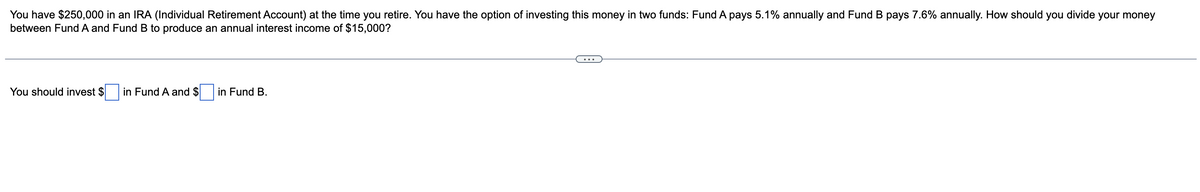

You have $250,000 in an IRA (Individual Retirement Account) at the time you retire. You have the option of investing this money in two funds: Fund A pays 5.1% annually and Fund B pays 7.6% annually. How should you divide your money between Fund A and Fund B to produce an annual interest income of $15,000? You should invest $ in Fund A and $ in Fund B.

You have $250,000 in an IRA (Individual Retirement Account) at the time you retire. You have the option of investing this money in two funds: Fund A pays 5.1% annually and Fund B pays 7.6% annually. How should you divide your money between Fund A and Fund B to produce an annual interest income of $15,000? You should invest $ in Fund A and $ in Fund B.

Chapter7: Systems Of Equations And Inequalities

Section7.2: Systems Of Linear Equations: Three Variables

Problem 64SE: You inherit one hundred thousand dollars. You invest it all in three accounts for one year. The...

Related questions

Question

21.

Transcribed Image Text:You have $250,000 in an IRA (Individual Retirement Account) at the time you retire. You have the option of investing this money in two funds: Fund A pays 5.1% annually and Fund B pays 7.6% annually. How should you divide your money

between Fund A and Fund B to produce an annual interest income of $15,000?

You should invest $

in Fund A and $

in Fund B.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you