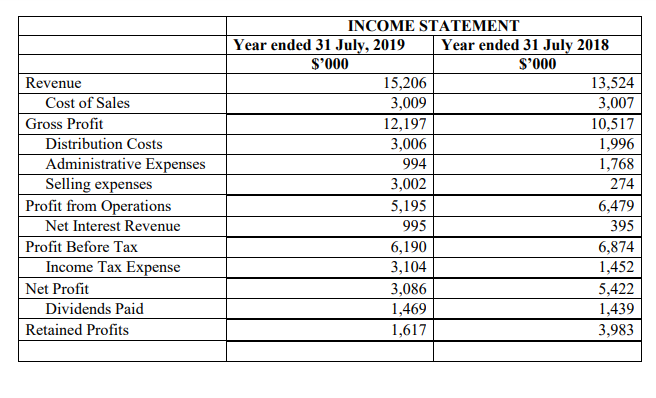

You have been presented with the following draft financial information about Bata Ltd, a very successful company that develops and licenses specialist computer software and hardware. Its noncurrent assets mainly consist of property, computer hardware and investments, and there have been additions to these during the year. The company is experiencing increasing competition from rival companies, most of which specialize in hardware or software, but not both. There is pressure to advertise and to cut prices. You are the audit manager. You are planning the audit and are conducting a preliminary analytical review and associated risk analysis for this client for the year ended 31 July 2019. You have been provided with a summarized draft income statement which has been produced very quickly and certain accounting ratios and percentages. You have been informed that the company accounts for research and development costs in accordance with IAS 38 Intangible Assets. Required: (i) Based on the attached (Income Statement & Accounting Ratios and Percentages), identify and explain 3 high risk areas. (ii) For each area, describe one audit procedure that can be performed in response to those risks

You have been presented with the following draft financial information about Bata Ltd, a very successful company that develops and licenses specialist computer software and hardware. Its noncurrent assets mainly consist of property, computer hardware and investments, and there have been additions to these during the year. The company is experiencing increasing competition from rival companies, most of which specialize in hardware or software, but not both. There is pressure to advertise and to cut prices. You are the audit manager. You are planning the audit and are conducting a preliminary analytical review and associated risk analysis for this client for the year ended 31 July 2019. You have been provided with a summarized draft income statement which has been produced very quickly and certain accounting ratios and percentages. You have been informed that the company accounts for research and development costs in accordance with IAS 38 Intangible Assets.

Required:

(i) Based on the attached (Income Statement & Accounting Ratios and Percentages), identify and explain 3 high risk areas.

(ii) For each area, describe one

Step by step

Solved in 2 steps