold…

Q: Jayden wn rour pizza shops in downtown Newa shop has a debt-to- equity ratio of 35 percent and makes…

A: Given Data: Debt equity35%interest Payment 52,000Cost of levered…

Q: Retlaw Corporation (RC) manufactures time-series photographic equipment. It is currently at its…

A: Net present value:Net Present Value (NPV) serves as a vital financial metric used to evaluate the…

Q: the value of the call option increases the value of the call option decreases it is uncertain if the…

A: Call option is derivative product that gives the opportunity to buy stock on expiration but there is…

Q: Problem 11-11 (Algo) Required: A pension plan is obligated to make disbursements of $2.6 million,…

A: In the given question, the portfolio consists of two assets i.e. zero-coupon bond and the perpetuity…

Q: Generic Inc. issued bonds in 2021 that will mature 16 years from the date of issue. The bond pays a…

A: The annual yield on bonds or yield to maturity (YTM), is a measure of the return an investor can…

Q: Banyan Co.’s common stock currently sells for $41.75 per share. The growth rate is a constant 6%,…

A: To apply the constant dividend growth model, 2 requirements have to be fulfilled:(1) The growth rate…

Q: A bond issue of 4%, 8-year bonds with a face value of $43,000 with interest payable annually on…

A: Coupon Rate = c = 4%Time = t = 8Face Value = fv = $43,000Interest Rate = r = 6%Payment Type = at the…

Q: A pottery factory purchases a continuous belt conveyor kiln for $64,000. A 7.2% APR loan with…

A: The number of payment periods is calculated using NPER function in excel with loan amount as…

Q: Sheridan Company is considering three capital expenditure projects. Relevant data for the projects…

A: NPV and IRR are the capital budgeting techniques where IRR is the rate at which NPV becomes zero and…

Q: What is the present value of a $1000 future amount received in 17 years if the appropriate discount…

A: Given:Future Amount (FV) = $1000Discount Rate (r) = 11.7% APR = 0.117Number of years (n) = 17

Q: An investment has an installed cost of $527,630. The cash flows over the four-year life of the…

A: Organizations can choose the best ratio of debt to equity financing for investment projects with the…

Q: The production department is proposing the purchase of an automatic insertion machine. It has…

A: The internal rate of return is one method that allows to compare and rank projects based on their…

Q: The following table shows annual rates for various types of loans in 2021. Assume monthly payments…

A: When the lender lends a loan to the borrower, he charges a rate of interest on the borrowed amount.…

Q: Your company has earnings per share of $4. It has 1 million shares outstanding, each of which has a…

A: The Earning per share is the earning or return on investment on one share. In the capital…

Q: Assume that at the beginning of the year, you purchase an investment for $6,300 that pays $130…

A: Rate of return on the investment has 2 components:(i) Annual income in the form of dividend,…

Q: Orkazana Corporation is experiencing rapid growth. Dividends are expected to grow 28 percent per…

A: Value of stock can be found as the present value of dividends and present value of terminal value of…

Q: Annual and Average Returns for Stocks, Bonds, and T-Bills, 1950 to 2017 Long-Term Treasury 1950 to…

A: Standard deviation is one of the types of risk which is business-specific risk. The standard…

Q: Delovely Productions Limited wants to raise $35 million for shows. rights offering will be used to…

A: The objective of the question is to calculate the value of a right at the present time. The company…

Q: You expect that Adidas AG will pay an annual dividend of $1.36 one year from now. You expect this…

A: Dividend For Year 1 = d1 = $1.36Growth Rate for next 5 Years = g5 = 11.5%Growth Rate after year 5 =…

Q: Consider a U.S. firm that deals in only one foreign currency, the peso. Fill in the blanks to…

A: If the peso depreciates, interest from investments in Mexico will likely decrease. This is because…

Q: None

A: Present Value is the current value (value today) of cash flows to be received in future.We are given…

Q: alculate the cumulative cash position. fen birini seçin: a.4.28 0 b.2.21 c.3.21 d.3.56 Unit…

A: Is the period required to recover the initial amount of investment of the project without…

Q: Bramble Inc. plans to purchase a new metal stamping machine for use in its manufacturing process.…

A: Present value:The concept of present value is fundamental in financial analysis, especially when…

Q: nvesting: Lesser-known Stocks WSR The following question is based on the following information about…

A: We invest in different financial assets like stocks, bonds, gold etc. When investing in stocks we…

Q: Trudy is 35 years old and is considering investing $2,000 per year in a savings account at 8%, or…

A: A Registered Retirement Savings Plan (RRSP) refers to a tax-advantaged investment account available…

Q: Question 9 Which of the following brand was once owned by Levi's? Question 9 options:…

A: The objective of the first question is to identify which brand was once owned by Levi's. Levi's is a…

Q: Find the time of the loan. Use a bankers year 360 days Principal 36,800.00 Rate 5.5% Interest $…

A: The simple interest can be found by using the following mathematical expressions:

Q: Compute the necessary calculations and advise Apple Limited if it is worth investing in neither, in…

A: We must determine the Net Present Value (NPV) of each project and compare it in order to assess the…

Q: None

A: Dividends refer to the cash payouts that the company distributes to the shareholders periodically…

Q: Pappy's Potato has come up with a new product, the Potato Pet (they are freeze-dried to last…

A: Capital budgeting refers to the evaluation of potential long-term investments undertaken by a…

Q: Question 9 (1 point) Which of the following brand was…

A: The question is asking to identify which of the given brands was once owned by Levi's.

Q: Given Principal $10,000, Interest Rate 8%, Time 240 days (use ordinary interest) Partial payments:…

A: Interest is the amount charged by bank in consideration of advancing loan to its borrowers. It is…

Q: A stock is currently priced at $49 and will move up by a factor of 1.48 or down by a factor of 88…

A: Option Market is a Stock Market Strategy. Under which investor will not purchase the shares of the…

Q: Calculate the present value of the company's debt and equity. Note: Do not round intermediate…

A: The present value is a tool used to determine how much money you should have now to cover future…

Q: Sonali and Nilesh are married. On December 30th of last year, Sonali contributed $25,000 to a…

A: The objective of the question is to determine the correct tax implications for Sonali and Nilesh…

Q: An investment has an installed cost of $527,630. The cash flows over the four-year life of the…

A: NPV is the difference between present value of cash inflows and present value of cash outflows given…

Q: Suppose that the term structure of interest rates is: t 0.5 1 1.5 2 r 1% 1.2% 1.4% 1.8% Interest…

A: The objective of the question is to calculate the price and modified duration of two bonds and then…

Q: The company falls in the 25% tax category for ordinary income and 40% tax category for capital…

A: Discount rate:In this scenario, the discount rate serves as the benchmark rate used to determine…

Q: Stock Y has a beta of 1.50 and an expected return of 14.2 percent. Stock Z has a beta of .85 and an…

A: CAPM is the capital asset pricing model and is used to find the required return using the following…

Q: Consider a pension fund with $20 million in assets and projected liabilities of $5, $10, and $15…

A: Duration of bond shows the weighted period required to receive all cash flows of the bond and it…

Q: Problem 11.1 Required: Grecian Tile Manufacturing of Athens, Georgia, borrows $1,500,000 at…

A: Amount borrowed = $1,500,000Bank credit premium = 0.46%Lending margin = 0.95%First 6-month SOFR =…

Q: $500 $500 0 1 2 3 F = ? 5 Compute the F5 = ? i = 10% 5 сл

A: P0= $500P4=$500i = 10%

Q: Use Table 12-1 to calculate the future value (in $) of the annuity due. (Round your answer to the…

A: Part 1: Answer:The future value of the annuity due is $10,598.43.Explanation:Part 2:…

Q: Required information [The following information applies to the questions displayed below.] On…

A: Face amount$25,600,000.00Coupon rate6%Years to maturity20YTM6%Compounding frequency2

Hi there,

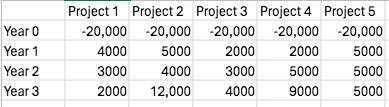

I am working on this problem. Can you please show me each step in solving this question without using excel? I am trying to figure out how to calculate the payback period for each project and also how do I calculate the IRR for each project?

Riley Ltd. has the following 5 investment projects to choose from, the company needs to select one project.

Trending now

This is a popular solution!

Step by step

Solved in 1 steps

- PROJECT A PROJECT BInitial Outlay -60,000 -80,000Inflow year 1 17,000 18,000Inflow year 2 17,000 18,000Inflow year 3 17,000 18,000Inflow year 4 17,000 18,000Inflow year 5 17,000 18,000Inflow year 6 17,000 18,000Ch 5. The following project has cash flows as follows: Year Project A 0 -$705,000 1 $225,000 2 $421,500 3 $275,000 What is the IRR? Round to one place past the decimal point and format as "XX.X"A4 9b A4 9a We find the following information on NPNG (No-Pain-No-Gain) Inc.: EBIT = $2,000,000Depreciation = $250,000Change in net working capital = $100,000Net capital spending = $300,000 These numbers are projected to increase at the following supernormal rates for the next three years, and 5% after the third year for the foreseeable future: EBIT: 20%Depreciation: 10%Change in net working capital: 15%Net capital spending: 10% The firm’s tax rate is 35%, and it has 1,000,000 outstanding shares and $8,000,000 in debt. We have estimated the WACC to be 15%. b. Calculate the CFA* for each of the next four years, using the formula CFA* = EBIT(1 – T) + Depr – ΔNWC – NCS.

- Question Content Area A project is estimated to cost $273,840 and provide annual net cash inflows of $60,000 for 7 years. Year 6% 10% 12% 1 0.943 0.909 0.893 2 1.833 1.736 1.690 3 2.673 2.487 2.402 4 3.465 3.170 3.037 5 4.212 3.791 3.605 6 4.917 4.355 4.111 7 5.582 4.868 4.564 8 6.210 5.335 4.968 9 6.802 5.759 5.328 10 7.360 6.145 5.650 Determine the internal rate of return for this project by using the above present value of an annuity table.fill in the blank 1 of 1%The project's NPV? WACC: 10.00% Year 0 1 2 3 Cash flows -$1,000 $450 $460 $470QUESTION 5Read the information below and answer the following questionsINFORMATIONThe management of Mastiff Enterprises has a choice between two projects viz. Project Cos and Project Tan, each ofwhich requires an initial investment of R2 500 000. The following information is presented to you:PROJECT COS PROJECT TANNet Profit Net ProfitYear R R1 130 000 80 0002 130 000 180 0003 130 000 120 0004 130 000 220 0005 130 000 50 000A scrap value of R100 000 is expected for Project Tan only. The required rate of return is 15%. Depreciation is calculated using the straight-line method.5.4 Benefit Cost Ratio of Project Cos (expressed to three decimal places). 5.5 Internal Rate of Return of Project Cos (expressed to two decimal places) USING INTERPOLATION.

- Question 21 The following information relates to three possible capital expenditure projects. Because of capital rationing only one project can be accepted. Project: A B C . Initial cost R100 000 R115 000 R90 000 Expected life 5 years 5 years 4 years Scrap value R5 000 R7 500 R4 000 Cash-inflows R R R End year 1 40 000 50 000 27 500 2 35 000 35 000 32 500…Question 16 The following information relates to three possible capital expenditure projects. Because of capital rationing only one project can be accepted. Project: A B C . Initial cost R100 000 R115 000 R90 000 Expected life 5 years 5 years 4 years Scrap value R5 000 R7 500 R4 000 Cash-inflows R R R End year 1 40 000 50 000 27 500 2 35 000 35 000 32 500…Ch 5. ABC Company has the following mutually exclusive projects. Year Project A Project B 0 -$19,520 -$16,800 1 11,500 9,500 2 8,750 7,100 3 2,500 3,500 If the company’s payback period is 2 years, which of these projects should be chosen? Group of answer choices Project A Neither Projects Both Projects Project B

- consider project D. calculate the payback period project c0 c1 c2 c3 D -372,000 200,000 140,000 72,000A3 5c. 5. We have two independent and mutually exclusive projects, A and B. Project A requires an initial investment of $1500, and will yield $800 of cash inflows for the next three years. Project B requires an initial investment of $5000, and will yield $1,500 of cash inflows for the next five years. The required return on each project is 10%. c. Which project should be chosen?Problem 10-10 (Algo) Interest capitalization; weighted-average method [LO10-7] On January 1, 2021, the company obtained a $3 million loan with a 12% interest rate. The building was completed on September 30, 2022. Expenditures on the project were as follows: January 1, 2021 $ 1,230,000 March 1, 2021 720,000 June 30, 2021 380,000 October 1, 2021 670,000 January 31, 2022 990,000 April 30, 2022 1,305,000 August 31, 2022 2,340,000 On January 1, 2021, the company obtained a $3 million construction loan with a 12% interest rate. Assume the $3 million loan is not specifically tied to construction of the building. The loan was outstanding all of 2021 and 2022. The company’s other interest-bearing debt included two long-term notes of $5,600,000 and $7,600,000 with interest rates of 8% and 10%, respectively. Both notes were outstanding during all of 2021 and 2022. Interest is paid annually on all debt. The company’s fiscal year-end is…