You are the vice president of finance for a manufacturer of scuba diving gear. The company is planning a major plant expansion in 5 years. You have decided to start a sinking fund to accumulate the funds necessary for the project. Your company's investments yield 12% compounded quarterly. It is estimated that $3,000,000 in today's dollars will be required; however, the inflation rate on construction costs and plant equipment is expected to average 7% per year for the next 5 years. What sinking fund payments (in $) will be required at the end of every 3-month period to accumulate the necessary funds? (Use Table 12-1. Round your answer to the nearest cent.)

You are the vice president of finance for a manufacturer of scuba diving gear. The company is planning a major plant expansion in 5 years. You have decided to start a sinking fund to accumulate the funds necessary for the project. Your company's investments yield 12% compounded quarterly. It is estimated that $3,000,000 in today's dollars will be required; however, the inflation rate on construction costs and plant equipment is expected to average 7% per year for the next 5 years. What sinking fund payments (in $) will be required at the end of every 3-month period to accumulate the necessary funds? (Use Table 12-1. Round your answer to the nearest cent.)

Essentials Of Investments

11th Edition

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Chapter1: Investments: Background And Issues

Section: Chapter Questions

Problem 1PS

Related questions

Question

You are the vice president of finance for a manufacturer of scuba diving gear. The company is planning a major plant expansion in 5 years. You have decided to start a sinking fund to accumulate the funds necessary for the project. Your company's investments yield 12% compounded quarterly. It is estimated that $3,000,000 in today's dollars will be required; however, the inflation rate on construction costs and plant equipment is expected to average 7% per year for the next 5 years.

What sinking fund payments (in $) will be required at the end of every 3-month period to accumulate the necessary funds? (Use Table 12-1. Round your answer to the nearest cent.)

$

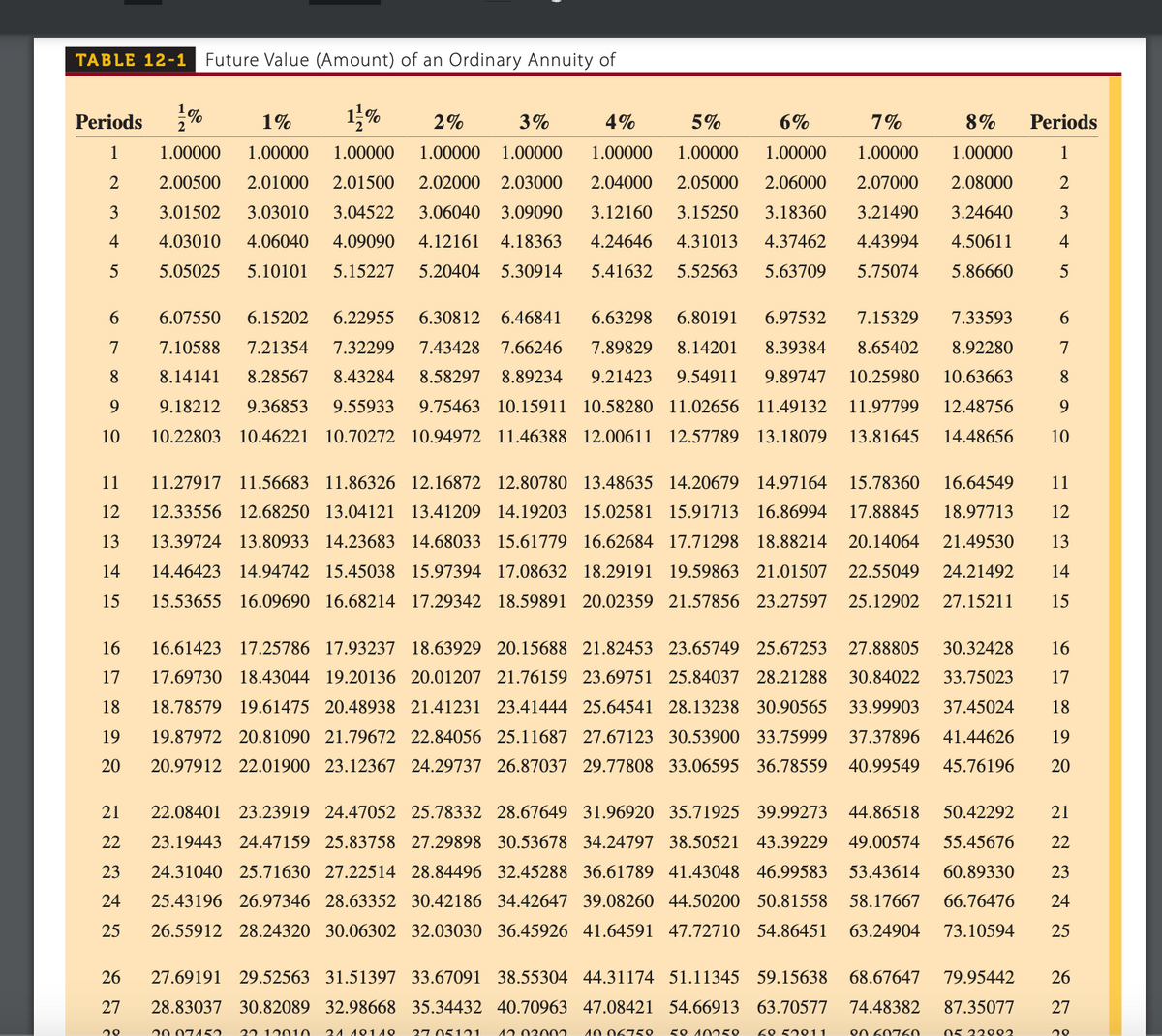

Transcribed Image Text:TABLE 12-1 Future Value (Amount) of an Ordinary Annuity of

1%

Periods

1%

1

1.00000

1.00000

2 2.00500 2.01000

3

4

5

6

7899

10

11

12

13

14

15

16

17

18

19

20

2%

3%

1.00000 1.00000 1.00000

2.01500 2.02000 2.03000

3.01502 3.03010 3.04522 3.06040 3.09090

4.03010 4.06040 4.09090 4.12161 4.18363

5.05025 5.10101 5.15227 5.20404 5.30914

20

6%

7%

4% 5%

1.00000 1.00000 1.00000 1.00000

2.04000 2.05000

3.12160 3.15250

4.24646 4.31013

5.41632

2.06000 2.07000

3.18360 3.21490 3.24640

4.50611

5.86660

4.37462 4.43994

5.75074

5.52563 5.63709

8% Periods

1.00000 1

2.08000

2

3

4

5

6.07550 6.15202

6.22955 6.30812

6

7

6.46841 6.63298 6.80191 6.97532 7.15329 7.33593

7.10588 7.21354 7.32299 7.43428 7.66246 7.89829 8.14201 8.39384 8.65402 8.92280

8.14141 8.28567 8.43284

8.58297 8.89234 9.21423 9.54911 9.89747 10.25980 10.63663

9.18212 9.36853 9.55933 9.75463 10.15911 10.58280 11.02656 11.49132 11.97799 12.48756

10.22803 10.46221 10.70272 10.94972 11.46388 12.00611 12.57789 13.18079 13.81645 14.48656 10

8

9

11

11.27917 11.56683 11.86326 12.16872 12.80780 13.48635 14.20679 14.97164 15.78360 16.64549

12.33556 12.68250 13.04121 13.41209 14.19203 15.02581 15.91713 16.86994 17.88845 18.97713 12

13.39724 13.80933 14.23683 14.68033 15.61779 16.62684 17.71298 18.88214 20.14064 21.49530 13

14.46423 14.94742 15.45038 15.97394 17.08632 18.29191 19.59863 21.01507 22.55049 24.21492 14

15.53655 16.09690 16.68214 17.29342 18.59891 20.02359 21.57856 23.27597 25.12902 27.15211 15

20.07150 22 12010

16.61423 17.25786 17.93237 18.63929 20.15688 21.82453 23.65749 25.67253 27.88805 30.32428 16

17.69730 18.43044 19.20136 20.01207 21.76159 23.69751 25.84037 28.21288 30.84022 33.75023 17

18.78579 19.61475 20.48938 21.41231 23.41444 25.64541 28.13238 30.90565 33.99903 37.45024 18

19.87972 20.81090 21.79672 22.84056 25.11687 27.67123 30.53900 33.75999 37.37896 41.44626 19

20.97912 22.01900 23.12367 24.29737 26.87037 29.77808 33.06595 36.78559 40.99549 45.76196 20

21 22.08401 23.23919 24.47052 25.78332 28.67649 31.96920 35.71925 39.99273 44.86518 50.42292 21

22 23.19443 24.47159 25.83758 27.29898 30.53678 34.24797 38.50521 43.39229 49.00574 55.45676 22

23 24.31040 25.71630 27.22514 28.84496 32.45288 36.61789 41.43048 46.99583 53.43614 60.89330 23

24 25.43196 26.97346 28.63352 30.42186 34.42647 39.08260 44.50200 50.81558 58.17667 66.76476 24

25 26.55912 28.24320 30.06302 32.03030 36.45926 41.64591 47.72710 54.86451 63.24904 73.10594 25

26 27.69191 29.52563 31.51397 33.67091 38.55304 44.31174 51.11345 59.15638 68.67647 79.95442 26

27 28.83037 30.82089 32.98668 35.34432 40.70963 47.08421 54.66913 63.70577 74.48382 87.35077 27

21 191 10 27.05101 12.02002 10.06750 50 10259 68 52811

90 60760

05 22892

20

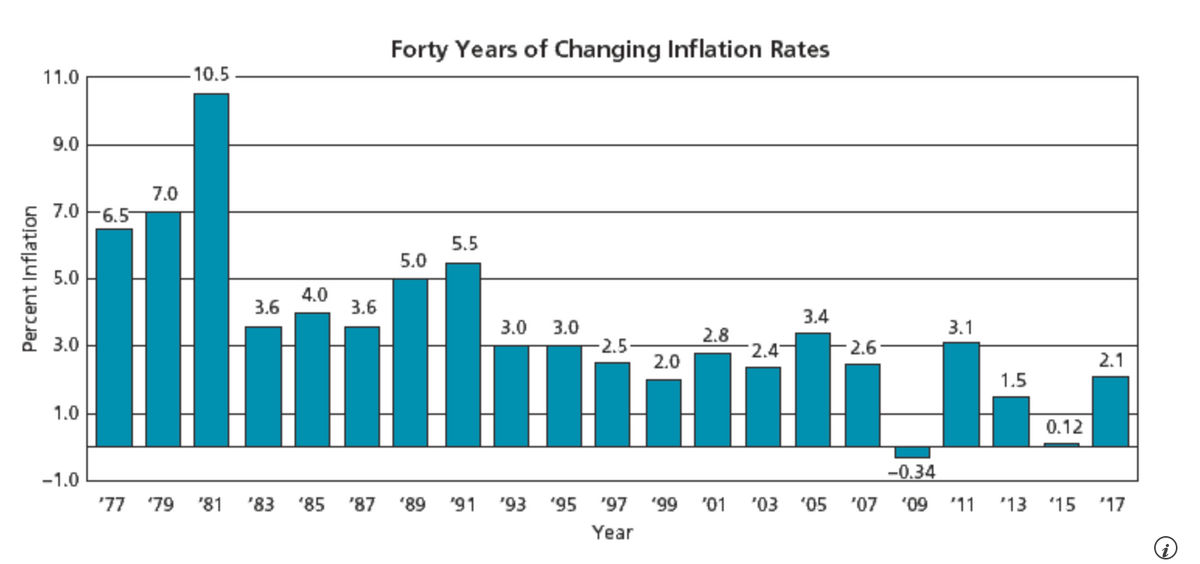

Transcribed Image Text:Percent Inflation

11.0

9.0

7.0 6.5

5.0

3.0

1.0

-1.0

T

7.0

10.5

'77 '79 '81

3.6

4.0

3.6

Forty Years of Changing Inflation Rates

5.0

5.5

3.0 3.0

-2.5-

2.0

2.8

2.4

3.4

2.6

3.1

1.5

-0.34

'83 '85 '87 '89 '91 '93 '95 '97 '99 '01 '03 '05 '07 '09 '11 '13

Year

0.12

2.1

$15 '17

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:

9780134897264

Author:

KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:

Pearson,

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i…

Finance

ISBN:

9780077861759

Author:

Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:

McGraw-Hill Education