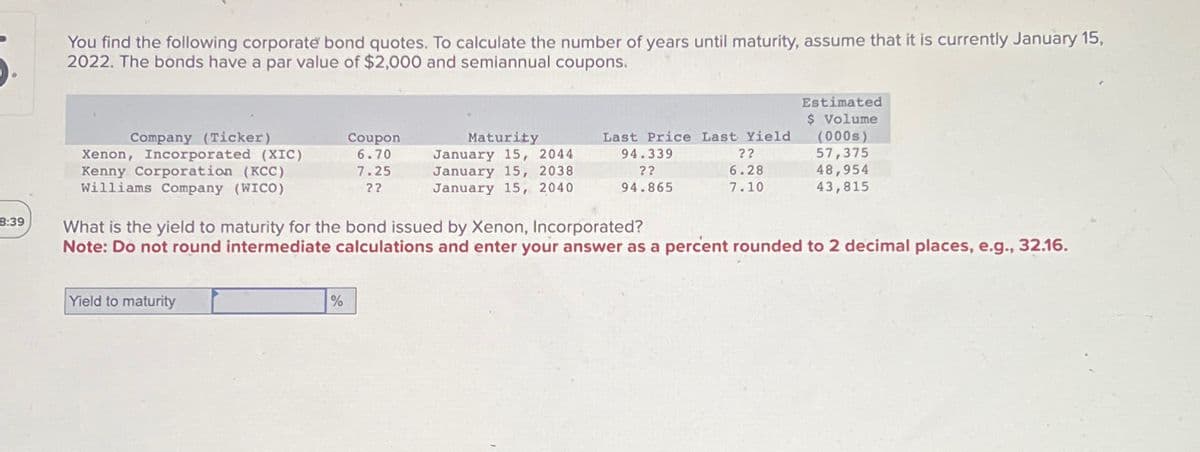

You find the following corporate bond quotes. To calculate the number of years until maturity, assume that it is currently January 15, 2022. The bonds have a par value of $2,000 and semiannual coupons. Estimated $ Volume Company (Ticker) Xenon, Incorporated (XIC) Kenny Corporation (KCC) Williams Company (WICO) Coupon 6.70 Maturity January 15, 2044 7.25 22 January 15, 2038 January 15, 2040 Last Price Last Yield 94.339 ?? 94.865 (000s) 22 6.28 57,375 48,954 7.10 43,815 What is the yield to maturity for the bond issued by Xenon, Incorporated? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. Yield to maturity %

You find the following corporate bond quotes. To calculate the number of years until maturity, assume that it is currently January 15 2022. The bonds have a par value of $2,000 and semiannual coupons Company Xenon, Incorporated (XIC) Kenny Corporation (XCC) Williams Company (WICO) Coupon 6.70 7.25 Maturity January 15, 2044 January 15, 2038 January 15, 2040 Estimated Price Last Yield ) 94.33957,375 6.28 48,954 94.865 7.1043,815 What is the yield to maturity for the bond issued by Xenon, Incorporated? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16 to maturity You find the following corporate bond quotes. To calculate the number of years until maturity, assume that it is currently January 15 , 2022. The bonds have a par value of $2,000 and semiannual coupons. \table[[.,,,,,\table[[Estimated],[$ Volume]]],[Company (Ticker),Coupon,Maturity,Last Price,Last Yield,(000s)

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images