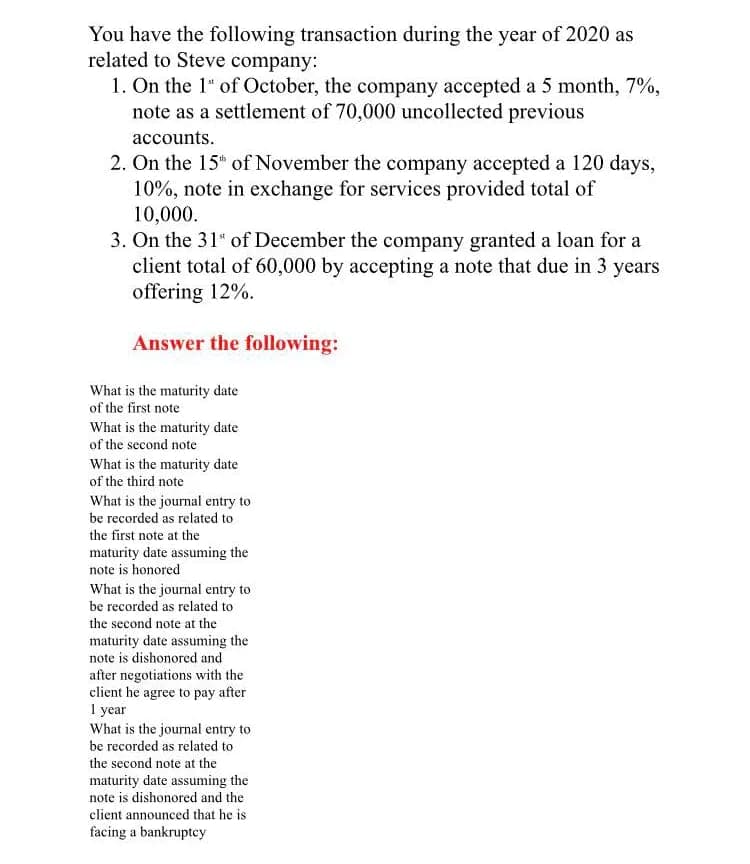

You have the following transaction during the year of 2020 as related to Steve company: 1. On the 1" of October, the company accepted a 5 month, 7%, note as a settlement of 70,000 uncollected previous accounts. 2. On the 15 of November the company accepted a 120 days, 10%, note in exchange for services provided total of 10,000. 3. On the 31" of December the company granted a loan for a client total of 60,000 by accepting a note that due in 3 years offering 12%. Answer the following: What is the maturity date of the first note What is the maturity date of the second note What is the maturity date of the third note What is the journal entry to be recorded as related to the first note at the maturity date assuming the note is honored What is the journal entry to be recorded as related to the second note at the maturity date assuming the note is dishonored and after negotiations with the client he agree to pay after I year What is the journal entry to be recorded as related to the second note at the maturity date assuming the note is dishonored and the client announced that he is facing a bankruptcy

You have the following transaction during the year of 2020 as related to Steve company: 1. On the 1" of October, the company accepted a 5 month, 7%, note as a settlement of 70,000 uncollected previous accounts. 2. On the 15 of November the company accepted a 120 days, 10%, note in exchange for services provided total of 10,000. 3. On the 31" of December the company granted a loan for a client total of 60,000 by accepting a note that due in 3 years offering 12%. Answer the following: What is the maturity date of the first note What is the maturity date of the second note What is the maturity date of the third note What is the journal entry to be recorded as related to the first note at the maturity date assuming the note is honored What is the journal entry to be recorded as related to the second note at the maturity date assuming the note is dishonored and after negotiations with the client he agree to pay after I year What is the journal entry to be recorded as related to the second note at the maturity date assuming the note is dishonored and the client announced that he is facing a bankruptcy

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter14: Financing Liabilities: Bonds And Long-term Notes Payable

Section: Chapter Questions

Problem 30E

Related questions

Question

PLEASE FAST

Transcribed Image Text:You have the following transaction during the year of 2020 as

related to Steve company:

1. On the 1" of October, the company accepted a 5 month, 7%,

note as a settlement of 70,000 uncollected previous

accounts.

2. On the 15h of November the company accepted a 120 days,

10%, note in exchange for services provided total of

10,000.

3. On the 31" of December the company granted a loan for a

client total of 60,000 by accepting a note that due in 3 years

offering 12%.

Answer the following:

What is the maturity date

of the first note

What is the maturity date

of the second note

What is the maturity date

of the third note

What is the journal entry to

be recorded as related to

the first note at the

maturity date assuming the

note is honored

What is the journal entry to

be recorded as related to

the second note at the

maturity date assuming the

note is dishonored and

after negotiations with the

client he agree to pay after

I year

What is the journal entry to

be recorded as related to

the second note at the

maturity date assuming the

note is dishonored and the

client announced that he is

facing a bankruptcy

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning