You have entered in a put option contract on British pound at a price of $0.04 per British pound. When the option was exercised the dollar was selling of 0.63 British pound. Compute your net profit from the option if the exercise price was $1.80 and size of option is 50,000.

Q: An investor has purchased United States dollar call options, with an exercise price of A$1.15 and a…

A: Call option is a derivative instruments which gives its buyer a right to buy an asset at pre…

Q: You purchased a put option on Australian dollars for RM0.02 per unit. The strike price was RM4.25,…

A: A buyer of put option expects the spot price to be below the strike price. The buyer of put option…

Q: Assume that Mr. Binda is a speculator who buys a 90-day British pound option with a strike price of…

A: Call Options gives the right but not the obligation to the buyer the option to buy a bond, stock,…

Q: Emmanuella purchased a put option on British pounds for $.06 per unit. The strike price was $1.85,…

A: given, put = $0.06 per unit k = $1.85 s= $1.69 units = 31250

Q: i sold a call option with an exercise price of $1.20/euro. the premium was $0.02/euro. what is my…

A: Buyer of call option will exercise the option if exchange rate is higher than the Exercise price For…

Q: Use the European option pricing formula to find the value of a six-month call option on Japanese…

A: When valuing a european call option exchange rate the formula to determine the same is:…

Q: FAB Corporation will need 200,000 Canadian dollars (C$) in 90 days to cover a payable position.…

A: Call option: A call option is the right to buy an underlying asset at a specified price over a given…

Q: You trade in two types of options. First, you purchase 7 call option contracts on the Euro with an…

A: Calculation of the profit or loss by participating in options is shown below:

Q: An Australian company imports goods from Germany and expects the payment of EUR 250,000 after 60…

A: Call option is a type of option contracts where buyer of call contract is given privilege. The buyer…

Q: One year ago, you sold a put option on 100,000 Australian dollars with an expiration date of one…

A:

Q: Mike sold a put option on British pounds for $.04 per unit. The exercise price was $1.70, and the…

A: Per unit net profit on option = Option premium + ( Spot price - Exercise price ), if the spot price…

Q: A put option on Australian dollars with a strike price of $.80 is purchased by a speculator for a…

A: Put option strike price = 0.8 Premium = 0.2 A dollar spot price = 0.74

Q: Jobbar sold a put option on British pounds for €.035 per unit. The exercise price was €1.1370, and…

A: The options are the derivatives, which provide the right, but not the obligation to buy or sell the…

Q: Assume that the Japanese yen is trading at a spot price of 92.04 cents per 100 yen. Further assume…

A: Intrinsic value is the value that helps in measuring the profitability of an option contract based…

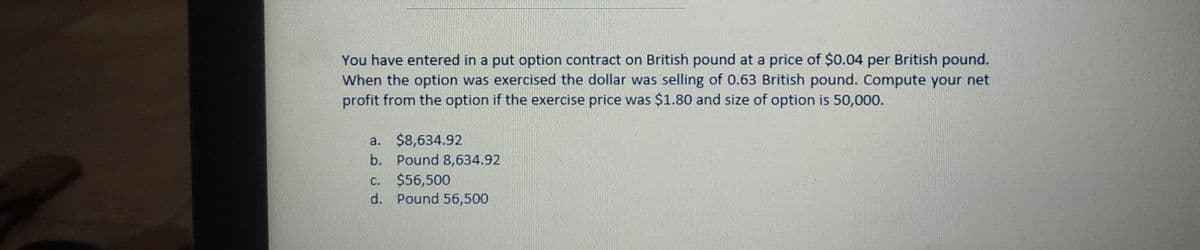

Q: You have entered in a put option contract on British pound at a price of $0.04 per British pound.…

A: Put option contract means where we buy an option to sell something . It is our right to sell and not…

Q: You have sold a put option on British pound and receive $0.03 per pound. The exercise price is $0.75…

A: The option is exercised by the buyer of the option when they earn a profit on executing the…

Q: Should Cachita buy a put on yen or a call on yen? What is Cachita's break-even price on the option…

A: Information Provided: Strike price = 125/Dollar Spot rate = $120.00 Premium on put = 0.00003 Premium…

Q: a)A dealer sold a put option on Canadian dollars for $.05 per unit. The strike price was $.78, and…

A: Hello. Since your question has multiple parts, we will solve first question for you. If you want…

Q: One year ago, you purchased a put option on 100,000 euros with an expiration date of 1 year. You…

A: Net profit on to the put options No. off euro in a Euro option context 100000 Strike Price 1.30…

Q: Assume that Smith Corporation will need to purchase 200,000 British pounds in 90 days. A call option…

A: Option: An option is a special type of contract which gives its holder the right but not obligation…

Q: i) Abdul sold a call option on British pounds for $.05 per unit. The exercise price was $1.80, and…

A: Given : call option on British pounds for $.05 per unit. The exercise price was $1.80, the spot…

Q: Consider the position of a call writer who sold a call option on Australian dollars at an exercise…

A: Given, Exercise price = $US0.7600/$A Exercise date = $US0.7475/$A, $US0.7550/$A, $US0.7600/$A,…

Q: Mike purchased a put option on British pounds for $.04 per unit. The exercise price was $1.70, and…

A: Purchase Price of a put option on British pounds =$.04 per unit The exercise price = $1.70, The spot…

Q: A speculator purchases a put option on British Pounds for 0.05$ per unit; the strike price is 1.50$.…

A: A put option (or "put") is a contract that grants the option buyer the right, but not the…

Q: i sold a call option with an exercise price of $1.20/euro. the premium was $0.02/euro. what is my…

A: Buyer of Call option will exercise the option if Price is higher than the Exercise Price. For seller…

Q: a. Should Cachita buy a put on yen or a call on yen? b. What is Cachita's breakeven price on the…

A: Put Option: A put option allows the buyer of the option the right and not the obligation to sell…

Q: Wesfarmers has developed the following probability distribution for the spot rate of the Indian…

A: When sum of probability is one than we can get expected value by weighted probability of all. it is…

Q: Consider the position of a call writer who sold a call option on Australian dollars at an exercise…

A: For a writer of a call option, The Payoff will be, = - Maximum of ( 0 or S - K) ; S =…

Q: You purchased a put option on British pounds for RM0.06 per unit. The strike price was RM5.60 and…

A: The question is related to speculating with currency put option.

Q: Speculating with Currency Call Options. ABC Inc., purchased 75,000 units call option on British…

A: Value at time 0 of call option = $0.021 Strike price = $0.78 Exercised price = $0.86 Number of units…

Q: Speculating with Currency Call Options. ABC Inc., purchased 75,000 units call option on British…

A: An option is a financial derivative that gives the buyer the right to buy or sell the underlying…

Q: ium of $US0.002/$A. Calculate and graphically depict the profits/losses for this call option…

A: Payoff to call option seller: If Market price <= Strike price (or Exercise price) , then payoff =…

Q: A speculator has purchased United States dollar put options, with an exercise price of A$1.30 and a…

A: Put Options are exchange traded contracts where an investor can acquire rights for selling its share…

Q: A speculator has purchased United States dollar put options, with an exercise price of A$1.30 and a…

A: A put option is an instrument which provides its holder an option to sell an underlying asset on a…

Q: Melbourne Capital Ltd considers selling European call options on ANZ Bank Ltd for $1.50 per option.…

A: Solution: (i) In the given case, the investor would make profit only when the spot price is higher…

Q: ABC Inc., purchased 75,000 units call option on British pounds for $.021 per unit. The strike…

A: Answer - Calculation of Profit per unit on exercising the option - Exercise Price - $…

Q: Abdul sold a call option on British pounds for $.05 per unit. The exercise price was $1.80, and the…

A: Hi There, Thanks for posting the questions. As per our Q&A guidelines, must be answered only one…

Q: Speculating with Currency Call Options. ABC Inc., purchased 75,000 units call option on British…

A: An option is a financial derivative that gives the buyer the right to buy or sell the underlying…

Q: An investor has purchased United States dollar call options, with an exercise price of A$1.15 and a…

A: Since you have posted a question with multiple sub-parts, we will solve first three sub-parts for…

Q: Petra is an option writer of Australian dollar (A$) options. In anticipation of an appreciation of…

A: The PE seller is writing the option. It means the individual would receive the premium and it would…

Q: Doctor Dumpkins is bullish on the British pound so he sells a one-month put for $0.03. The strike…

A: In a financial market, a put option is a trading strategy that gives a right to its owner to sell…

Q: Malibu, Inc., is a U.S. company that imports British goods. It plans to use call options to hedge…

A: A company can hedge its exposure to foreign exchange currency risk by entering into derivatives…

Q: Speculating with Currency Call Options. ABC Inc., purchased 75,000 units call option on British…

A: Net profit is the total profit earned by the company after paying interest and tax , In this all…

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- You have entered in a put option contract on British pound at a price of $0.04 per British pound. When the option was exercised the dollar was selling of 0.63 British pound. Compute your net profit from the option if the exercise price was $1.80 and size of option is 50,000. a. $8,634. b. Pound 8,634. c. $56,5 d. Pound 56,5 00009292d 56,500You purchased a put option on British pounds for RM0.06 per unit. The strike price was RM5.60 and the spot rate at the time the pound option was exercised was RM5.68. Assume there are 47,580 units in a British pound option. What was your net profit on the option?You purchased a put option on Australian dollars for RM0.02 per unit. The strike price was RM4.25, and the spot rate at the time the option was exercised was RM4.38. Assuming that there are 13,830 units in the Australian dollar option.Would you exercise the option? What will your net profit on the put option?

- There is a European call option on the dollar with strike price of Kc = 94 pence per dollar and a European put option on the dollar with a strike price of Kp = 100 pence per dollar. Both have a notional N = 1 and both expire at date T. The current (date t) price of one dollar is St = 100 pence. The current prices of call option is 27.5 (55/2) pence and the price of the put option is 8.33 (25/3) pence. The sterling interest rate for borrowing and lending between dates t and T is 20% (1/5) and the corresponding dollar interest rate is 25% (1/4). Whatarethecurrent (datet) intrinsic and time value of the call and put options?Emmanuella purchased a put option on British pounds for $.06 per unit. The strike price was $1.85, and the spot rate at the time the pound option was exercised was $1.69. Assume there are 31,250 units in a British pound option. What was Emmanuella’s net profit on the option?Assume that Smith Corporation will need to purchase 200,000 British pounds in 90 days. A call option exists on British pounds with an exercise price of $1.68, a 90-day expiration date, and a premium of $.04. A put option exists on British pounds, with an exercise price of $1.69, a 90-day expiration date, and a premium of $.03. Smith Corporation plans to purchase options to cover its future payables. It will exercise the option in 90 days (if at all). It expects the spot rate of the pound to be $1.76 in 90 days. Determine the amount of dollars it will pay for the payables, including the amount paid for the option premium. A. $336,000. B. $344,000. C. $332,000. D. $360,000. E. $338,000.

- A speculator purchases a put option on British Pounds for 0.05$ per unit; the strike price is 1.50$. A pound option represents 31.250 units Assume that at the time of the purchase, the spot rate of the pound is 151$ and continually rises to 1.62$ by the expiration date. 1. Compute the highest net profit possible for the speculator based on the information above? 2. Compute the highest profit/loss for the seller of this put optioni) Abdul sold a call option on British pounds for $.05 per unit. The exercise price was $1.80, and the spot rate at the time the pound option was exercised was $1.92. Assume there are 31,250 units in a British pound option contract. What was Abdul’s per unit net profit on the option contract? What was Abdul’s total net profit on the option contract? Calculate the break-even spot rate (at expiration) for Abdul. ii) Mike sold a put option on British pounds for $.04 per unit. The exercise price was $1.70, and the spot rate at the time the pound option was exercised was $1.68. Assume there are 50,250 units in a British pound option. What was Mike’s per unit net profit on the option? What was Mike’s total net profit on the option? Calculate the break-even spot rate (at expiration) for Mike.A speculator has purchased United States dollar put options, with an exercise price of A$1.30and a premium of A$0.05 per unit.(a) Calculate the break-even price.(b) Calculate the profit or loss of the option for the speculator if the spot rate at the time the speculator considers exercising the options is : (1) A$1.20 (2) A$1.28 (3) A$1.34.(c) What is the maximum profit and maximum loss for the speculator?

- Three months ago, you sold a put option contract on Swiss franc with a strike price of $.60/SF and an option price of $.0060 per SF. Contract size is 10,000 SF. The option expires today when the value of Swiss franc is $.625. What is your total profit or loss on your investment? A. -$310 B. -$60 C. $0 D. $60Mike purchased a put option on British pounds for $.04 per unit. The exercise price was $1.70, and the spot rate at the time the pound option was exercised was $1.59. Assume there are 50,250 units in a British pound option. What was Mike’s per unit net profit on the option? What was Mike’s total net profit on the option? Calculate the break-even spot rate (at expiration) for Mike. Discuss (briefly) the answer. Add necessary graphs to your discussionSpeculating with Currency Call Options. ABC Inc., purchased 75,000 units call option on British pounds for $.021 per unit. The strike price was $ 0.78 and the spot rate at the time the option was exercised was $0.89. Assume there are 25,000 units per British pound option.