You are required to answer the following: (a) What is the current market value of the company? (b) What is the market value of debt in the proposed debt capital structure? (c) How many shares must be repurchased in the proposed levered company? (d) What is the cost of equity in the levered company?

You are required to answer the following: (a) What is the current market value of the company? (b) What is the market value of debt in the proposed debt capital structure? (c) How many shares must be repurchased in the proposed levered company? (d) What is the cost of equity in the levered company?

Chapter3: The Financial Environment: Markets, Institutions And Investment Banking

Section: Chapter Questions

Problem 9PROB

Related questions

Question

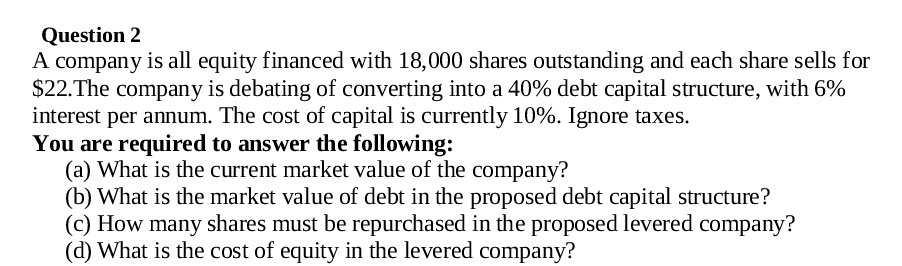

Transcribed Image Text:Question 2

A company is all equity financed with 18,000 shares outstanding and each share sells for

$22. The company is debating of converting into a 40% debt capital structure, with 6%

interest per annum. The cost of capital is currently 10%. Ignore taxes.

You are required to answer the following:

(a) What is the current market value of the company?

(b) What is the market value of debt in the proposed debt capital structure?

(c) How many shares must be repurchased in the proposed levered company?

(d) What is the cost of equity in the levered company?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning