you are trying to determine how much you should save fc you can spend now. For retirement, you will deposit toda. sum in a bank account paying 10 percent compounded an touching this deposit until you retire in five years (Januar on living for 20 additional years. During your retirement a payment of $50,000 on the first day of each year, with ary 1, 2021, and the last payment on January 1, 2041(C your desire to have one final three-year fling during whi down all the original cast members of Hey Dude and Sa autographs. To finance this, you want to receive $250,00 nothing on January 1, 2037, and January 1, 2038, becau In addition, after you pass on (January 1, 2041),)you wc $100,000 to leave to your children. a. How much must you deposit in the bank at 10 perce to achieve your goal? (Use a timeline to answer this the last second of December 31 is equivalent to the b. What kinds of problems are associated with this ana (Çalculating the future value of a complex annuity) Spri ire at age 100 so he can stea $1 billic

you are trying to determine how much you should save fc you can spend now. For retirement, you will deposit toda. sum in a bank account paying 10 percent compounded an touching this deposit until you retire in five years (Januar on living for 20 additional years. During your retirement a payment of $50,000 on the first day of each year, with ary 1, 2021, and the last payment on January 1, 2041(C your desire to have one final three-year fling during whi down all the original cast members of Hey Dude and Sa autographs. To finance this, you want to receive $250,00 nothing on January 1, 2037, and January 1, 2038, becau In addition, after you pass on (January 1, 2041),)you wc $100,000 to leave to your children. a. How much must you deposit in the bank at 10 perce to achieve your goal? (Use a timeline to answer this the last second of December 31 is equivalent to the b. What kinds of problems are associated with this ana (Çalculating the future value of a complex annuity) Spri ire at age 100 so he can stea $1 billic

Chapter5: The Time Value Of Money

Section: Chapter Questions

Problem 33P

Related questions

Question

100%

Transcribed Image Text:house's first contribution is made one year from today and his last is made the day he

mo p00,000 per year. II Mil-

retires, how much money must he contribute each year to his retirement fund?

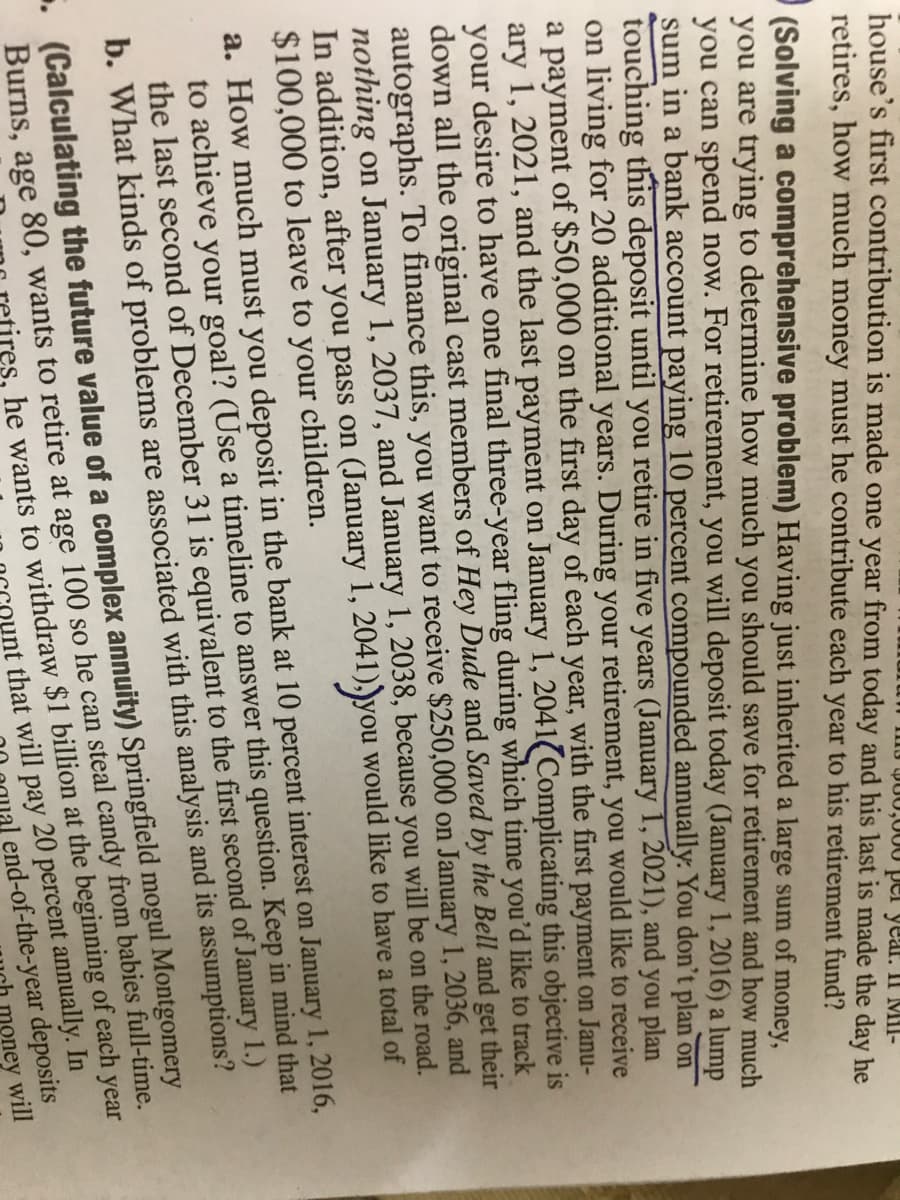

(Solving a comprehensive problem) Having just inherited a large sum of money,

you are trying to determine how much you should save for retirement and how much

you can spend now. For retirement, you will deposit today (January 1, 2016) a lump

sum in a bank account paying 10 percent compounded annually: You don't plan on

touching this deposit until you retire in five years (January 1, 2021), and you plan

on living for 20 additional years. During your retirement, you would like to receive

a payment of $50,000 on the first day of each year, with the first payment on Janu-

ary 1, 2021, and the last payment on January 1, 2041(Complicating this objective is

desire to have one final three-year fling during which time you'd like to track

your

down all the original cast members of Hey Dude and Saved by the Bell and get their

autographs. To finance this, you want to receive $250,000 on January 1, 2036, and

nothing on January 1, 2037, and January 1, 2038, because you will be on the road.

In addition, after you pass on (January 1, 2041),) you would like to have a total of

$100,000 to leave to your children.

a. How much must you deposit in the bank at 10 percent interest on January 1, 2016,

to achieve your goal? (Use a timeline to answer this question. Keep in mind that

the last second of December 31 is equivalent to the first second of January 1.)

b. What kinds of problems are associated with this analysis and its assumptions?

Burns, age 80, wants to retire at age 100 so he can steal candy from babies full-time.

he wants to withdraw $1 billion at the beginning of each year

unt that will pay 20 percent annually. In

end-of-the-year deposits

oney will

. (Calculating the future value of a complex annuity) Springfield mogul Montgomery

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning