You have a 401(k) plan, which is used for retirement savings, at work. If you plan to invest $5,000 at the end of every year for 35 years until you retire, which formula would you use to determine how much you will have when you retire? O future value of an annuity due present value of a lump-sum future value of an ordinary annuity present value of an ordinary annuity future value of a lump-sum

You have a 401(k) plan, which is used for retirement savings, at work. If you plan to invest $5,000 at the end of every year for 35 years until you retire, which formula would you use to determine how much you will have when you retire? O future value of an annuity due present value of a lump-sum future value of an ordinary annuity present value of an ordinary annuity future value of a lump-sum

PFIN (with PFIN Online, 1 term (6 months) Printed Access Card) (New, Engaging Titles from 4LTR Press)

6th Edition

ISBN:9781337117005

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Chapter14: Planning For Retirement

Section: Chapter Questions

Problem 3FPE

Related questions

Question

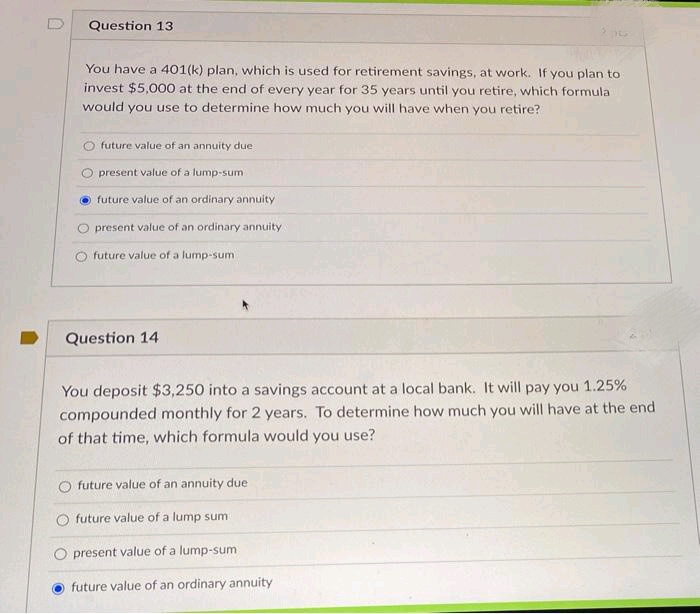

Transcribed Image Text:Question 13

You have a 401(k) plan, which is used for retirement savings, at work. If you plan to

invest $5,000 at the end of every year for 35 years until you retire, which formula

would you use to determine how much you will have when you retire?

O future value of an annuity due

O present value of a lump-sum

future value of an ordinary annuity

present value of an ordinary annuity

future value of a lump-sum

Question 14

You deposit $3,250 into a savings account at a local bank. It will pay you 1.25%

compounded monthly for 2 years. To determine how much you will have at the end

of that time, which formula would you use?

future value of an annuity due

O future value of a lump sum

O present value of a lump-sum

future value of an ordinary annuity

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning