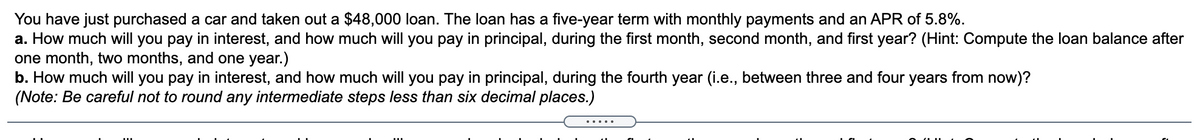

You have just purchased a car and taken out a $48,000 loan. The loan has a five-year term with monthly payments and an APR of 5.8%. a. How much will you pay in interest, and how much will you pay in principal, during the first month, second month, and first year? (Hint: Compute the loan balance after one month, two months, and one year.) b. How much will you pay in interest, and how much will you pay in principal, during the fourth year (i.e., between three and four years from now)? (Note: Be careful not to round any intermediate steps less than six decimal places.)

You have just purchased a car and taken out a $48,000 loan. The loan has a five-year term with monthly payments and an APR of 5.8%. a. How much will you pay in interest, and how much will you pay in principal, during the first month, second month, and first year? (Hint: Compute the loan balance after one month, two months, and one year.) b. How much will you pay in interest, and how much will you pay in principal, during the fourth year (i.e., between three and four years from now)? (Note: Be careful not to round any intermediate steps less than six decimal places.)

Chapter4: Time Value Of Money

Section4.17: Amortized Loans

Problem 1ST

Related questions

Question

Transcribed Image Text:You have just purchased a car and taken out a $48,000 loan. The loan has a five-year term with monthly payments and an APR of 5.8%.

a. How much will you pay in interest, and how much will you pay in principal, during the first month, second month, and first year? (Hint: Compute the loan balance after

one month, two months, and one year.)

b. How much will you pay in interest, and how much will you pay in principal, during the fourth year (i.e., between three and four years from now)?

(Note: Be careful not to round any intermediate steps less than six decimal places.)

.....

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 8 images

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning