Year 1 Sales $161,120 Cost of Goods Sold 105,035 SG&A 42.957 Depreciation 6,687 Operating Income (EBIT) 6,441 Interest Expense

Year 1 Sales $161,120 Cost of Goods Sold 105,035 SG&A 42.957 Depreciation 6,687 Operating Income (EBIT) 6,441 Interest Expense

Chapter3: Business Income And Expenses

Section: Chapter Questions

Problem 5MCQ

Related questions

Question

2

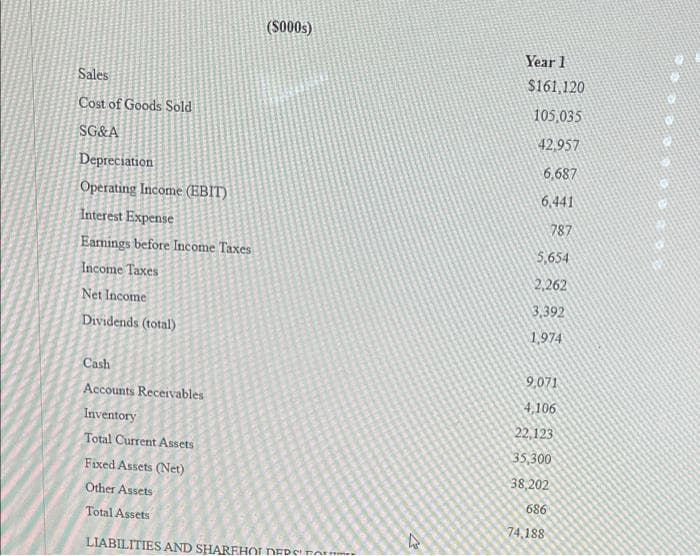

Transcribed Image Text:(S000s)

Year 1

Sales

$161,120

Cost of Goods Sold

105,035

SG&A

42,957

Depreciation

6,687

Operating Income (EBIT)

6,441

Interest Expense

787

Earmings before Income Taxes

5,654

Income Taxes

2,262

Net Income

3,392

Dividends (total)

1,974

Cash

9,071

Accounts Receivables

4,106

Inventory

22,123

Total Current Assets

35,300

Fixed Assets (Net)

38,202

Other Assets

686

Total Assets

74,188

LIABILITIES AND SHAREHOLDERS Ar

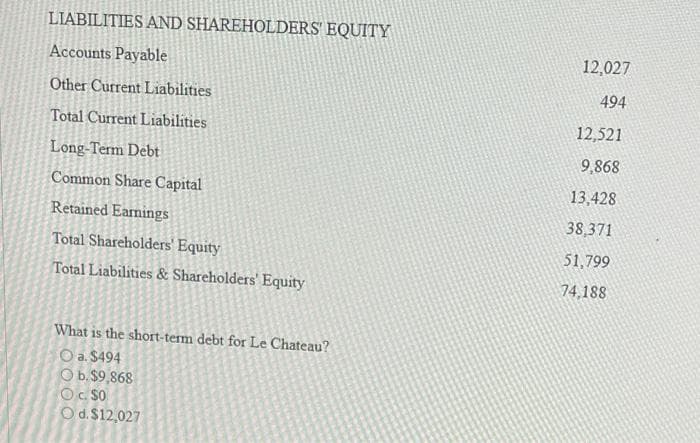

Transcribed Image Text:LIABILITIES AND SHAREHOLDERS' EQUITY

Accounts Payable

12,027

Other Current Liabilities

494

Total Current Liabilities

12,521

Long-Term Debt

9,868

Common Share Capital

13,428

Retained Earnings

38,371

Total Shareholders' Equity

51,799

Total Liabilities & Shareholders' Equity

74,188

What is the short-term debt for Le Chateau?

O a. $494

O b.$9,868

Oc S0

Od.$12,027

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning