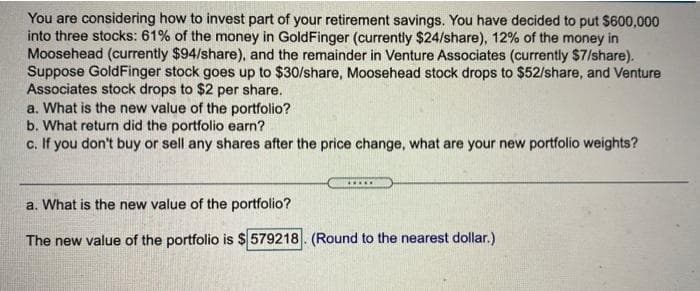

You are considering how to invest part of your retirement savings. You have decided to put $600,000 into three stocks: 61% of the money in GoldFinger (currently $24/share), 12% of the money in Moosehead (currently $94/share), and the remainder in Venture Associates (currently $7/share). Suppose GoldFinger stock goes up to $30/share, Moosehead stock drops to $52/share, and Venture Associates stock drops to $2 per share. a. What is the new value of the portfolio? b. What return did the portfolio earn? c. If you don't buy or sell any shares after the price change, what are your new portfolio weights?

You are considering how to invest part of your retirement savings. You have decided to put $600,000 into three stocks: 61% of the money in GoldFinger (currently $24/share), 12% of the money in Moosehead (currently $94/share), and the remainder in Venture Associates (currently $7/share). Suppose GoldFinger stock goes up to $30/share, Moosehead stock drops to $52/share, and Venture Associates stock drops to $2 per share. a. What is the new value of the portfolio? b. What return did the portfolio earn? c. If you don't buy or sell any shares after the price change, what are your new portfolio weights?

Chapter2: The Domestic And International Financial Marketplace

Section: Chapter Questions

Problem 2P

Related questions

Question

Transcribed Image Text:You are considering how to invest part of your retirement savings. You have decided to put $600,000

into three stocks: 61% of the money in GoldFinger (currently $24/share), 12% of the money in

Moosehead (currently $94/share), and the remainder in Venture Associates (currently $7/share).

Suppose GoldFinger stock goes up to $30/share, Moosehead stock drops to $52/share, and Venture

Associates stock drops to $2 per share.

a. What is the new value of the portfolio?

b. What return did the portfolio earn?

c. If you don't buy or sell any shares after the price change, what are your new portfolio weights?

a. What is the new value of the portfolio?

The new value of the portfolio is $ 579218. (Round to the nearest dollar.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning