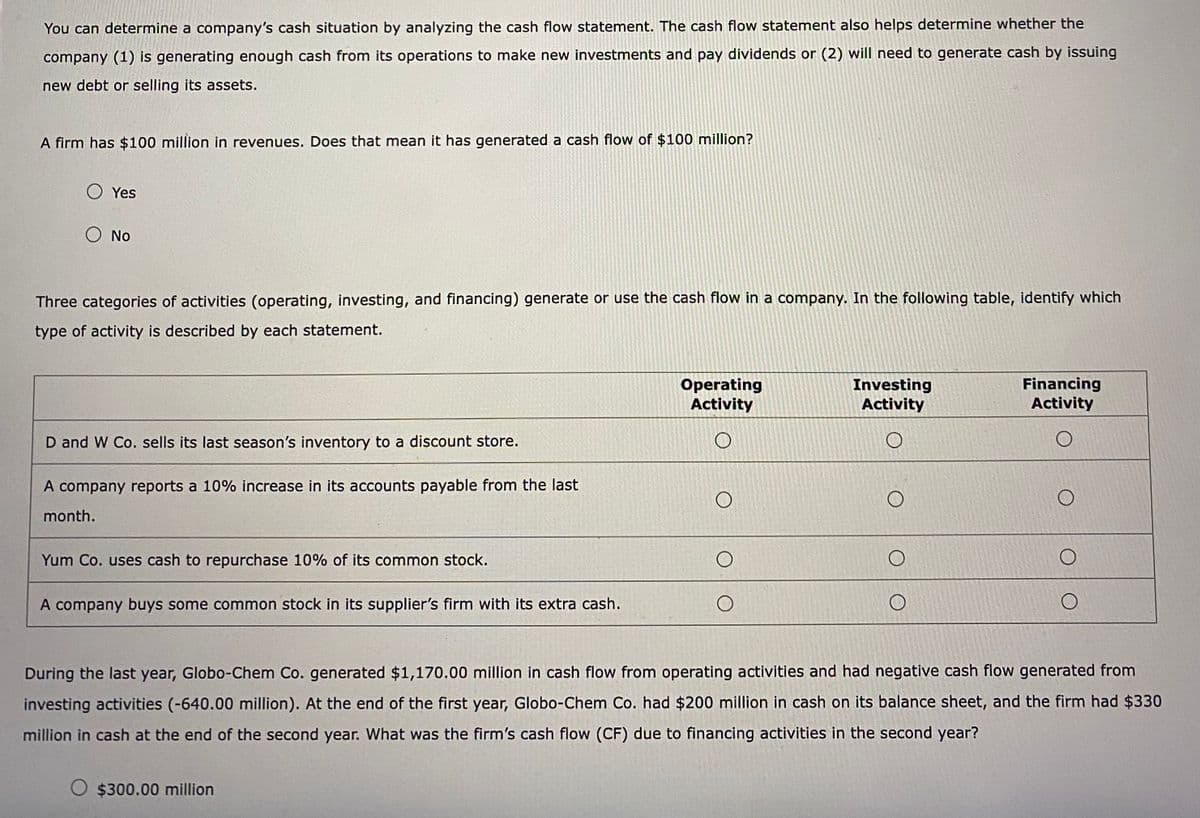

You can determine a company's cash situation by analyzing the cash flow statement. The cash flow statement also helps determine whether the company (1) is generating enough cash from its operations to make new investments and pay dividends or (2) will need to generate cash by issuing new debt or selling its assets. A firm has $100 million in revenues. Does that mean it has generated a cash flow of $100 million? O Yes O No Three categories of activities (operating, investing, and financing) generate or use the cash flow in a company. In the following table, identify which type of activity is described by each statement.

You can determine a company's cash situation by analyzing the cash flow statement. The cash flow statement also helps determine whether the company (1) is generating enough cash from its operations to make new investments and pay dividends or (2) will need to generate cash by issuing new debt or selling its assets. A firm has $100 million in revenues. Does that mean it has generated a cash flow of $100 million? O Yes O No Three categories of activities (operating, investing, and financing) generate or use the cash flow in a company. In the following table, identify which type of activity is described by each statement.

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter16: Statement Of Cash Flows: Another Look

Section: Chapter Questions

Problem 15P

Related questions

Question

Transcribed Image Text:You can determine a company's cash situation by analyzing the cash flow statement. The cash flow statement also helps determine whether the

company (1) is generating enough cash from its operations to make new investments and pay dividends or (2) will need to generate cash by issuing

new debt or selling its assets.

A firm has $100 million in revenues. Does that mean it has generated a cash flow of $100 million?

Yes

O NO

Three categories of activities (operating, investing, and financing) generate or use the cash flow in a company. In the following table, identify which

type of activity is described by each statement.

D and W Co. sells its last season's inventory to a discount store.

A company reports a 10% increase in its accounts payable from the last

month.

Yum Co. uses cash to repurchase 10% of its common stock.

A company buys some common stock in its supplier's firm with its extra cash.

Operating

Activity

O

O $300.00 million

O

O

Investing

Activity

O

O

O

Financing

Activity

O

O

O

O

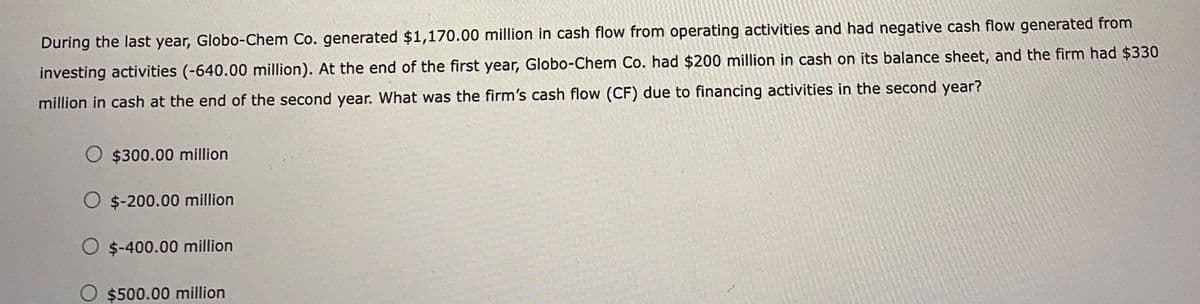

During the last year, Globo-Chem Co. generated $1,170.00 million in cash flow from operating activities and had negative cash flow generated from

investing activities (-640.00 million). At the end of the first year, Globo-Chem Co. had $200 million in cash on its balance sheet, and the firm had $330

million in cash at the end of the second year. What was the firm's cash flow (CF) due to financing activities in the second year?

Transcribed Image Text:During the last year, Globo-Chem Co. generated $1,170.00 million in cash flow from operating activities and had negative cash flow generated from

investing activities (-640.00 million). At the end of the first year, Globo-Chem Co. had $200 million in cash on its balance sheet, and the firm had $330

million in cash at the end of the second year. What was the firm's cash flow (CF) due to financing activities in the second year?

O $300.00 million

O $-200.00 million

O $-400.00 million

O $500.00 million

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning