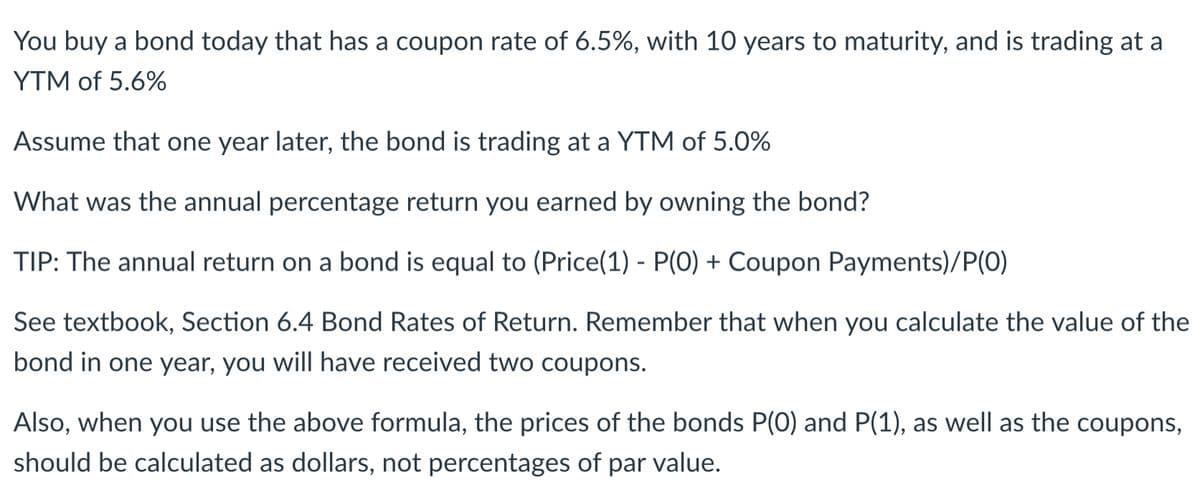

You buy a bond today that has a coupon rate of 6.5%, with 10 years to maturity, and is trading at a YTM of 5.6% Assume that one year later, the bond is trading at a YTM of 5.0% What was the annual percentage return you earned by owning the bond? TIP: The annual return on a bond is equal to (Price(1) - P(0) + Coupon Payments)/P(0) See textbook, Section 6.4 Bond Rates of Return. Remember that when you calculate the value of the bond in one year, you will have received two coupons. Also, when you use the above formula, the prices of the bonds P(0) and P(1), as well as the coupons, should be calculated as dollars, not percentages of par value.

You buy a bond today that has a coupon rate of 6.5%, with 10 years to maturity, and is trading at a YTM of 5.6% Assume that one year later, the bond is trading at a YTM of 5.0% What was the annual percentage return you earned by owning the bond? TIP: The annual return on a bond is equal to (Price(1) - P(0) + Coupon Payments)/P(0) See textbook, Section 6.4 Bond Rates of Return. Remember that when you calculate the value of the bond in one year, you will have received two coupons. Also, when you use the above formula, the prices of the bonds P(0) and P(1), as well as the coupons, should be calculated as dollars, not percentages of par value.

Chapter14: Investing In Stocks And Bonds

Section: Chapter Questions

Problem 7DTM

Related questions

Question

Transcribed Image Text:You buy a bond today that has a coupon rate of 6.5%, with 10 years to maturity, and is trading at a

YTM of 5.6%

Assume that one year later, the bond is trading at a YTM of 5.0%

What was the annual percentage return you earned by owning the bond?

TIP: The annual return on a bond is equal to (Price(1) - P(0) + Coupon Payments)/P(0)

See textbook, Section 6.4 Bond Rates of Return. Remember that when you calculate the value of the

bond in one year, you will have received two coupons.

Also, when you use the above formula, the prices of the bonds P(0) and P(1), as well as the coupons,

should be calculated as dollars, not percentages of par value.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT