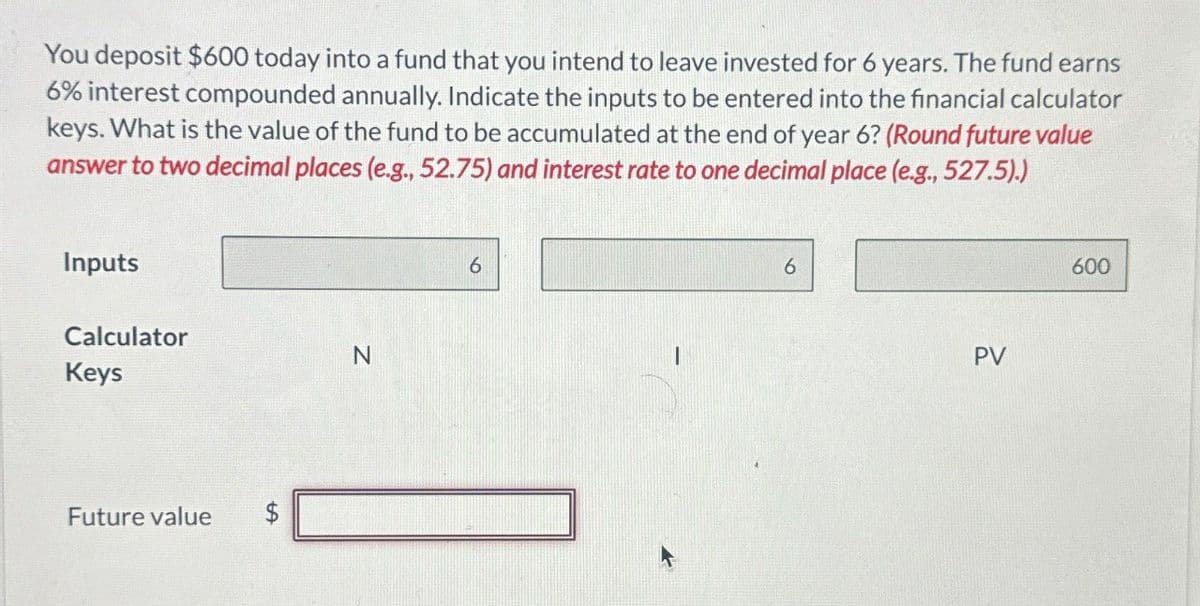

You deposit $600 today into a fund that you intend to leave invested for 6 years. The fund earns 6% interest compounded annually. Indicate the inputs to be entered into the financial calculator keys. What is the value of the fund to be accumulated at the end of year 6? (Round future value answer to two decimal places (e.g., 52.75) and interest rate to one decimal place (e.g., 527.5).) Inputs Calculator N Keys Future value $ 6 I 6 PV 600

You deposit $600 today into a fund that you intend to leave invested for 6 years. The fund earns 6% interest compounded annually. Indicate the inputs to be entered into the financial calculator keys. What is the value of the fund to be accumulated at the end of year 6? (Round future value answer to two decimal places (e.g., 52.75) and interest rate to one decimal place (e.g., 527.5).) Inputs Calculator N Keys Future value $ 6 I 6 PV 600

Chapter11: Capital Budgeting Decisions

Section: Chapter Questions

Problem 8EB: You put $600 in the bank for 3 years at 15%. A. If Interest Is added at the end of the year, how...

Related questions

Question

None

Transcribed Image Text:You deposit $600 today into a fund that you intend to leave invested for 6 years. The fund earns

6% interest compounded annually. Indicate the inputs to be entered into the financial calculator

keys. What is the value of the fund to be accumulated at the end of year 6? (Round future value

answer to two decimal places (e.g., 52.75) and interest rate to one decimal place (e.g., 527.5).)

Inputs

Calculator

N

Keys

Future value

$

6

I

6

PV

600

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning