Year 1 Issued $74,000,000 of 20-year, 11% callable bonds dated July 1, July Year 1, at a market (effective) rate of 139%, receiving cash of 1 $65,532,267. Interest is payable semiannually on December s1 and June 30. Borrowed $200,000 by issuing a six-year, 6% installment note to Oct. Nicks Bank. The note requires annual payments of $40,675, with the first payment occurring on September 30, Year 2. 1 Dec. Accrued $s,000 of interest on the installment note. The interest is payable on the date of the next installment note payment. s1 Paid the semiannual interest on the bonds. The bond discount amortization of $261,693 is combined with the semiannual interest payment. si Year 2 Paid the semiannual interest on the bonds. The bond discount June amortization of $261,693 is combined with the semiannual so interest payment. Sept. Paid the annual payment on the note, which consisted of so interest of $12,000 and principal of $28,678. - Accrued $2,570 of interest on the installment note. The Dec. interest is payable on the date of the next installment note si payment. Paid the .semiannual interest on the bonds. The bond discount si amortization of $261,693 is combined with the semiannual interest payment. Year Recorded the redemption of the bonds, which were called at June 98. The balance in the bond discount account is $9,420,961 after payment of interest and amortization of discount have been recorded. Record the redemption only. so Sept. Paid the second annual payment on the note, which consisted so of interest of $10,280 and principal of $30,395.

Year 1 Issued $74,000,000 of 20-year, 11% callable bonds dated July 1, July Year 1, at a market (effective) rate of 139%, receiving cash of 1 $65,532,267. Interest is payable semiannually on December s1 and June 30. Borrowed $200,000 by issuing a six-year, 6% installment note to Oct. Nicks Bank. The note requires annual payments of $40,675, with the first payment occurring on September 30, Year 2. 1 Dec. Accrued $s,000 of interest on the installment note. The interest is payable on the date of the next installment note payment. s1 Paid the semiannual interest on the bonds. The bond discount amortization of $261,693 is combined with the semiannual interest payment. si Year 2 Paid the semiannual interest on the bonds. The bond discount June amortization of $261,693 is combined with the semiannual so interest payment. Sept. Paid the annual payment on the note, which consisted of so interest of $12,000 and principal of $28,678. - Accrued $2,570 of interest on the installment note. The Dec. interest is payable on the date of the next installment note si payment. Paid the .semiannual interest on the bonds. The bond discount si amortization of $261,693 is combined with the semiannual interest payment. Year Recorded the redemption of the bonds, which were called at June 98. The balance in the bond discount account is $9,420,961 after payment of interest and amortization of discount have been recorded. Record the redemption only. so Sept. Paid the second annual payment on the note, which consisted so of interest of $10,280 and principal of $30,395.

Practical Management Science

6th Edition

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:WINSTON, Wayne L.

Chapter2: Introduction To Spreadsheet Modeling

Section: Chapter Questions

Problem 20P: Julie James is opening a lemonade stand. She believes the fixed cost per week of running the stand...

Related questions

Question

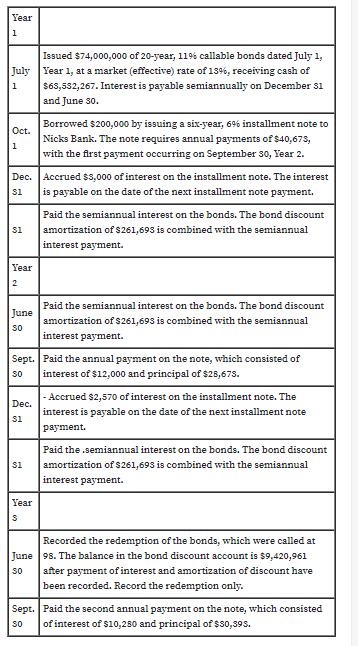

Entries for bonds payable and installment note transactions

The following transactions were completed by Winklevoss Inc., whose

fiscal year is the calendar year

Instructions

1.

amounts to the nearest dollar.

2. Indicate the amount of the interest expense in (a) Year 1 and (b) Year

2.

3. Determine the carrying amount of the bonds as of December 31, Year

2.

Transcribed Image Text:Year

1

Issued $74,000,000 of 20-year, 11% callable bonds dated July 1,

July Year 1, at a market (effective) rate of 139%, receiving cash of

1

$65,532,267. Interest is payable semiannually on December s1

and June 30.

Borrowed $200,000 by issuing a six-year, 6% installment note to

Oct.

Nicks Bank. The note requires annual payments of $40,675,

with the first payment occurring on September 30, Year 2.

1

Dec. Accrued $s,000 of interest on the installment note. The interest

is payable on the date of the next installment note payment.

s1

Paid the semiannual interest on the bonds. The bond discount

amortization of $261,693 is combined with the semiannual

interest payment.

si

Year

2

Paid the semiannual interest on the bonds. The bond discount

June

amortization of $261,693 is combined with the semiannual

so

interest payment.

Sept. Paid the annual payment on the note, which consisted of

so

interest of $12,000 and principal of $28,678.

- Accrued $2,570 of interest on the installment note. The

Dec.

interest is payable on the date of the next installment note

si

payment.

Paid the .semiannual interest on the bonds. The bond discount

si

amortization of $261,693 is combined with the semiannual

interest payment.

Year

Recorded the redemption of the bonds, which were called at

June 98. The balance in the bond discount account is $9,420,961

after payment of interest and amortization of discount have

been recorded. Record the redemption only.

so

Sept. Paid the second annual payment on the note, which consisted

so

of interest of $10,280 and principal of $30,395.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, operations-management and related others by exploring similar questions and additional content below.Recommended textbooks for you

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,

Operations Management

Operations Management

ISBN:

9781259667473

Author:

William J Stevenson

Publisher:

McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi…

Operations Management

ISBN:

9781259666100

Author:

F. Robert Jacobs, Richard B Chase

Publisher:

McGraw-Hill Education

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,

Operations Management

Operations Management

ISBN:

9781259667473

Author:

William J Stevenson

Publisher:

McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi…

Operations Management

ISBN:

9781259666100

Author:

F. Robert Jacobs, Richard B Chase

Publisher:

McGraw-Hill Education

Purchasing and Supply Chain Management

Operations Management

ISBN:

9781285869681

Author:

Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. Patterson

Publisher:

Cengage Learning

Production and Operations Analysis, Seventh Editi…

Operations Management

ISBN:

9781478623069

Author:

Steven Nahmias, Tava Lennon Olsen

Publisher:

Waveland Press, Inc.