You are a highly priced accountant. Jay and Beyonce have come to you for tax advice and would like to know the tax ramifications of each of the events and transactions lieted

You are a highly priced accountant. Jay and Beyonce have come to you for tax advice and would like to know the tax ramifications of each of the events and transactions lieted

Chapter5: Gross Income: Exclusions

Section: Chapter Questions

Problem 30P

Related questions

Question

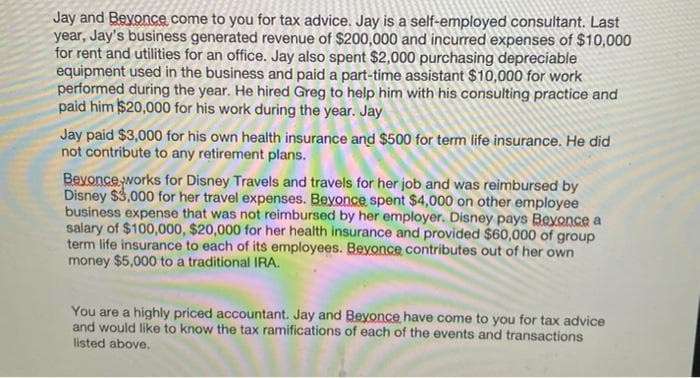

Transcribed Image Text:Jay and Bevonce come to you for tax advice. Jay is a self-employed consultant. Last

year, Jay's business generated revenue of $200,000 and incurred expenses of $10,000

for rent and utilities for an office. Jay also spent $2,000 purchasing depreciable

equipment used in the business and paid a part-time assistant $10,000 for work

performed during the year. He hired Greg to help him with his consulting practice and

paid him $20,000 for his work during the year. Jay

Jay paid $3,000 for his own health insurance and $500 for term life insurance. He did

not contribute to any retirement plans.

Bevonce works for Disney Travels and travels for her job and was reimbursed by

Disney $3,000 for her travel expenses. Beyonce spent $4,000 on other employee

business expense that was not reimbursed by her employer. Disney pays Beyonce a

salary of $100,000, $20,000 for her health insurance and provided $60,000 of group

term life insurance to each of its employees. Beyonce contributes out of her own

money $5,000 to a traditional IRA.

You are a highly priced accountant. Jay and Beyonce have come to you for tax advice

and would like to know the tax ramifications of each of the events and transactions

listed above.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT