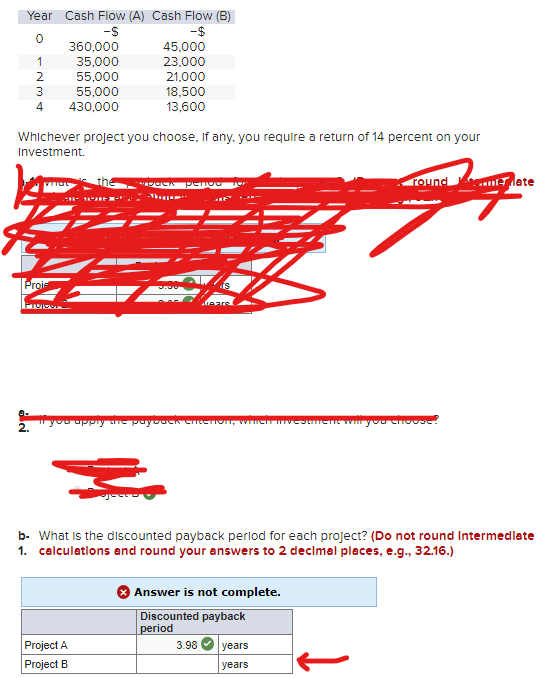

Year Cash Flow (A) Cash Flow (B) -S -$ 0 360,000 35,000 55,000 3 55,000 4 430,000 1234 2 45,000 23,000 21,000 18,500 13,600 Whichever project you choose, if any, you require a return of 14 percent on your Investment

Year Cash Flow (A) Cash Flow (B) -S -$ 0 360,000 35,000 55,000 3 55,000 4 430,000 1234 2 45,000 23,000 21,000 18,500 13,600 Whichever project you choose, if any, you require a return of 14 percent on your Investment

Chapter11: Capital Budgeting Decisions

Section: Chapter Questions

Problem 16EA: Project B cost $5,000 and will generate after-tax net cash inflows of $500 in year one, $1,200 in...

Related questions

Question

100%

Just need b-1, d-1, and e-1 answered.

Transcribed Image Text:Year Cash Flow (A) Cash Flow (B)

-S

-$

0

-N3A

2

4

Whichever project you choose, if any, you require a return of 14 percent on your

Investment.

VITORL the

Proie

360,000

35,000

55,000

55,000

430,000

PTVJOG

45,000

23,000

21,000

18,500

13,600

Che womezena 2 Shapem

penou

z

Project A

Project B

If you apply the payback entenon, which investment will you choose?

round

b- What is the discounted payback perlod for each project? (Do not round Intermediate

1. calculations and round your answers to 2 decimal places, e.g., 32.16.)

Answer is not complete.

Discounted payback

period

3.98 years

years

Mate

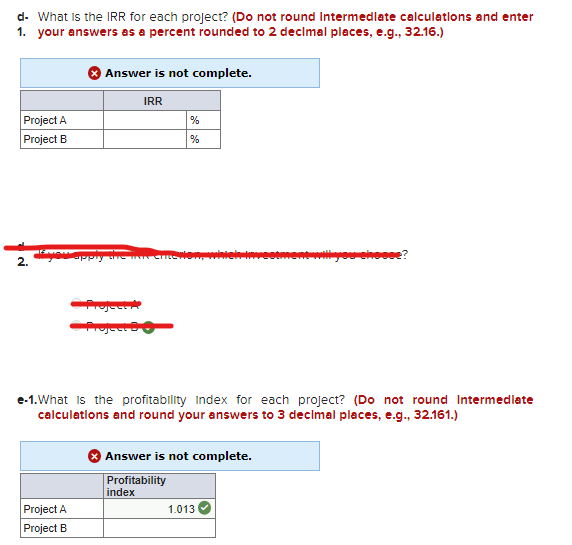

Transcribed Image Text:d- What is the IRR for each project? (Do not round Intermediate calculations and enter

1. your answers as a percent rounded to 2 decimal places, e.g., 32.16.)

Project A

Project B

Answer is not complete.

IRR

2. you apply the m

Project A

Project B

Project

Project

%

%

e-1. What is the profitability Index for each project? (Do not round Intermediate

calculations and round your answers to 3 decimal places, e.g., 32.161.)

Answer is not complete.

Profitability

index

wwwill you choose?

1.013

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning