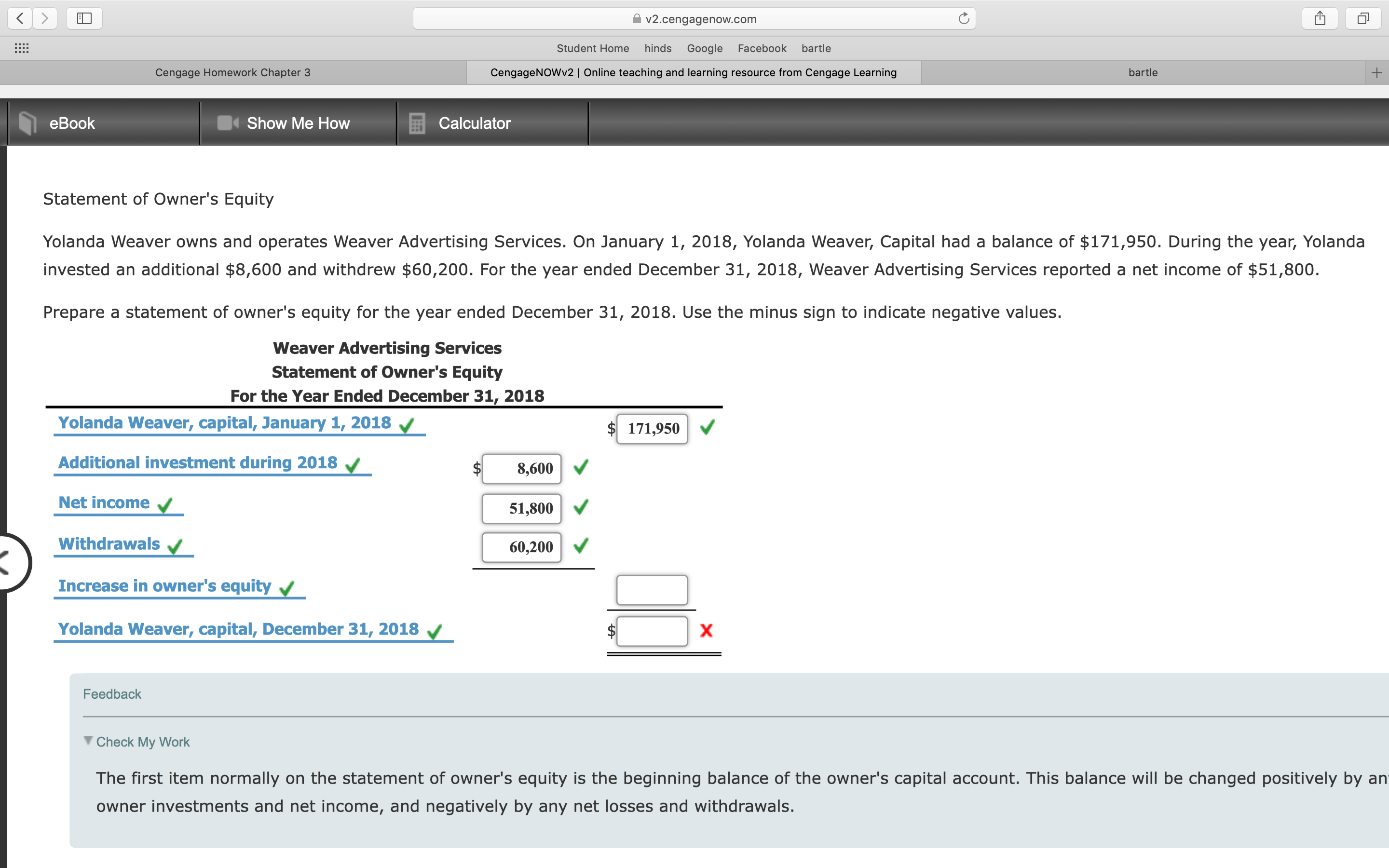

Yolanda Weaver owns and operates Weaver Advertising Services. On January 1, 2018, Yolanda Weaver, Capital had a balance of $171,950. During the year, Yolanda invested an additional $8,600 and withdrew $60,200. For the year ended December 31, 2018, Weaver Advertising Services reported a net income of $51,800. Prepare a statement of owner's equity for the year ended December 31, 2018. Use the minus sign to indicate negative values.

Yolanda Weaver owns and operates Weaver Advertising Services. On January 1, 2018, Yolanda Weaver, Capital had a balance of $171,950. During the year, Yolanda invested an additional $8,600 and withdrew $60,200. For the year ended December 31, 2018, Weaver Advertising Services reported a net income of $51,800. Prepare a statement of owner's equity for the year ended December 31, 2018. Use the minus sign to indicate negative values.

Financial Accounting

14th Edition

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Carl Warren, Jim Reeve, Jonathan Duchac

Chapter1: Introduction To Accounting And Business

Section: Chapter Questions

Problem 5PEA: Using the income statement for Ousel Travel Service shown in Practice Exercise 1-4A, prepare a...

Related questions

Topic Video

Question

100%

Yolanda Weaver owns and operates Weaver Advertising Services. On January 1, 2018, Yolanda Weaver, Capital had a balance of $171,950. During the year, Yolanda invested an additional $8,600 and withdrew $60,200. For the year ended December 31, 2018, Weaver Advertising Services reported a net income of $51,800.

Prepare a statement of owner's equity for the year ended December 31, 2018. Use the minus sign to indicate negative values.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning