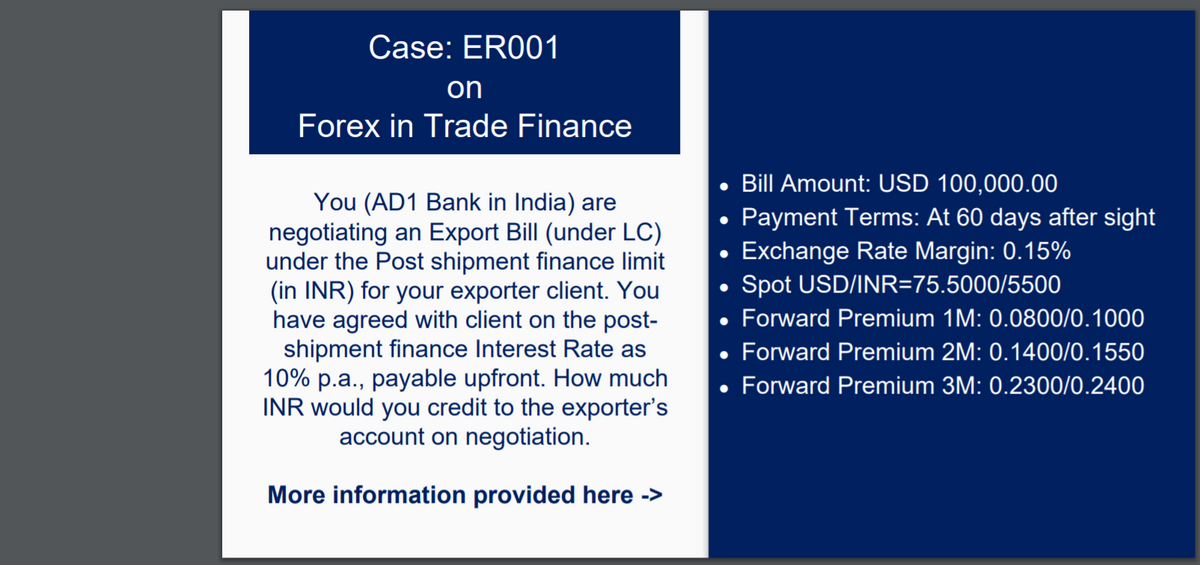

You (AD1 Bank in India) are negotiating an Export Bill (under LC) under the Post shipment finance limit (in INR) for your exporter client. You have agreed with client on the post- shipment finance Interest Rate as 10% p.a., payable upfront. How much INR would you credit to the exporter's account on negotiation.

You (AD1 Bank in India) are negotiating an Export Bill (under LC) under the Post shipment finance limit (in INR) for your exporter client. You have agreed with client on the post- shipment finance Interest Rate as 10% p.a., payable upfront. How much INR would you credit to the exporter's account on negotiation.

Chapter22: International Financial Management

Section: Chapter Questions

Problem 8P

Related questions

Question

Transcribed Image Text:Case: ER001

on

Forex in Trade Finance

Bill Amount: USD 100,000.00

You (AD1 Bank in India) are

negotiating an Export Bill (under LC)

under the Post shipment finance limit

(in INR) for your exporter client. You

have agreed with client on the post-

shipment finance Interest Rate as

10% p.a., payable upfront. How much

INR would you credit to the exporter's

account on negotiation.

Payment Terms: At 60 days after sight

Exchange Rate Margin: 0.15%

Spot USD/INR=75.5000/5500

Forward Premium 1M: 0.0800/0.1000

Forward Premium 2M: 0.1400/0.1550

• Forward Premium 3M: 0.2300/0.2400

More information provided here ->

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT