Years Purchase Price Unleveraged Cash Flow Resale Price Total CF (12,000,000) (12,000,000) 0 1 640,000 670,000 640,000 670,000 2 3 685,000 700,000 10,500,000 11,185,000 700,000 4

Q: uppose you want to have $600,000 for retirement in 25 years. Your account earns 4% interest. How muc…

A: The amount to be deposited monthly is an annuity and the final amount of $600,000 is the future…

Q: achieved by diversification or holding a large nu rsified portfolio that is composed of 500 large st…

A: 1.A Diversified portfolio that consists of many stocks from varieties of companies, from varieties…

Q: A property owner is evaluating the following alternatives for leasing space in his office building…

A: Data given: First year rent per square foot=$17 Subsequent year, rent increase= increase in CPI CPI…

Q: The next dividend payment by Skippy, Inc., will be $1.56 per share. The dividends are anticipated to…

A: When you invest in the stock market there are two types of benefits one is dividend payment and…

Q: How much would you need to deposit in an account each month in order to have $20,000 in the accom 9…

A: Value of money of increases with time due to the accumulation of interest over the time and due to…

Q: Explain the features of venture capital.

A: A type of private equity funding known as venture capital is given to early-stage or fast-growing…

Q: Stefano takes out a 5 year mortgage for $1,100,000 at an interest rate of i(12) = 4.750%. The…

A: To solve this problem, we need to use the mortgage formula to calculate the weekly payments, and…

Q: : Semi-annually : $1,000 Nominal value:$1000 Callable period: First p

A: The bond price is the combined value of the present value of the coupons and the redemption or the…

Q: Jackson & Sons uses packing machines to prepare its products for shipping. They need to replace…

A: EAC is that amount which is also known as Equivalent Annual Cost. It is calculated when we have…

Q: A company is developing a special vehicle for Arctic exploration. The development requires an…

A: The net present value of a project is the present value of all future cash flows associated with the…

Q: A sum of money is deposited at the beginning of each year for 3 years at 12% p.a. compounded…

A: It represents a kind of annuity where the payments are made at the beginning of the period or…

Q: Allied Food Products is considering expanding into the fruit juice business with a new fresh lemon…

A: Cash flow refers to the movement of cash into and out of a business or an individual's financial…

Q: assume you have an option that pays 1 if the stock price equals or above 10 and 0 otherwise. If the…

A: The value of an option is the price at which the option can be bought or sold in the market. It is…

Q: next dividend is $3.50 and it is expected to grow by 4.5% per year forever. If you as an investor…

A: Price of stock can be determined based on the constant growth model of dividend in which value of…

Q: (increases/decreases/remains co

A: For a given level of output, the Degree of Operating Leverage (DOL) decreases as the size of the…

Q: You are choosing between two projects. The cash flows for the projects are given in the following…

A: IRR stands for Internal Rate of Return, which is a financial metric used to evaluate the…

Q: Fixed Income Securities 4. Today is t = 0. You have just bought a five-year zero-coupon Treasury…

A: The price for a zero coupon bond (ZCB) is known. The annually compounded yield to maturity on the…

Q: Holt Enterprises recently paid a dividend, D0, of $3.00. It expects to have nonconstant growth of…

A: Data given: D0=$3.00 Nonconstant growth of 25% for 2 years Thereafter constant rate of 8% Required…

Q: The acceptance or rejection decision made for this type of project does not affect the acceptance or…

A: These are terms related to capital budgeting. We need to match the terms given on the left side…

Q: A 3-year bond with 10% coupon rate and $1000 face value yield to maturity is 8% . Assuming annual…

A: Solution:- Bond price means the price at which a bond is trading in the market. It is the summation…

Q: Consider developing a business plan for a new indian food resturant, how will you manage…

A: A business plan is a written document that outlines a company's goals, strategies, and projected…

Q: Excited to buy her dream car, Molly rushes into her local Jeep dealership. Molly picks out a car,…

A: Monthly payment refers to the periodic repayment that is extended by the borrower to the lender.…

Q: Current Assets Cash Accs Rec Inventory Fixed Assets Total Assets 2015 150 350 600 1,100 Please…

A: An income statement and a balance sheet are two financial statements used to analyze a company's…

Q: How will you relate and apply the derivatives instrument to an insurance policy?

A: Derivatives instruments are financial contracts whose value is derived from underlying assets, such…

Q: Helene invests R5918 in a savings account that pays interest at 6% pa compounded monthly. Exactly 5…

A: Here,

Q: A 4-year SGS has a coupon rate of 8% and is priced at $115 today (par value is $100). In addition,…

A: Price of the bond is the PV of all future coupons and par value discounted at the respective spot…

Q: Compute the amount of money to be set aside today to ensure a future value of 4,100 in one year if…

A: The amount of money to be set aside today would be present value of future value of 4,100. Present…

Q: A person has to make two payments to pay off a debt. The first payment is due 3 years from now in…

A: The concepts of time value of money will be used to get the answers to the problem. The amount paid…

Q: Here and Gone, Inc., has sales of $17,546,456, total assets of $10,662,678, and total debt of…

A: Net Income will be calculated using formula : Net Income = Net Sales × Profit Margin

Q: What is the coupon rate if a two-year $10,000 bond with semiannual coupons and a price $9636.67 if…

A: The annual rate of interest paid on a fixed-income security, such as a bond or debenture, is…

Q: Gray Manufacturing is expected to pay a dividend of $1.25 per share at the end of the year (D₁ =…

A: The question asks us to calculate the expected growth rate of the dividend for Gray Manufacturing,…

Q: Cute Camel Woodcraft Company is a small firm, and several of its managers are worried about how soon…

A: The payback period is a financial metric that represents the time required for a project to recoup…

Q: What is financial services

A: Financial services encompass a wide range of services that help individuals and businesses manage…

Q: An investment is a current commitment of money for a period of time, in order to derive future…

A: Time value of money refers to the concept that money available today is worth more than the same…

Q: Mullen Inc. has an outstanding issue of perpetual preferred stock with an annual dividend of $2.90…

A: Perpetual preferred stock is a type of stock that pays a fixed dividend indefinitely, without any…

Q: As a mutual fund manager, you have a $40.00 million portfolio with a beta of 1.20. The risk-free…

A: Existing funds = $40 million Beta of existing portfolio = 1.20 Risk-free rate = 3.25% Market risk…

Q: A student takes out a loan of $1,400 at the beginning of each semester (semi-annually) for 11…

A: A loan is taken out the beginning of the period for a finite number of periods. The loan accumulates…

Q: The Hudson Corporation makes an investment of $44,400 that provides the following cash flow: Year 1…

A: Capital budgeting is an important process because it helps companies allocate their resources…

Q: Define financial system?

A: Financial System is a set of institutions which includes banks, insurance companies, and stock…

Q: Suppose the interest rate is 10.2 % APR with monthly compounding. What is the present value…

A: Time, value of money defines the money receive today is more valuable than the money will receive in…

Q: Pharmos Incorporated is a Pharmaceutical Company which is considering investing in a new production…

A: Terminal cash flow is the cash flow other than the operating cash flow at the end of the project…

Q: Part B Write a procedural text of about 200 to 300 words that describes how to successfully carry…

A: The answer to the question are given below:

Q: Analyze the financial status of Starbucks in the last five years (2018-2022), and give data and…

A: Starbucks is a multinational coffeehouse chain based in Seattle, Washington, in the United States.…

Q: A stock has had returns of -19.7 percent, 29.7 percent, 32.4 percent, -10.8 percent, 35.5 percent,…

A: r1 = - 0.197 r2 = 0.297 r3 = 0.324 r4 = - 0.108 r5 = 0.355 r6 = 0.277 Number of returns (n) = 6

Q: Horizon Group's stock has a required rate of return of 13.0%, and it sells for $87.50 per share,…

A:

Q: A key to resolving the NPV and IRR conflict is through the assumed reinvestment rate. The NPV…

A: The Net Present Value (NPV) and Internal Rate of Return (IRR) are two commonly used methods for…

Q: A 8-year bond with semiannual coupons is bought at a discount to yield 9% convertible semiannually.…

A: A bond was purchased in discount. Since all the bond prices are pulled to par, a discount bond…

Q: stock

A: There are many companies listed in the stock markets in the USA, they belong to different sectors…

Q: 1. You make $6,600 annual deposits into a retirement account that pays an APR of 11.1 percent…

A: Hi, there, Thanks for posting the question. As per our Q&A honour code, we must answer the first…

Q: Subject: Financial strategy & policy 1) A leasing contract calls for an immediate payment of…

A: Time, value of money defines the money receive is more valuable than the amount will receive in…

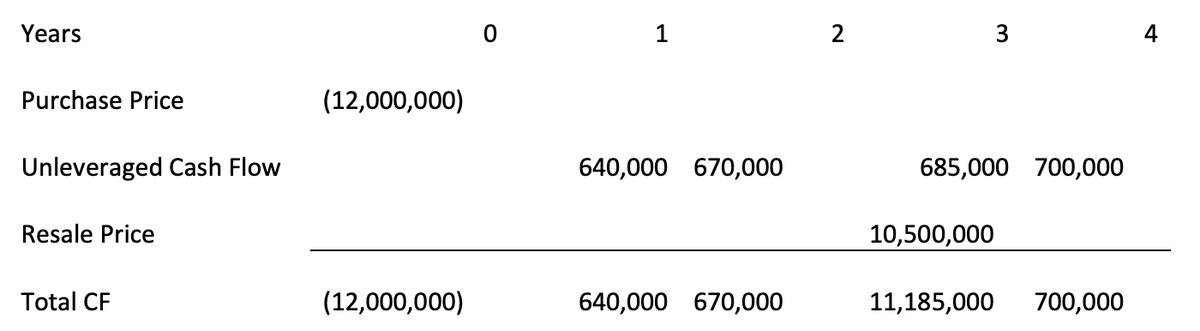

The following proforma shows unleveraged cash flows for a property if an investor were to purchase it today and resell it at the end of the third year: (Show answer in Excel)

- What is the present value of the each of the discounted cash flows from Year 1, Year 2, and Year 3, using a discount rate of 8.75% (hint: calculate each on separately)?

- What is the

Net Present Value of this investment?

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

- Year Net Cash Flow Discount Factor Present Value (using the factor) Present Value (using Excel formula) 0 $ (3,500,000.00) 1 $ (3,500,000.00) ($3,500,000.00) 1 $ 900,000.00 0.90909 $ 818,181.00 $818,181.82 2 $ 900,000.00 0.82645 $ 743,805.00 $743,801.65 3 $ 900,000.00 0.75131 $ 676,179.00 $676,183.32 4 $ 900,000.00 0.68301 $ 614,709.00 $614,712.11 5 $ 900,000.00 0.62092 $ 558,828.00 $558,829.19 Net Present Value $ (88,298.00) $ (88,291.91) 3. Now assume that inflation is estimated as a 5% increase each year (starting with Year 1) for the entire 5 years. Calculate the new net cash flow values for each year. start with 5% increase for Year 1 net cash flow. Year Net Cash Flow 0 $…ind the IRR for the following cash flows assuming a WACC of 10%. YR CF 0 -15,000 1 6,000 2 4,000 3 2,000 4 3,000 5 2,000Assuming today is 1st January 2021. Date Cash flows (Rs.) 01-Jan-21 (900,000 ) 31-Dec-21 0 31-Dec-22 240,000 31-Dec-23 320,000 31-Dec-24 490,000 31-Dec-25 250,000 31-Dec-26 345,000 Cost of Capital = 8% Required: Net Present Value (NPV) Payback period (Simple and discounted) Internal Rate of Return (IRR) Solve At Excel.

- LiabilitiesOMRAssetsOMRShare capital400,000Land and building280,000Net profit60,000Plant and machinery700,000General reserve80,000Stock400,000Debentures840,000Debtors200,000Creditors200,000Bills receivables20,000Bills payable100,000Cash80,000Total1,680,000Total1,680,000 1>calculate total current liabilites 2>calculate total Current assetsDetermine the ERR (External rate of return) of the cash flows if external rate (e) is given as %19. Year Cash Flow 0 -3000 1 2000 2 4000 3 -1000 4 3000 5 4000 6 -5000 7 9000 Select one: a. 0.2988 b. 0.2638 c. 0.2565 d. 0.3073 e. 0.2783 f. 0.3491From the following forecast the Balance sheet for the year 2021Balance sheet as of 31/12/2020Liabilities& Equity AmountAssetsAmountEquity33,000 Plant and machinery 10,000Retained earnings 10,000 Land Property20.000Accounts payable 7,000 Accounts receivables 3.000Inventories10.000Cash in hand2000Cash at Bank5.00050,00050,0001. It is expected that the company will make a net income of10% of forecasted sales2. The company will purchase additional 5000 OMR worthmachines by taking an additional loan of 5000 OMR3. Forecasted sales OMR 100,0004. Dividend payout will be 50%5. The following estimates are also given;Accounts payable 10,000Accounts receivable 6,000Inventories 15,000Cash in hand 6.000Cash at bank 1,000

- What is the present value of the following cash flow stream at a rate of 10.0%? Years: 0 1 2 3 CFs: $750 $2,450 $3,175 $4,400 a. $10,755.00 b. $13,143.15 c. $11,855.25 d. $9,722.73 e. $8,907.021. How much is the net share in the profit or loss of the associate (investment income) in 2021? P480,000 P825,000 P420,000 P135,000 2. How much is the carrying amount of the investment as of December 31, 2021? P7,815,000 P8,025,000 P7,680,000 P7,125,000Use the following information to answer the questionsProperty:Purchase Price$7,017,000Acquisition Costs$0Year 1 PGI$1,263,060PGI Growth Rate/year4.0%Year 1 Miscellaneous Income$0Miscellaneous Income Growth Rate/year0.0%Annual Vacancy and Collection Losses/year11.0%Year 1 Operating Expense$415,926Operating Expense Annual Growth Rate2.8%Year 1 Capital Expenditures$38,220Capital Expenditures Annual Growth Rate1.6%Holding period (years)5Property to be sold for NOI6 capitalized at (Terminal Cap Rate):7.5%Selling Expenses in year 56.5%Financing:LTV67%Loan Costs (% of Mortgage Value)1.40%Loan term (years)30Monthly Amortization / monthly paymentsLoan is a 2/2 ARMLoan Rate = T-Bill + 0.37%Teaser Rate3.420%T-Bill Rate at Initiation2.990%T-Bill on Reset Date 15.540%T-Bill on Reset Date 25.910%T-Bill on Reset Date 36.850%T-Bill on Reset Date 47.250%T-Bill on Reset Date 58.120%T-Bill on Reset Date 68.900%Pre-tax Required Return32.00% 1-Find the annual debt service in year 3 2-Find the Annual Debt…

- : Answers the days of Working capital based on the information below: 2020 2021 Profit of the year $126,000 $175,000 Depreciation/Amortization 25,000 35,000 Trade receivables 260,000 285,000 Inventories 350,000 390,000 Trade and other payables 290,000 310,000 Revenue 1,800,000 2,100,000Perform a vertical analysis on the following information. 2021 2020Cash $ 420,000 $ 1,050,000Accounts receivable 660,000 300,000Inventory 1,020,000 925,000Long-term assets 3,900,000 2,725,000Total assets $ 6,000,000 $ 5,000,000D CONSOLIDATED STATEMENTS OF FINANCIAL POSITION December 31, December 31, PERCENTAGE 2021 2020 USD USD Assets Current assets Cash and cash equivalents 34,115,412 25,681,845 Short-term financial instruments 71,417,748 80,798,680 Short-term financial assets at amortized cost 2,944,705 2,409,853 Short-term financial assets at fair value through profit or loss 35,624 62,452 Trade receivables 35,585,565 27,065,012 Non-trade receivables 3,930,828 3,150,548 Prepaid expenses 2,042,001 1,980,685 Inventories 36,172,043 28,007,314 Other current assets 4,441,629 3,281,589 Assets held-for-sale - 812,370 Total Current Assets 190,685,555 173,250,348 Non-current assets Financial assets at fair value through other comprehensive income 12,206,843 10,991,369 Financial assets at fair value through profit or loss 1,333,227 1,051,455 Investment in associates and joint ventures…