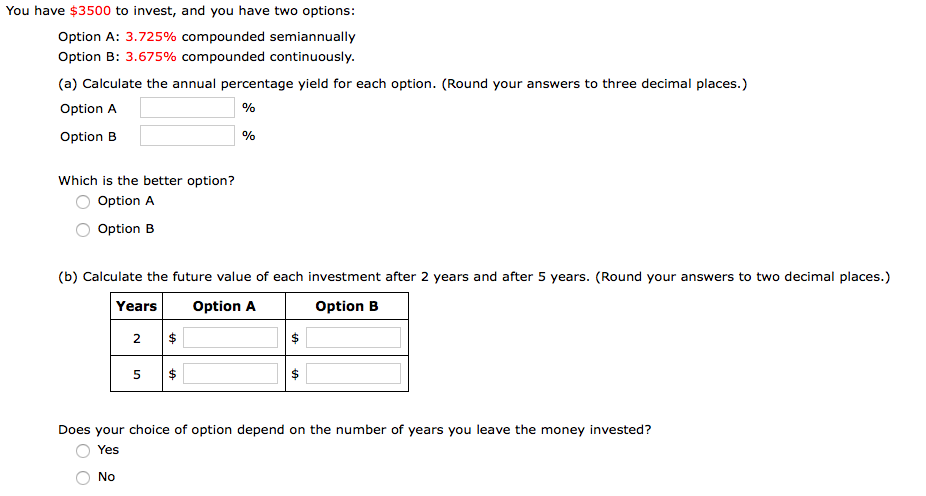

You have $3500 to invest, and you have two options: Option A: 3.725% compounded semiannually Option B: 3.675% compounded continuously. (a) Calculate the annual percentage yield for each option. (Round your answers to three decimal places.) Option A Option B Which is the better option? Option A Option B (b) Calculate the future value of each investment after 2 years and after 5 years. (Round your answers to two decimal places.) Years Option A Option B 2 Does your choice of option depend on the number of years you leave the money invested? Yes No %24

You have $3500 to invest, and you have two options: Option A: 3.725% compounded semiannually Option B: 3.675% compounded continuously. (a) Calculate the annual percentage yield for each option. (Round your answers to three decimal places.) Option A Option B Which is the better option? Option A Option B (b) Calculate the future value of each investment after 2 years and after 5 years. (Round your answers to two decimal places.) Years Option A Option B 2 Does your choice of option depend on the number of years you leave the money invested? Yes No %24

Chapter5: The Time Value Of Money

Section: Chapter Questions

Problem 16P

Related questions

Question

Transcribed Image Text:You have $3500 to invest, and you have two options:

Option A: 3.725% compounded semiannually

Option B: 3.675% compounded continuously.

(a) Calculate the annual percentage yield for each option. (Round your answers to three decimal places.)

Option A

Option B

Which is the better option?

Option A

Option B

(b) Calculate the future value of each investment after 2 years and after 5 years. (Round your answers to two decimal places.)

Years

Option A

Option B

2

Does your choice of option depend on the number of years you leave the money invested?

Yes

No

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 7 steps with 4 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College