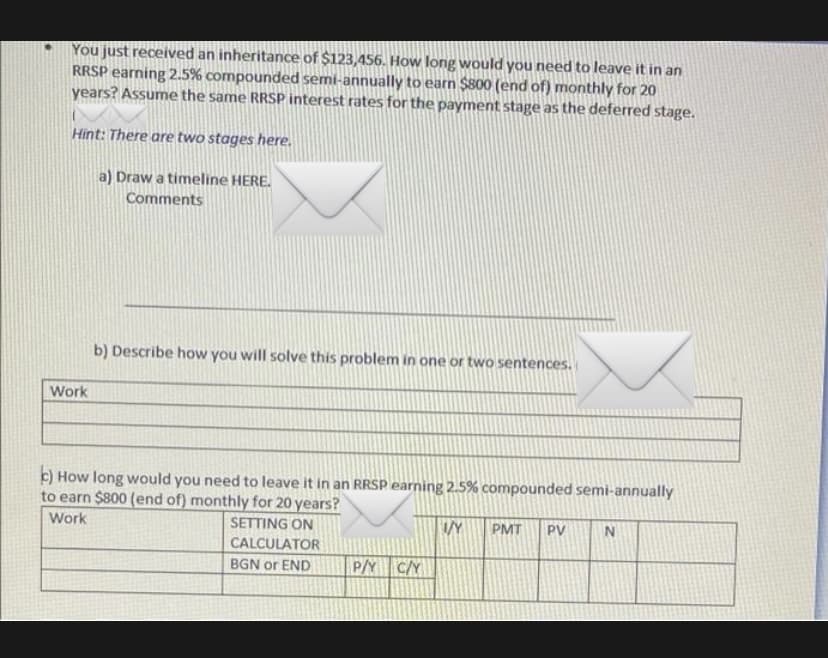

You just received an inheritance of $123,456. How long would you need to leave it in an RRSP earning 2.5% compounded semi-annually to earn $800 (end of) monthly for 20 years? Assume the same RRSP interest rates for the payment stage as the deferred stage. Hint: There are two stages here. a) Draw a timeline HERE. Comments b) Describe how you will solve this problem in one or two sentences. Work c) How long would you need to leave it in an RRSP earning 2.5% compounded semi-annually to earn $800 (end of) monthly for 20 years? Work SETTING ON /Y PMT PV CALCULATOR BGN or END P/Y C/Y

You just received an inheritance of $123,456. How long would you need to leave it in an RRSP earning 2.5% compounded semi-annually to earn $800 (end of) monthly for 20 years? Assume the same RRSP interest rates for the payment stage as the deferred stage. Hint: There are two stages here. a) Draw a timeline HERE. Comments b) Describe how you will solve this problem in one or two sentences. Work c) How long would you need to leave it in an RRSP earning 2.5% compounded semi-annually to earn $800 (end of) monthly for 20 years? Work SETTING ON /Y PMT PV CALCULATOR BGN or END P/Y C/Y

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

ChapterA3: Time Value Of Money

Section: Chapter Questions

Problem 5CE

Related questions

Question

Transcribed Image Text:You just received an inheritance of $123,456. How long would you need to leave it in an

RRSP earning 2.5% compounded semi-annually to earn $800 (end of) monthly for 20

years? Assume the same RRSP interest rates for the payment stage as the deferred stage.

Hint: There are two stages here.

a) Draw a timeline HERE.

Comments

b) Describe how you will solve this problem in one or two sentences.

Work

c) How long would you need to leave it in an RRSP earning 2.5% compounded semi-annually

to earn $800 (end of) monthly for 20 years?

Work

SETTING ON

PMT

PV

CALCULATOR

BGN or END

P/Y C/Y

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 6 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT