You and your best friend, Angelo started working at Microsoft 2022. You know that he is much stronger than you at negotiating and you belie money than you. This is the first job for both of you and neither of you joined th plan. You have asked him for his salary but he refuses to tell you. He has hower made the maximum Registered Retirement Savings Plan (RRSP) contribution a amount of $16,200. Both of you have not yet received a raise since starting at

You and your best friend, Angelo started working at Microsoft 2022. You know that he is much stronger than you at negotiating and you belie money than you. This is the first job for both of you and neither of you joined th plan. You have asked him for his salary but he refuses to tell you. He has hower made the maximum Registered Retirement Savings Plan (RRSP) contribution a amount of $16,200. Both of you have not yet received a raise since starting at

Chapter19: Deferred Compensation

Section: Chapter Questions

Problem 55P

Related questions

Question

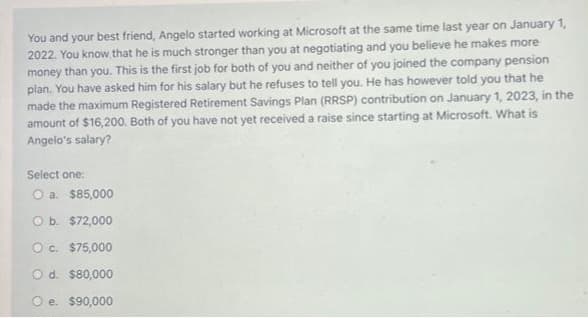

Transcribed Image Text:You and your best friend, Angelo started working at Microsoft at the same time last year on January 1,

2022. You know that he is much stronger than you at negotiating and you believe he makes more

money than you. This is the first job for both of you and neither of you joined the company pension

plan. You have asked him for his salary but he refuses to tell you. He has however told you that he

made the maximum Registered Retirement Savings Plan (RRSP) contribution on January 1, 2023, in the

amount of $16,200. Both of you have not yet received a raise since starting at Microsoft. What is

Angelo's salary?

Select one:

O a. $85,000

O b. $72,000

O c. $75,000

O d. $80,000

O e. $90,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning