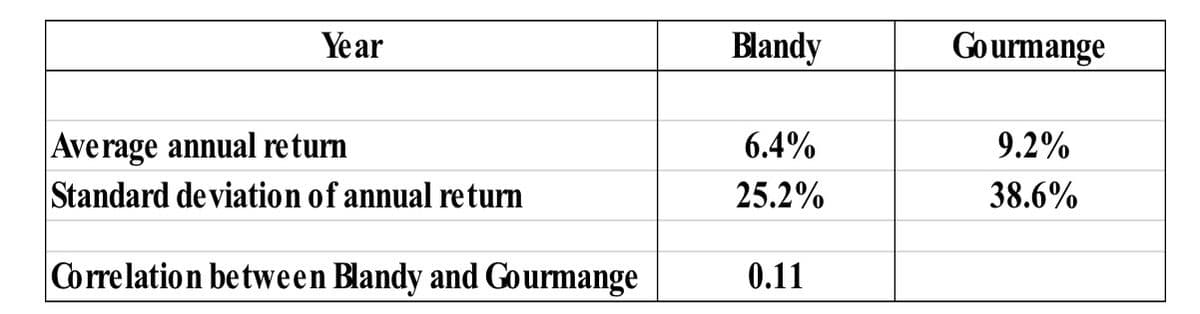

You currently have $300,000. You want to invest it in the following three assets: 10-year US Treasury bond with coupon rate 3.8%, Blandy and Gourmange stocks attached: Your goal is to have the expected return of 6.8% with a minimum portfolio risk. How much money should you allocate to these three assets?

Q: Examine the effect of the actions below on the current ratio. Assume that the prevailing current…

A: Current ratio is a ratio that explains the relationship between current assets and current…

Q: For services rendered, an attorney accepts a 120-day note for $4,300 at 7% simple interest from a…

A: Note value- $ 4300 Time – 120 days Interest rate – 7% Repaid: Amount - $4350 Time – 30 days

Q: answer using TVM calculations and formulas Today Dante and Sharon had their first child. All of the…

A: Initial deposit (I) = $23,000 Monthly interest rate (r) = 0.00266666666666667 (i.e. 0.032 / 12)…

Q: The manager of a large apartment complex knows from experience that 110 units will be occupied if…

A: The manager collected 400 dollars for 110 units. But he have remain 1 dollar from the rent then To…

Q: Jane Austen purchased shares with a market price of $50 when the initial margin requirement was 70%.…

A: The initial margin requirement is the minimum amount of the shares that need to be paid to buy a…

Q: 12-12. Using the following information for Handy Hardware, determine the capital structure that…

A: As per the given information: Proportion of debt Earnings per share (EPS)Stock price…

Q: Please answer one of the following questions in detail, providing examples whenever applicable.…

A: An option buyer has the right but not the duty to exercise the option. The greatest loss to the…

Q: (Related to Checkpoint 9.3) (Bond valuation) Pybus, Inc. is considering issuing bonds that will…

A: Information Provided: Bond maturity = 24 years Annual coupon rate = 6% Par value = $1000 Yield to…

Q: Accounting practice in the United States follows the generally accepted accounting principles (GAAP)…

A: Hi, there, Thanks for posting the question. As per our Q&A honour code, we must answer the first…

Q: (Related to Checkpoint 9.2) (Yield to maturity) Abner Corporation's bonds mature in 17 years and pay…

A: Solution:- Bond price means the price at which the bond is currently trading in the market. It is…

Q: Baker Industries’ net income is $24000, its interest expense is $4000, and its tax rate is 45%. Its…

A: ROE means return on equity, means how much net income has been generated on common equity of the…

Q: 1. Suppose you need a $10,000 loan from the car dealer to buy the car you wish. The dealer offers…

A: To Find: Nominal Interest rate Effective interest rate

Q: (Complex annuity) Upon graduating from college 40 years ago, Dr. Nick Riviera was already thinking…

A: Given, Amount deposited quarterly is $250 Interest rate is 10.9% compounded quarterly Term is 40…

Q: Maple Aircraft has issued a 4¾% convertible subordinated debenture due 3 years from now. The…

A: Since you have posted a question with multiple sub-parts, we will solve the first three sub-parts…

Q: 3. A bank pays 4% compounded annually. At the end of 4 years, a 2% bonus is paid on the balance. If…

A: Effective interest rate is the interest rate earned after any additional bonus or any extra benefit…

Q: Jack is celebrating his 24th birthday today. He wants to start saving in one year’s time, and retire…

A: Data given: FV=SGD 700,000 Rate=3% p.a. (compounded annually) N=70-25+1=46 (70 inclusive) nper=70…

Q: 0.Analyze the relationship between the federal budget and national debt. Explain how a federal…

A: “Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: You expect to have $12,000 in one year. A bank is offering loans at 5.5% interest per year. How much…

A: In this question we have to calculate present value of $ 12,000 in one year at 5.5% interest rate.…

Q: You deposit $1.2 million into your account to cover expenses in the next 12 years. The account earns…

A: We have an initial balance to support the living expenses of next two year. We have to find the…

Q: A 10-year bond carries a 8% coupon rate and pays interest semiannually. The market price of the bond…

A: The bonds are the securities issued by the companies to raise funds. The issuer may be a…

Q: The Gilbert Instrument Corporation is considering replacing the wood steamer it currently uses to…

A: Net present value is helpful in determining whether the project is to be acceptable or not. It is…

Q: The treasurer of a large corporation wants to invest $22 million in excess short-term cash in a…

A: Information Provided: EAR = 3.33% Term of the instrument = 78 days

Q: Burnett Corporation pays a constant $22 dividend on its stock. The company will maintain this…

A: Given Dividend is $22 term is 13 years Required return is 7%

Q: Problem 1 The Bird Co. is considering a 7-year project that would require a cash outlay of $160,000…

A: The company can discount cash flow methods to evaluate a project and whether to accept it or not.…

Q: 3.37 Find the present worth in year 0 for the cash flows shown. Let i= 10% per year. i = 10% 4 2 200…

A: Present value To make an investment, it is important to understand the current value of the…

Q: Complete the following, using ordinary interest. (Use Days in a year table.) Note: Do not round…

A: The borrower is the one who borrows money from the lender and the lender charges interest for the…

Q: Suppose there is an expression for vehicleSale, defined as [loanAmount] + [downPayment], in the…

A: Given: Vehiclesale = [LoanAmount]+[downpayment] With this query LoanID is also available.

Q: As one of the loan officers for Grove Gate Bank, calculate the monthly principal and interest, PI…

A: Given, Monthly payment is $1773.60 Annual tax is $6,513 Annual insurance is $2,186

Q: Bauhinia Equity Fund sells two types of shares, A+ and A++. A+ shares are sold with front-end load…

A: Here, To Find: Part A. Value of investment made by Mr. Star =? Part B. Value of investment made by…

Q: 4. (a) Suppose you decide to short sell some GameStop shares. Their cur- rent price is $5, and you…

A: Buying on margin When some amount can be borrowed for trading securities, it is said trading on…

Q: 1) Calculate the present worth (P+) of the given cash flow, i= 10% 0 A- $100 3 $150 6 $200 7 $250 8…

A:

Q: if you are willing to accept no less than $1200 in one year in exchange for providing a loan of…

A: Discount rate The rate that helps to discount the future value of a cash flow to calculate its…

Q: Senyor Pigafetta borrowed today from Ginoong Lapulapu P300,000.00 and agreed to repay the loan with…

A: M = Mortgage amount P300,000.00 i = Monthly interest rate 0.01 (i.e. 0.12 / 12) t = Number of…

Q: Bonds are fixed income securities issued by public authorities, credit institutions, companies and…

A: 1. To calculate the price of the bond we will use the present value function in excel. Just simple…

Q: Perpetuities are also called annuities with an extended or unlimited life. Based on your…

A: As per Bartleby guidelines, If multiple questions are posted, only the first 1 question will be…

Q: In 2016 Beth purchased a 10-year, 3.20% p.a. semi-annual paying coupon bond with a Face Value (FV)…

A: If beth decides to sell the long-term bond, then here are some advantages of short-term debt…

Q: Vince Oliver plans to invest P30,000 in municipal bonds, savings bonds,and treasury bills. He wishes…

A: Given Information - Total amount of Investment = P 30,000 Modes of Investment along with Interest…

Q: (Related to Checkpoint 9.6) (Inflation and interest rates) What would you expect the nominal rate of…

A: Given, Real rate is 4.3% Inflation is 6.9%

Q: 9. Implied interest rate and period Consider the case of the following annuities, and the need to…

A: Present Value of Ordinary Annuity refers to the concept which gives out the discounted or today's…

Q: If the nominal interest rate is 12% per year compounded monthly, then the effective interest rate…

A: Given: Interest rate = 12% Compounding =Monthly Want effective rate for 6 months.

Q: A loan for $2,500 with a simple annual interest rate of 18% was made on June 30th and was due on…

A: Interest and its types: The cost of borrowing money and the reward for lending money is known as…

Q: Your bank is offering you an account that will pay 25% interest (an effective two-year rate) in…

A:

Q: Burt's TVs has current liabilities of $24.8 million. Cash makes up 39 percent of the current assets…

A: Current assets refer to those assets that are expected to be converted to cash in less than 12…

Q: Which of the following nominal rates compounded bi-weekly is equivalent to ¡(³65) = 2.100%. O a.…

A: i365 = 0.021 Daily rate (r) = 0.0000575342465753425 (i.e. 0.021 / 365) Number of compounding in a…

Q: An analysis of the income statement revealed that interest expense was P60,000. Grant Company's…

A: Given: Income before income taxes =P420,000 Income tax expense =P120,000 Net income = P300,000…

Q: Matchmaker Cards (MC) has $30 million in assets and EBIT equal to $3.5 million. If MC's debt ratio…

A: Earning par share(EPS) is calculated by dividing net income by number of outstanding shares.…

Q: What is the price of a U.S. Treasury bill with 89 days to maturity quoted at a discount yield of…

A: Face Value = $1,000,000 Time Period = 89 Days Discount Yield = 1.35%

Q: Required information You need $6,000 on 4/1/2016 and you have two options. Option A: Borrow money…

A: A loan refers to the amount that is being given to the borrower by the lender in exchange if the…

Q: What is the formula used for the questions without using excel?

A: Daily Withdrawals = $175 Time Period of Withdrawal = 21 Days Interest Rate on Withdrawals = 28%

Q: Convert the following cash flow pattern to a uniform series of end-of-year costs over a seven year…

A: The cash flow diagram here shows cash outflows. As the arrows are pointed downwards these are cash…

You currently have $300,000. You want to invest it in the following three assets: 10-year US Treasury bond with coupon rate 3.8%, Blandy and Gourmange stocks attached:

Your goal is to have the expected return of 6.8% with a minimum portfolio risk. How much money should you allocate to these three assets?

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

- Use the following information to compute the standard deviation of returns: Yearly Returns Year Return (%) 1 19 2 1 3 10 4 26 5 4Calculate the standard deviation of the following returns. Year Return 1 0.25 2 0.16 3 0.01 4 0.07 5 -0.11Over the past 4 years an investment returned 0.1, -0.12, -0.08, and 0.13. What is the standard deviation of returns? (Note: input raw results with four decimal digits, NOT percentage results. For example, input 0.0102 NOT 1.02%)

- Suppose the returns on an asset are normally distributed. The historical average annual return for the asset was 5.7 percent and the standard deviation was 18.3 percent. a. What is the probability that your return on this asset will be less than –4.1 percent in a given year? Use the NORMDIST function in Excel® to answer this question. (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. What range of returns would you expect to see 95 percent of the time? (Enter your answers for the range from lowest to highest. A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) c. What range of returns would you expect to see 99 percent of the time? (Enter your answers for the range from lowest to highest. A negative answer should be indicated by a minus sign. Do not round intermediate calculations…Measuring risk and rate return) Given the following holding-period returns, calculate the average return for the market. Month Champ Inc. Market 1 2.8% 1.8% 2 3.2% 1.2% 3 9.0% 11.0% 4 -2.6% -1.0% 5 -2.9% -4.7% 6 12.0% 8.0% answer is 2.72%Florida Company (FC) andMinnesota Company (MC) areboth service companies. Theirstock returns for the past threeyears were as follows: FC: -16 |percent, 24 percent, 22 percent;MC: 19 percent, 19 percent, 31percent, Calculate the correlationcoefficient between the returnsof FC and MC. Multiple Choice-0.461 0.469 0.306 0.000

- What is the variance of the following returns? State probability return Boom .2 .75 normal .55 .25 recession .15 -.1 depression .1 -.5 a. .0413 b. .01239 c. .1944 d. .2601 e. .3519Which one of the following is defined as the average compound return earned per year over a multiyear period? Multiple Choice A Geometric average return B Variance of returns C Standard deviation of returns D Arithmetic average return E. Normal distribution of returnsExpected Return, Variance, Std. Deviation and Cofficient of Variation:Magee Inc.'s manager believes that economic conditions during the next year will be strong, normal, or weak, and she thinks that the firm's returns will have the probability distribution shown below. What's the standard deviation of the estimated returns?Round your answer to two decimal places. For example, if your answer is $345.6671 round as 345.67 and if your answer is .05718 or 5.7182% round as 5.72. State of the Economy Probability of State Occurring Stock's Expected Return Boom 20% 24.15% Normal 50% 13.50% Recession 30% –13.30% Group of answer choices 15.68% 16.39% 14.26% 13.54% 10.69%

- Expected Return, Variance, Std. Deviation and Cofficient of Variation:Magee Inc.'s manager believes that economic conditions during the next year will be strong, normal, or weak, and she thinks that the firm's returns will have the probability distribution shown below. What's the standard deviation of the estimated returns?Round your answer to two decimal places. For example, if your answer is $345.6671 round as 345.67 and if your answer is .05718 or 5.7182% round as 5.72. State of the Economy Probability of State Occurring Stock's Expected Return Boom 20% 22.20% Normal 50% 12.90% Recession 30% –11.40%Expected Return, Variance, Std. Deviation and Cofficient of Variation:Magee Inc.'s manager believes that economic conditions during the next year will be strong, normal, or weak, and she thinks that the firm's returns will have the probability distribution shown below. What's the standard deviation of the estimated returns?Round your answer to two decimal places. For example, if your answer is $345.6671 round as 345.67 and if your answer is .05718 or 5.7182% round as 5.72. State of the Economy Probability of State Occurring Stock's Expected Return Boom 30% 21.60% Normal 55% 13.50% Recession 15% –11.35% A. 11.04% B. 12.10% C. 9.47% D. 10.52% E. 9.99%Which one of the following best describes an arithmetic average return? Multiple Choice A. Total return divided by N − 1, where N equals the number of individual returns B. Average compound return earned per year over a multiyear period C. Total compound return divided by the number of individual returns D. Return earned in an average year over a multiyear period E. Positive square root of the average compound return