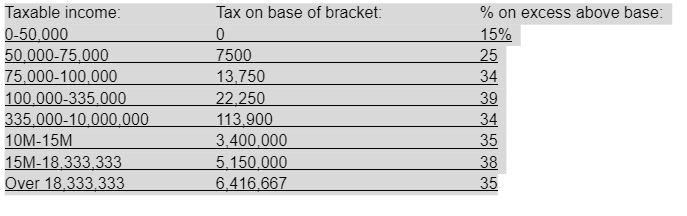

year, Martyn Company had $500,000 in taxable income from its operations, $50,000 in interest income, and $100,000 in dividend income. Using the corporate tax rate table given below, what was the company's tax liability for the year?

year, Martyn Company had $500,000 in taxable income from its operations, $50,000 in interest income, and $100,000 in dividend income. Using the corporate tax rate table given below, what was the company's tax liability for the year?

Chapter28: Income Taxation Of Trusts And Estates

Section: Chapter Questions

Problem 13CE

Related questions

Question

Last year, Martyn Company had $500,000 in taxable income from its operations, $50,000 in interest income, and $100,000 in dividend income. Using the corporate tax rate table given below, what was the company's tax liability for the year?

Transcribed Image Text:Taxable income:

0-50,000

50.000-75,000

75,000-100,000

100.000-335.000

335.000-10.000.000

10M-15M

15M-18.333.333

Over 18.333.333

Tax on base of bracket:

0

7500

13,750

22,250

113.900

3,400,000

5,150,000

6.416,667

% on excess above base:

15%

25

34

39

34

35

38

35

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you