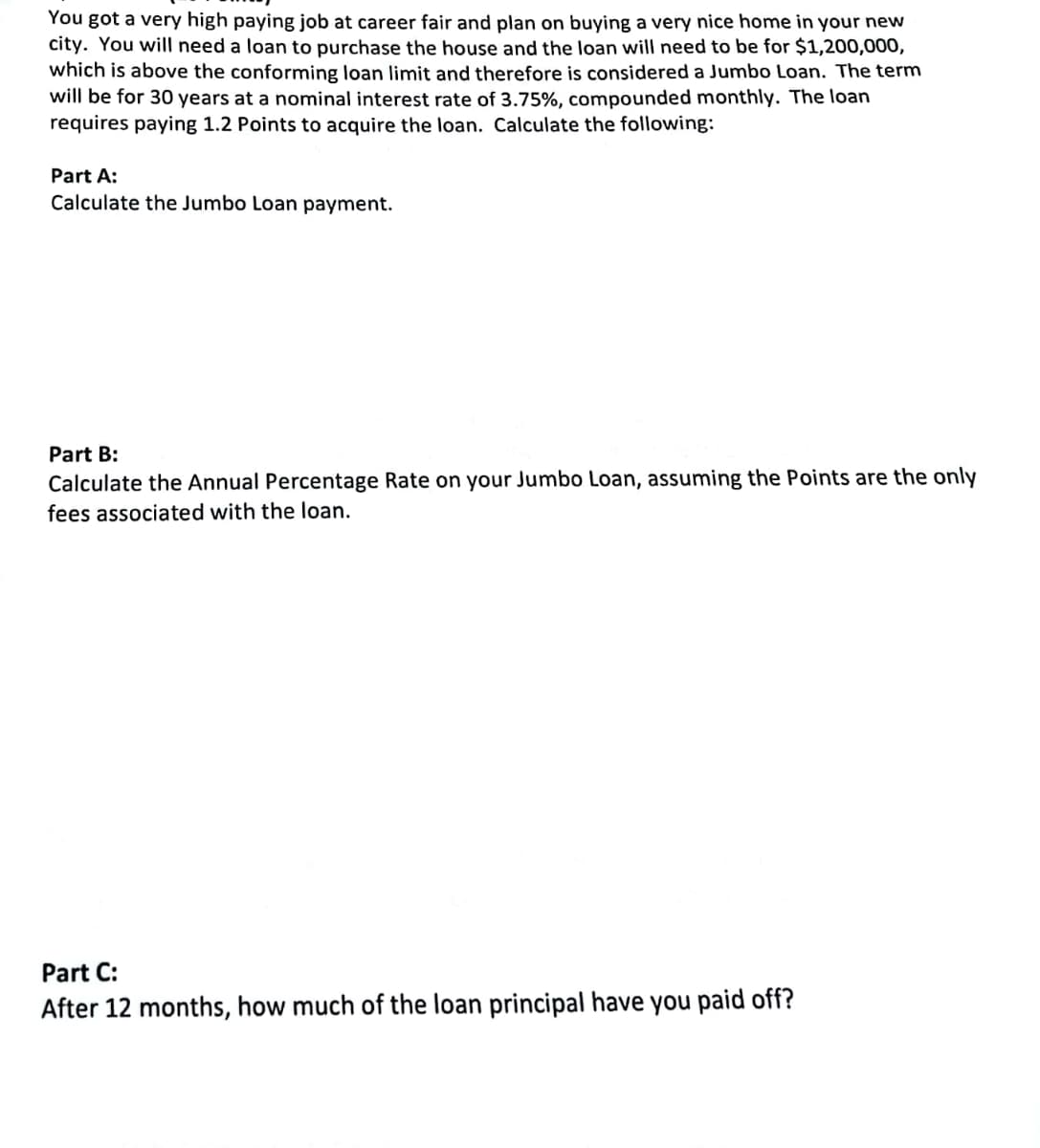

You got a very high paying job at career fair and plan on buying a very nice home in your new city. You will need a loan to purchase the house and the loan will need to be for $1,200,000, which is above the conforming loan limit and therefore is considered a Jumbo Loan. The term will be for 30 years at a nominal interest rate of 3.75%, compounded monthly. The loan requires paying 1.2 Points to acquire the loan. Calculate the following: Part A: Calculate the Jumbo Loan payment. Part B: Calculate the Annual Percentage Rate on your Jumbo Loan, assuming the Points are the only fees associated with the loan. Part C: After 12 months, how much of the loan principal have you paid off?

You got a very high paying job at career fair and plan on buying a very nice home in your new city. You will need a loan to purchase the house and the loan will need to be for $1,200,000, which is above the conforming loan limit and therefore is considered a Jumbo Loan. The term will be for 30 years at a nominal interest rate of 3.75%, compounded monthly. The loan requires paying 1.2 Points to acquire the loan. Calculate the following: Part A: Calculate the Jumbo Loan payment. Part B: Calculate the Annual Percentage Rate on your Jumbo Loan, assuming the Points are the only fees associated with the loan. Part C: After 12 months, how much of the loan principal have you paid off?

Chapter16: Working Capital Policy And Short-term Financing

Section: Chapter Questions

Problem 14P

Related questions

Question

Please try to solve it in 30 minute

Transcribed Image Text:You got a very high paying job at career fair and plan on buying a very nice home in your new

city. You will need a loan to purchase the house and the loan will need to be for $1,200,000,

which is above the conforming loan limit and therefore is considered a Jumbo Loan. The term

will be for 30 years at a nominal interest rate of 3.75%, compounded monthly. The loan

requires paying 1.2 Points to acquire the loan. Calculate the following:

Part A:

Calculate the Jumbo Loan payment.

Part B:

Calculate the Annual Percentage Rate on your Jumbo Loan, assuming the Points are the only

fees associated with the loan.

Part C:

After 12 months, how much of the loan principal have you paid off?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning