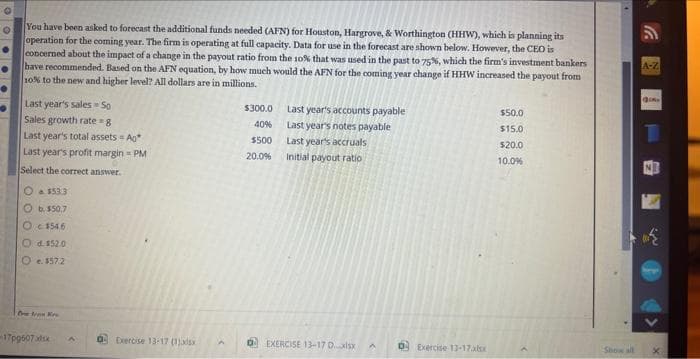

You have been asked to forecast the additional funds needed (AFN) for Houston, Hargrove, & Worthington (HHW), which is planning its operation for the coming year. The firm is operating at full capacity. Data for use in the forecast are shown below. However, the CEO is concerned about the impact of a change in the payout ratio from the 10% that was used in the past to 75%, which the firm's investment bankers have recommended. Based on the AFN equation, by how much would the AFN for the coming year change if HHW increased the payout from 10% to the new and higher level? All dollars are in millions. Last year's sales - So Sales growth rate=g Last year's total assets Ag Last year's profit margin = PM Select the correct answer. O a $53.3 Ob $50.7 O c. 154.6 O d.152.0 O.157.2 $300.0 40% $500 20.0% Last year's accounts payable Last year's notes payable Last year's accruals Initial payout ratio $50.0 $15.0 $20.0 10.0%

You have been asked to forecast the additional funds needed (AFN) for Houston, Hargrove, & Worthington (HHW), which is planning its operation for the coming year. The firm is operating at full capacity. Data for use in the forecast are shown below. However, the CEO is concerned about the impact of a change in the payout ratio from the 10% that was used in the past to 75%, which the firm's investment bankers have recommended. Based on the AFN equation, by how much would the AFN for the coming year change if HHW increased the payout from 10% to the new and higher level? All dollars are in millions. Last year's sales - So Sales growth rate=g Last year's total assets Ag Last year's profit margin = PM Select the correct answer. O a $53.3 Ob $50.7 O c. 154.6 O d.152.0 O.157.2 $300.0 40% $500 20.0% Last year's accounts payable Last year's notes payable Last year's accruals Initial payout ratio $50.0 $15.0 $20.0 10.0%

Chapter16: Working Capital Policy And Short-term Financing

Section: Chapter Questions

Problem 11P

Related questions

Question

Transcribed Image Text:O

You have been asked to forecast the additional funds needed (AFN) for Houston, Hargrove, & Worthington (HHW), which is planning its

operation for the coming year. The firm is operating at full capacity. Data for use in the forecast are shown below. However, the CEO is

concerned about the impact of a change in the payout ratio from the 10% that was used in the past to 75%, which the firm's investment bankers

have recommended. Based on the AFN equation, by how much would the AFN for the coming year change if HHW increased the payout from

10% to the new and higher level? All dollars are in millions.

Last year's sales - So

Sales growth rate=g

Last year's total assets - Ag

Last year's profit margin = PM

Select the correct answer.

O a $533

Ob $50.7

O $54.6

Od. 152.0

O. 1572

Dewan Ke

-17p9607xlsx A

Exercise 13-17 (1)adsx

$300.0

40%

$500

20.0%

Last year's accounts payable

Last year's notes payable

Last year's accruals

Initial payout ratio

EXERCISE 13-17 D.xlsx

A

0 Exercise 13-17.xlsx

$50.0

$15.0

$20.0

10.0%

Show all

A-Z

9.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College