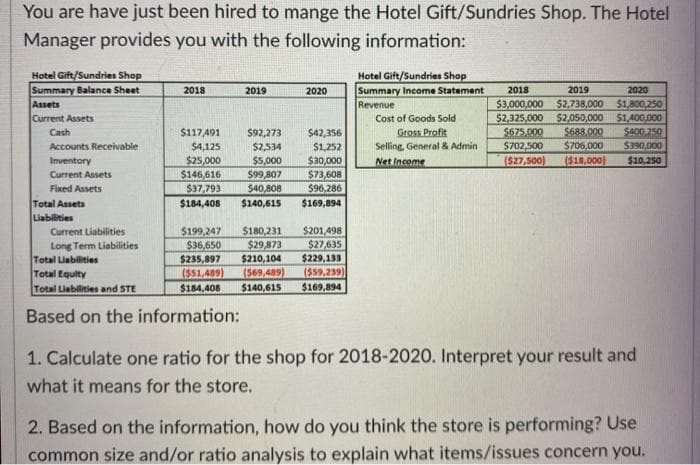

You are have just been hired to mange the Hotel Gift/Sundries Shop. The Hotel Manager provides you with the following information: Hotel Gift/Sundries Shop Summary Balance Sheet Assets Current Assets Cash Hotel Gift/Sundries Shop Summary Income Statement Revenue 2020 $1.800 250 $1,400,000 $400,750 $390,000 $10,250 2018 2019 2020 2018 2019 $3,000,000 $2,738,000 $2,325,000 $2,050,000 $675.000 Cost of Goods Sold $117,491 $92,273 Gross Profit $688.000 $42,356 $1,252 Accounts Receivable $4,125 $2,534 Selling General & Admin $702,500 $706,000 $30,000 $73,608 $96,286 (527,500) $25,000 $146,616 $37,793 Inventory (518,000) $5,000 $99,807 $40,808 Net Income Current Assets Fixed Assets Total Assets Liabilities $184,408 $140,615 $169,894 $199,247 $36,650 $235,897 (551,489) $184,408 $180,231 $29,873 $210,104 $201,498 $27,635 $229,133 (559,239) Current Liabilities Long Term Liabilities Total Liebilities Total Equity Total Liabilities and STE (569,489) $140,615 $169,894 Based on the information: 1. Calculate one ratio for the shop for 2018-2020. Interpret your result and what it means for the store. 2. Based on the information, how do you think the store is performing? Use common size and/or ratio analysis to explain what items/issues concern you.

Master Budget

A master budget can be defined as an estimation of the revenue earned or expenses incurred over a specified period of time in the future and it is generally prepared on a periodic basis which can be either monthly, quarterly, half-yearly, or annually. It helps a business, an organization, or even an individual to manage the money effectively. A budget also helps in monitoring the performance of the people in the organization and helps in better decision-making.

Sales Budget and Selling

A budget is a financial plan designed by an undertaking for a definite period in future which acts as a major contributor towards enhancing the financial success of the business undertaking. The budget generally takes into account both current and future income and expenses.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images