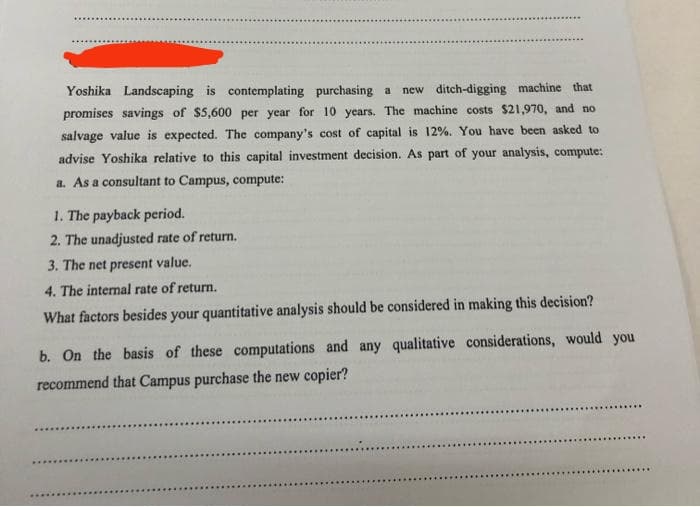

Yoshika Landscaping is contemplating purchasing a new ditch-digging machine that promises savings of $5,600 per year for 10 years. The machine costs $21,970, and no salvage value is expected. The company's cost of capital is 12%. You have been asked to advise Yoshika relative to this capital investment decision. As part of your analysis, compute: a. As a consultant to Campus, compute: 1. The payback period. 2. The unadjusted rate of return. 3. The net present value. 4. The internal rate of return. What factors besides your quantitative analysis should be considered in making this decision? b. On the basis of these computations and any qualitative considerations, would you recommend that Campus purchase the new copier?

Yoshika Landscaping is contemplating purchasing a new ditch-digging machine that promises savings of $5,600 per year for 10 years. The machine costs $21,970, and no salvage value is expected. The company's cost of capital is 12%. You have been asked to advise Yoshika relative to this capital investment decision. As part of your analysis, compute: a. As a consultant to Campus, compute: 1. The payback period. 2. The unadjusted rate of return. 3. The net present value. 4. The internal rate of return. What factors besides your quantitative analysis should be considered in making this decision? b. On the basis of these computations and any qualitative considerations, would you recommend that Campus purchase the new copier?

Chapter12: Sequences, Series And Binomial Theorem

Section12.3: Geometric Sequences And Series

Problem 12.58TI: What is the total effect on the economy of a government tax rebate of $500 to each household in...

Related questions

Question

100%

Transcribed Image Text:Yoshika Landscaping is contemplating purchasing a new ditch-digging machine that

promises savings of $5,600 per year for 10 years. The machine costs $21,970, and no

salvage value is expected. The company's cost of capital is 12%. You have been asked to

advise Yoshika relative to this capital investment decision. As part of your analysis, compute:

a. As a consultant to Campus, compute:

1. The payback period.

2. The unadjusted rate of return.

3. The net present value.

4. The internal rate of return.

What factors besides your quantitative analysis should be considered in making this decision?

b. On the basis of these computations and any qualitative considerations, would you

recommend that Campus purchase the new copier?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you