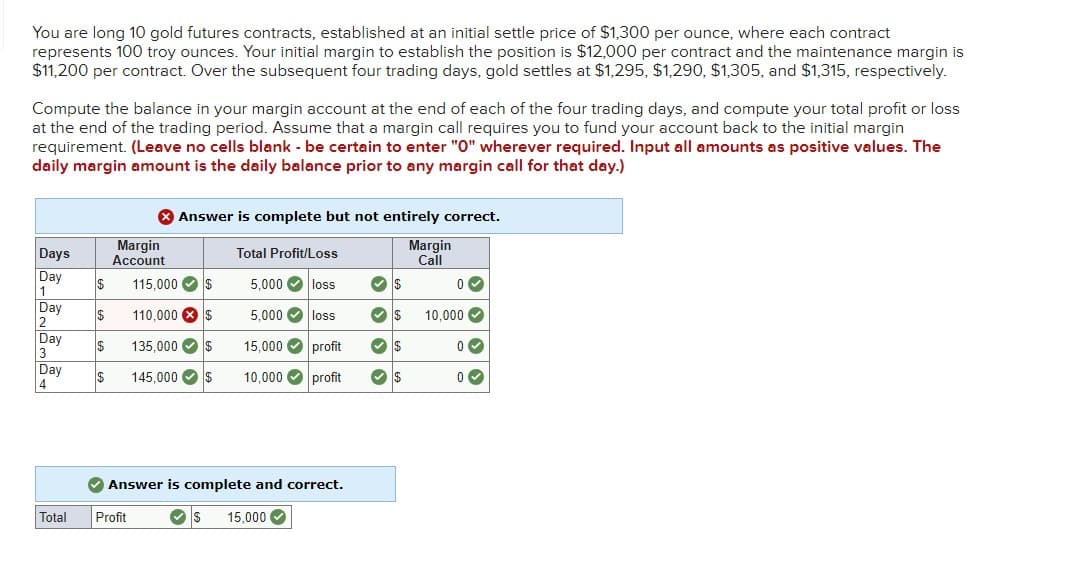

You are long 10 gold futures contracts, established at an initial settle price of $1,300 per ounce, where each contract represents 100 troy ounces. Your initial margin to establish the position is $12,000 per contract and the maintenance margin is $11,200 per contract. Over the subsequent four trading days, gold settles at $1,295, $1,290, $1,305, and $1,315, respectively. Compute the balance in your margin account at the end of each of the four trading days, and compute your total profit or loss at the end of the trading period. Assume that a margin call requires you to fund your account back to the initial margin requirement. (Leave no cells blank - be certain to enter "O" wherever required. Input all amounts as positive values. The daily margin amount is the daily balance prior to any margin call for that day.) Days Total Profit/Loss Margin Account Answer is complete but not entirely correct. Margin Call Day $ 115,000 $ 5,000 loss $ 0 1 Day $ 110,000 $ 5,000 loss $ 10,000 2 Day $ 135,000 $ 15,000 profit $ 3 Day $ 145,000 $ 10,000 profit $ 4 Answer is complete and correct. Total Profit $ 15,000

You are long 10 gold futures contracts, established at an initial settle price of $1,300 per ounce, where each contract represents 100 troy ounces. Your initial margin to establish the position is $12,000 per contract and the maintenance margin is $11,200 per contract. Over the subsequent four trading days, gold settles at $1,295, $1,290, $1,305, and $1,315, respectively. Compute the balance in your margin account at the end of each of the four trading days, and compute your total profit or loss at the end of the trading period. Assume that a margin call requires you to fund your account back to the initial margin requirement. (Leave no cells blank - be certain to enter "O" wherever required. Input all amounts as positive values. The daily margin amount is the daily balance prior to any margin call for that day.) Days Total Profit/Loss Margin Account Answer is complete but not entirely correct. Margin Call Day $ 115,000 $ 5,000 loss $ 0 1 Day $ 110,000 $ 5,000 loss $ 10,000 2 Day $ 135,000 $ 15,000 profit $ 3 Day $ 145,000 $ 10,000 profit $ 4 Answer is complete and correct. Total Profit $ 15,000

Chapter21: Risk Management

Section: Chapter Questions

Problem 2P

Question

Nikul

Transcribed Image Text:You are long 10 gold futures contracts, established at an initial settle price of $1,300 per ounce, where each contract

represents 100 troy ounces. Your initial margin to establish the position is $12,000 per contract and the maintenance margin is

$11,200 per contract. Over the subsequent four trading days, gold settles at $1,295, $1,290, $1,305, and $1,315, respectively.

Compute the balance in your margin account at the end of each of the four trading days, and compute your total profit or loss

at the end of the trading period. Assume that a margin call requires you to fund your account back to the initial margin

requirement. (Leave no cells blank - be certain to enter "O" wherever required. Input all amounts as positive values. The

daily margin amount is the daily balance prior to any margin call for that day.)

Days

Total Profit/Loss

Margin

Account

Answer is complete but not entirely correct.

Margin

Call

Day

$

115,000 $

5,000

loss

$

0

1

Day

$

110,000 $

5,000

loss

$

10,000

2

Day

$

135,000 $

15,000

profit

$

3

Day

$

145,000 $ 10,000

profit

$

4

Answer is complete and correct.

Total

Profit

$ 15,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT