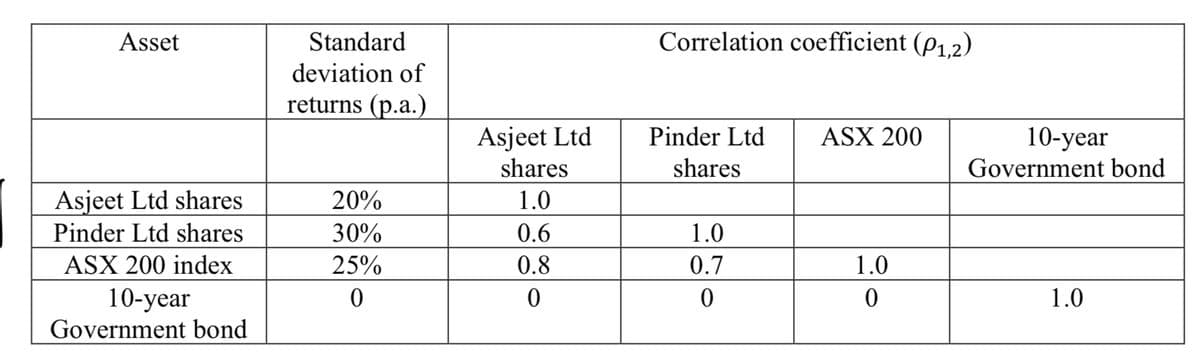

You are an investor keen to invest in the shares of Asjeet Ltd and Pinder Ltd. Your plan is to construct a portfolio consisting of a 30% investment in Asjeet Ltd shares and 70% in Pinder Ltd shares. You estimate that the current yield on a 10-year Government bond is 3% p.a. and plan to use this security as a proxy for the risk-free asset. You also estimate that the market risk premium is 6% p.a. You go on to compile the following information with a view to treating the ASX 200 index as a proxy for the market portfolio. a)What is the standard deviation of returns for your portfolio (as a percentage to two decimal places – e.g. 10.03%)? b)What is the beta of Asjeet Ltd and Pinder Ltd shares (to two decimal places)? c)According to the CAPM, what is the expected return for your portfolio (as a percentage to two decimal places – e.g. 10.03%)?

-

You are an investor keen to invest in the shares of Asjeet Ltd and Pinder Ltd. Your plan is to construct a portfolio consisting of a 30% investment in Asjeet Ltd shares and 70% in Pinder Ltd shares. You estimate that the current yield on a 10-year Government bond is 3% p.a. and plan to use this security as a proxy for the risk-free asset. You also estimate that the market risk premium is 6% p.a. You go on to compile the following information with a view to treating the ASX 200 index as a proxy for the market portfolio.

a)What is the standard deviation of returns for your portfolio (as a percentage to two decimal places – e.g. 10.03%)?

b)What is the beta of Asjeet Ltd and Pinder Ltd shares (to two decimal places)?

c)According to the

Step by step

Solved in 4 steps