Year 1 Year 2.... Year 3 $30,000 $40,000

Q: Maud'Dib Intergalactic has a new project available on Arrakis. The cost of the project is $38,000…

A: NPV is the PV of net benefit arises in the future from the project. It can be simply computed by…

Q: Cash flows estimation and capital budgeting: You are the head of finance department in XYZ Company.…

A: NPV refers to the net present value of an investment. It is calculated as the present value of…

Q: Project Cash Flow The financial staff of Cairn Communications has identified the following…

A: Operating Cashflow = Net Profit + Depreciation

Q: Colsen Communications is trying to estimate the first-year cash flow (at Year 1) for a proposed…

A: Operating cash flows refers to the form of measurement which computes the total amount of cash flows…

Q: Cash payback period for a Service Company Prime Financial Inc. is evaluating two capital investment…

A: The payback method is one of the capital budgeting techniques which helps in evaluating the…

Q: Cash Payback Period RiverBend Wood is evaluating two capital investment proposals for a retail…

A: Location 1 Payback period

Q: The financial staff of Cairn Communications has identified the following information for the first…

A: Cash flows are the cash generated from the operation of the business organisation. In other words,…

Q: You are the head of finance department in XYZ Company. You are considering adding a new machine to…

A: The question is based on the concept the net present value (NPV). NPV is a method of capital…

Q: Cash payback period for a Service Company Prime Financial Inc. is evaluating two capital investment…

A: Compute cash payback period for location 1 as shown below:

Q: Project Cash Flow The financial staff of Cairn Communications has identified the following…

A: The cash flow that is generated by a company from its primary business operation is term as the…

Q: Annual cash inflows that will arise from two competing investment projects are given below: Year…

A: Present value of cash inflows = Cash inflows x Present value factor

Q: Cash flows estimation and capital budgeting: You are the head of finance department in XYZ Company.…

A: Depreciation expense: Depreciation expense is the reduction in a particular asset due to its use or…

Q: Determine the cash payback period for both location proposals. Location 1 years Location 2 years

A: Given information is: Prime Financial Inc. is evaluating two capital investment proposals for a…

Q: The company faces a 25% tax rate. What is the project's operating cash flow for the first year (t =…

A: Operating cash flow (OCF) refers to the amount of cash flow (CF) generated by the company during a…

Q: Cash flows estimation and capital budgeting: You are the head of finance department in XYZ Company.…

A: It is very important to find the cash flows of a project as they will be used to evaluate the…

Q: Required information [The following information applies to the questions displayed below.] A…

A: Internal Rate of return is calculated below: Present Value Factor = Amount Invested / Annual Net…

Q: (Calculating MIRR) OTR Trucking Company runs a fleet of long-haul trucks and has recently expanded…

A: We accept projects whose NPV is positive and IRR is more than the discount rate.

Q: Cash Payback Period, Net Present Value Method, and Analysis Elite Apparel Inc. is considering two…

A: GIVEN, RATE = 10% Initial investment =$288,000 Year Plant Expansion Retail Store Expansion 1…

Q: Required information [The following information applies to the questions displayed below.] A company…

A: calculation of internal rate of return are as follows.

Q: he head of finance department in XYZ Company. You are considering adding a new machine to your…

A: Net present value is the difference between the present value of cash flow and initial investment.

Q: Cash flows estimation and capital budgeting: You are the head of finance department in XYZ Company.…

A: Computation:

Q: [EXCEL] Net present value: Kingston, Inc. management is considering purchasing a new machine at a…

A: The calculation under excel is shown below:

Q: The financial staff of Cairn Communications has identified the following information for the first…

A: Operating Cash Flow: Operating cash flow, often known as OCF, refers to the amount of cash that is…

Q: Payback period. Given the cash flow of two projects—A and B—and using the payback period decision…

A: Payback period is a capital budgeting decision criteria in which projects are selected based on the…

Q: Cash flows estimation and capital budgeting:You are the head of finance department in XYZ Company.…

A: The provided information are: Base price = $10000 Installation cost = $2140 Increase in net working…

Q: Project Cash Flow The financial staff of Cairn Communications has identified the following…

A: Operating cash flow means cash inflow or outflow from main operations of the company. It is…

Q: The financial staff of Cairn Communications has identified the following information for the first…

A: The term operating cash flows refers to the cash flows generated by a company from its main…

Q: Calculating operating cash flows) The Heritage Farm Implement Company is considering an…

A: Hence, the net profit after interest and expense is $1,122,000, which is determined by reducing cash…

Q: Annual cash inflows from two competing investment opportunities are given below. Each investment…

A: Net present value (NPV) is used to determine the present value of all future cash flows. Net present…

Q: Project Cash Flow The financial staff of Cairn Communications has identified the following…

A: Depreciation is a non cash expense and is added back to calculate the operating cash flow.

Q: The financial staff of Cairn Communications has identified the following information for the first…

A: Given:

Q: Cash flows estimation and capital budgeting: You are the head of finance department in XYZ Company.…

A: Answer: Step 1: Calculation of the after-tax salvage value:

Q: Project Cash Flow The financial staff of Cairn Communications has identified the following…

A: project's operating cash flow for the first year (t = 1) = Earnings after tax (EAT) + depreciation

Q: PROJECT CASH FLOW Colsen Communications is trying to estimate the first-year cash flow (at Year 1)…

A: A situation in which revenue from an existing project declines due to investment in a new project is…

Q: what was the amount of the original investment? *

A: Net Present Value: It is the difference between the discounted cash inflows and cash outflows for a…

Q: A large project requires an investment of $210 million. The construction will take 3 years: $55…

A: The payback period is one of the techniques of capital budgeting. It refers to the length of the…

Q: The financial staff of Cairn Communications has identified the following information for the first…

A: Operating cash flow = EAT + Depreciation

Q: Cash payback period for a Service Company Prime Financial Inc. is evaluating two capital investment…

A: Thus, the cash payback period for Location 1 is 5 years.

Q: Cash payback period for a Service Company Prime Financial Inc. is evaluating two capital investment…

A: Payback period refers to the time within which the original amount invested is returned back to the…

Uncertain Cash Flows

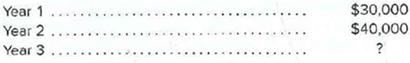

The Cambro Foundation, a nonprofit organization, is planning to invest $104,950 in a project that will last for three years. The project will produce net cash inflows as follows:

Required:

Assuming that the project will yield exactly a 12%

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

- ANSWER QUICK!! JUST THE ANSWERS!! NO EXPLANATIOn 10. a)During 20X2, ABC Inc earned $200,000 in service revenue, of which $120,000 was received in cash; the balance will be collected in January 20X3. The company's 20X2 income statement should show which of the following amounts for service revenue? $320,000 $200,000 $80,000 $120,000 b)Assume that a company's financial position on January 1, 2022 was: Assets, $40,000 and Liabilities, $15,000. During January 2022, the company completed the following transactions: (a) paid a “note payable”: $4,000 (without interest); (b) received payment from his client: $4,000; (c) paid supplier debts: $2,000; (d) purchased a truck, $1,000 in cash and $8,000 in Notes Payable. What is the financial situation of the company as of January 31, 2022?Question 9 options: Assets = $44,000 Liabilities = $17,000 Equity = $27,000 Assets = $43,000 Liabilities = $18,000 Equity = $25,000 Assets = $42,000 Liabilities = $17,000 Equity = $25,000 Assets = $42,000…part 3 4 solution needed Year Net cashflows 0 -575,000 1 £125,000 2 £248,000 3 £176,000 4 £146,000Company A Company B Company C Company D Company E December 31, 2019 Assets 162,000 189,000 118,125 121,500 351,000 Liabilities 101,250 135,000 67,500 74,250 ? December 31, 2020 Assets 175,500 249,750 432,000 ? 519,750 Liabilities 85,725 ? 182,250 108,000 202,500 During 2020 Net income ? 33,750 67,500 60,750 81,000 Investments 23,625 40,500 ? 81,000 0 Withdrawals 6,750 10,125 20,250 27,000 40,500 What was the owner’s equity of each of the five companies on December 31, 2019? What was the owner’s equity of each of the five companies on December 31, 2020 What was the amount of net income of Company A for 2020? How much is the liabilities owed by Company B on December 31, 2020? For Company C, calculate the amount of investments. How much is the total assets on December 31, 2020 of Company D? How much is the…

- A2 1 d Use the following information for Delta Corporation to answer question 1: Year 20X1 20X2 Net sales $1,500,000 $1,656,598 Cost of goods sold 675,000 745,469 Depreciation 270,000 298,188 Interest paid 43,600 44,000 Cash 127,500 140,811 Accounts receivable 450,000 496,980 Inventory 525,000 579,809 Net fixed assets 1,800,000 1,987,918 Accounts payable 375,000 414,150 Notes payable 45,000 50,000 Long-term debt 500,000 500,000 Common stock 1,000,000 1,000,000 Retained earnings 982,500 1,241,368 Tax rate 35% 35% Dividend payout 30% 30% Delta has 600,000 common shares outstanding. The firm is projecting a 20% increase in net sales for the coming year (20X3). Delta uses the percentage of sales approach to plan for its financing needs. In using this approach, the firm assumes that cost of goods sold, all assets (current and fixed), and accounts payable will…A2 1 c Use the following information for Delta Corporation to answer question 1: Year 20X1 20X2 Net sales $1,500,000 $1,656,598 Cost of goods sold 675,000 745,469 Depreciation 270,000 298,188 Interest paid 43,600 44,000 Cash 127,500 140,811 Accounts receivable 450,000 496,980 Inventory 525,000 579,809 Net fixed assets 1,800,000 1,987,918 Accounts payable 375,000 414,150 Notes payable 45,000 50,000 Long-term debt 500,000 500,000 Common stock 1,000,000 1,000,000 Retained earnings 982,500 1,241,368 Tax rate 35% 35% Dividend payout 30% 30% Delta has 600,000 common shares outstanding. The firm is projecting a 20% increase in net sales for the coming year (20X3). Delta uses the percentage of sales approach to plan for its financing needs. In using this approach, the firm assumes that cost of goods sold, all assets (current and fixed), and accounts payable will…4. How much cash was paid for wages during the year? a. ₱ 250,000 b. ₱ 254,000 c. ₱ 240,000 d. ₱ 244,000

- PROBLEM 1 ASSETS LIABILITIES OWNER’S EQUITY a. 760,000 360,000 ? b. 860,000 ? 592,000 c. ? 108,000 760,000 d. 626,600 376,240 ? e. ? 800,000 (100,000)A2 1 a Use the following information for Delta Corporation to answer question 1: Year 20X1 20X2 Net sales $1,500,000 $1,656,598 Cost of goods sold 675,000 745,469 Depreciation 270,000 298,188 Interest paid 43,600 44,000 Cash 127,500 140,811 Accounts receivable 450,000 496,980 Inventory 525,000 579,809 Net fixed assets 1,800,000 1,987,918 Accounts payable 375,000 414,150 Notes payable 45,000 50,000 Long-term debt 500,000 500,000 Common stock 1,000,000 1,000,000 Retained earnings 982,500 1,241,368 Tax rate 35% 35% Dividend payout 30% 30% Delta has 600,000 common shares outstanding. The firm is projecting a 20% increase in net sales for the coming year (20X3). Delta uses the percentage of sales approach to plan for its financing needs. In using this approach, the firm assumes that cost of goods sold, all assets (current and fixed), and accounts payable will…A2 1g May I please have the answer in formula form and not in excel. Thx:) Use the following information for Delta Corporation to answer question 1: Year 20X1 20X2 Net sales $1,500,000 $1,656,598 Cost of goods sold 675,000 745,469 Depreciation 270,000 298,188 Interest paid 43,600 44,000 Cash 127,500 140,811 Account’s receivable 450,000 496,980 Inventory 525,000 579,809 Net fixed assets 1,800,000 1,987,918 Accounts payable 375,000 414,150 Notes payable 45,000 50,000 Long-term debt 500,000 500,000 Common stock 1,000,000 1,000,000 Retained earnings 982,500 1,241,368 Tax rate 35% 35% Dividend payout 30% 30% Delta has 600,000 common shares outstanding. The firm is projecting a 20% increase in net sales for the coming year (20X3). Delta uses the percentage of sales approach to plan for its financing needs. In using this approach, the firm assumes that cost of…

- CASE 1: PM Company PM Company provided the following adjusted account balances on December 31, 2X14: Wages payable P250,000 Cash 200,000 Mortgage payable 1,500,000 Dividends payable 150,000 Prepaid rent 100,000 Inventory 800,000 Sinking fund 500,000 Short-term investments 300,000 Taxes payable 220,000 Accounts payable 240,000 Accounts receivable 350,000 Requirement: Compute for the total current assets on December 31, 2X14AC, Inc. began operations in Year 1. The following information is provided at the end of each year: Year 1 Year 2 Salaries expense $ 350,000 $ 500,000 Salaries payable 50,000 75,000 What would be LAC's cash paid to employees in Year 2? Select one: a. $450,000 b. $475,000 c. $525,000 d. $550,000 e. $425,000Q3) A. The following information has been taken from the accounting records of Ahmed and Company in first and second period. Period Sales Profit 2019 $ 100,000 $15,000 2020 150,000 25,000 Calculate: 1) Sales required to earn a profit of $25,000 2) Profit when sales are $200,000